Tax

Mitigating Tax Hikes, Creating Alpha With Cash Value Life Insurance - Part 2

This is the second half of an article setting out what the author says are the tax and value-building qualities of life insurance in the various forms in which it operates in the US.

As FWR readers know, lawmakers in Washington DC are pushing for tax hikes on capital gains, estate and income taxes, among others. Whatever the rights and wrongs of these measures, tax mitigation is at the top of the wealth management agenda. In this detailed article, the author examines the life insurance toolbox.

The writer is Andreas Stuermann, president of Stuermann Consulting, a firm which specializes in designing, implementing and administering life insurance solutions for individual and institutional clients.

Readers can find the first half of the article here.

The editors of this publication are pleased to share these

views. The usual editorial disclaimers apply. To jump into the

debate, email tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

Choosing the policy

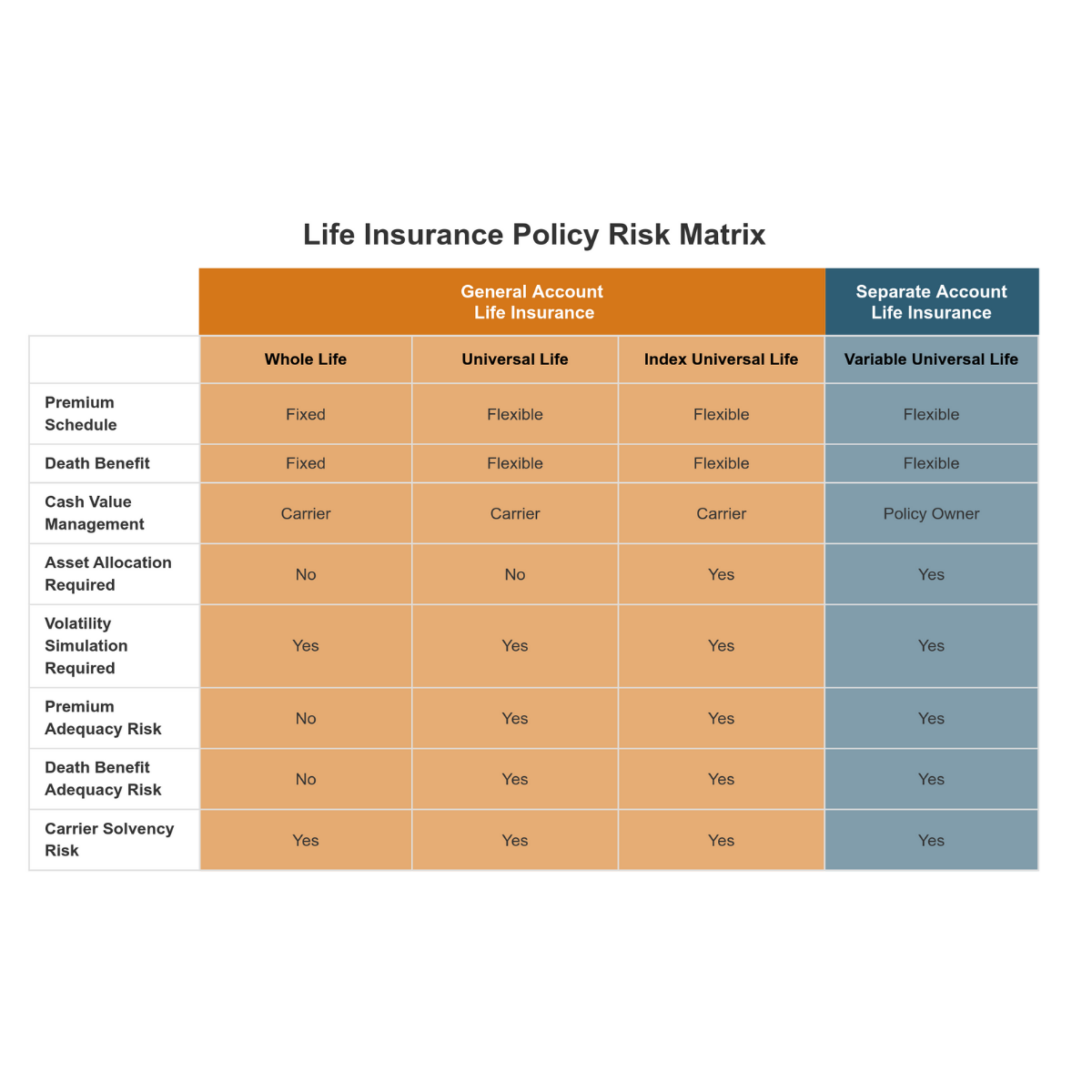

Two types of cash value life insurance policies provide wealthy

individuals with the structure and flexibility to integrate into

a tax diversification strategy: (1) General Account Life

Insurance, including traditional whole life (“WL”), universal

life (“UL”) and indexed (“IUL”); and, (2) Separate Account Life

Insurance in the form of variable universal life (“VUL”).

General account cash value life insurance policies place most of the investment risk underlying a policy’s performance with the insurance company. The insurance company makes either all or most of the investment decisions, choosing mainly to invest into high quality intermediate fixed income securities, leaving a policyholder to accept a share of the relatively conservative and stable returns. Clients seeking separate account life insurance policies are typically seeking to adopt more of the performance risk by making investment selections from a life insurance company’s platform of professionally managed sub accounts by major fund companies. While VUL contracts historically had little in the way of downside protection, new iterations allow the policyholder to purchase guarantees to either or both the performance of the cash value and death benefit.

How much risk an individual will assume is a key component to evaluating a financial strategy that includes cash value life insurance. A bearish client is likely best suited for either a WL or UL policy that provides the greatest safety, but the least opportunity for growth. Someone who is bullish may find a VUL policy that offers the greatest opportunity for growth with the opportunity to participate in the market best option.

Clients who identify as in between bearish and bullish might find IUL meets their tolerance. UL offers a balance between VUL on one end of the spectrum and UL and WL on the other, offering greater growth potential with an indexed account than with a fixed account. It also offers downside protection from negative market returns with a guaranteed floor.

“It is important clients have a deep understanding of how a policy works and should perform,” says Rice. “For instance, when considering a variable insurance contract, the client should know that much of the investment risk supporting the policy is being shifted from the insurance company to the client. This differs from general account policies like traditional whole life and universal life where the insurer retains most or all of the investment risk.”

When evaluating cash value life insurance policies, stress

testing is recommended to see how the policy is projected to

perform in various return and insurance cost scenarios; it never

hurts to look at best- and worst-case scenarios. A review of the

carrier’s financial ratings and its treatment of existing

policyholders along with understanding the contractual rights of

the policy-owner should also be conducted to ensure informed

buying decisions.

Obtaining the policy

The underwriting process can be a hurdle to the acquisition of

cash value life insurance. Often perceived as time consuming and

invasive, the medical examination part of the policy application

process has historically been a necessary evil in being able to

take advantage of all the tax benefits of owning a policy.

Historically, this application data included a physical exam with

doctor’s notes, blood work, and urine analysis. As prospective

insureds increasingly expect on-demand digital services, some

insurers are using accelerated underwriting (“AU”) techniques to

forgo a physical exam and supplement the application process with

data from external sources along with new analytics and modeling

techniques. The result is a reduction in the application process

from several weeks to just hours (8). It may be possible to

obtain a policy with a death benefit approaching $10 million

without taking a medical exam.

Besides the information provided on the application, the data for AU techniques comes from a number of different sources including credit reports, motor vehicle records, and the Medical Information Bureau. (9). Then, predictive analytics tools are used to segment and price the applicant’s risk. However, AU alone does not always lead to issuance of a policy. For some applicants, the available data will be insufficient to adequately evaluate their risk profile, so they will still need to complete the traditional underwriting process including a physical exam.

It is now common practice for insureds to be able to improve upon their initial underwriting classification and corresponding pricing, including exceeding the top underwriting rate. Life insurance companies are increasingly offering insureds incentives to maintain or improve their health. By engaging with their clients via vitality programs and health credits, life insurers are able to make pricing concessions to reward insureds for healthy behavior. Insureds are able to communicate their healthy habits by completing periodic questionnaires, linking digital fitness trackers or submitting updated medical information.

Prospective policyholders should understand the differences in acquiring a policy from an agent versus a broker. An agent is considered ‘captive’ to the life insurance company which either employs the agent or to which the agent is contracted. In this scenario, the life insurance professional is serving as an agent, or an extension, of the insurance company and representing only that carrier’s product offerings.

A broker, on the other hand, works for an independent distribution firm and represents the prospective policyholder. This structure permits the life insurance professional to source policies from many, or all, life insurance companies, resulting in selecting a policy which best fits the needs of the client.

Evaluating policy costs

“It is natural that clients focus on the size of the premium and

how much money it is costing them,” says Hyde. “Instead, they

should look at purchasing life insurance from a balance sheet

perspective. On a personal balance sheet, you are essentially

moving money around, from being liquid, to being the account

value of a policy. Eventually, at the death of the insured, the

policy account value will revert back to liquidity via the death

benefit.”

Rice agrees, “By treating the purchase of life insurance not as a cost but as a shifting of assets on a balance sheet, the door can be opened to efficient methods to pay for a policy. This includes studying any advantages derived from paying for a policy in as few premium payments as possible or examining if financing the premium by either leveraging the policy or other assets receiving attractive returns creates additional value.”

Properly funded and designed cash value life insurance policies have all-in costs of 50 to 100 basis points on average around life expectancy.

In the long term, cash value life insurance is often less expensive than many investment alternatives. Prospective policyholders frequently point to surrender charges and high insurance costs in early policy years in their decision to not buy a policy. These costs either disappear or have a minimal, lasting impact on the living benefits of a policy.

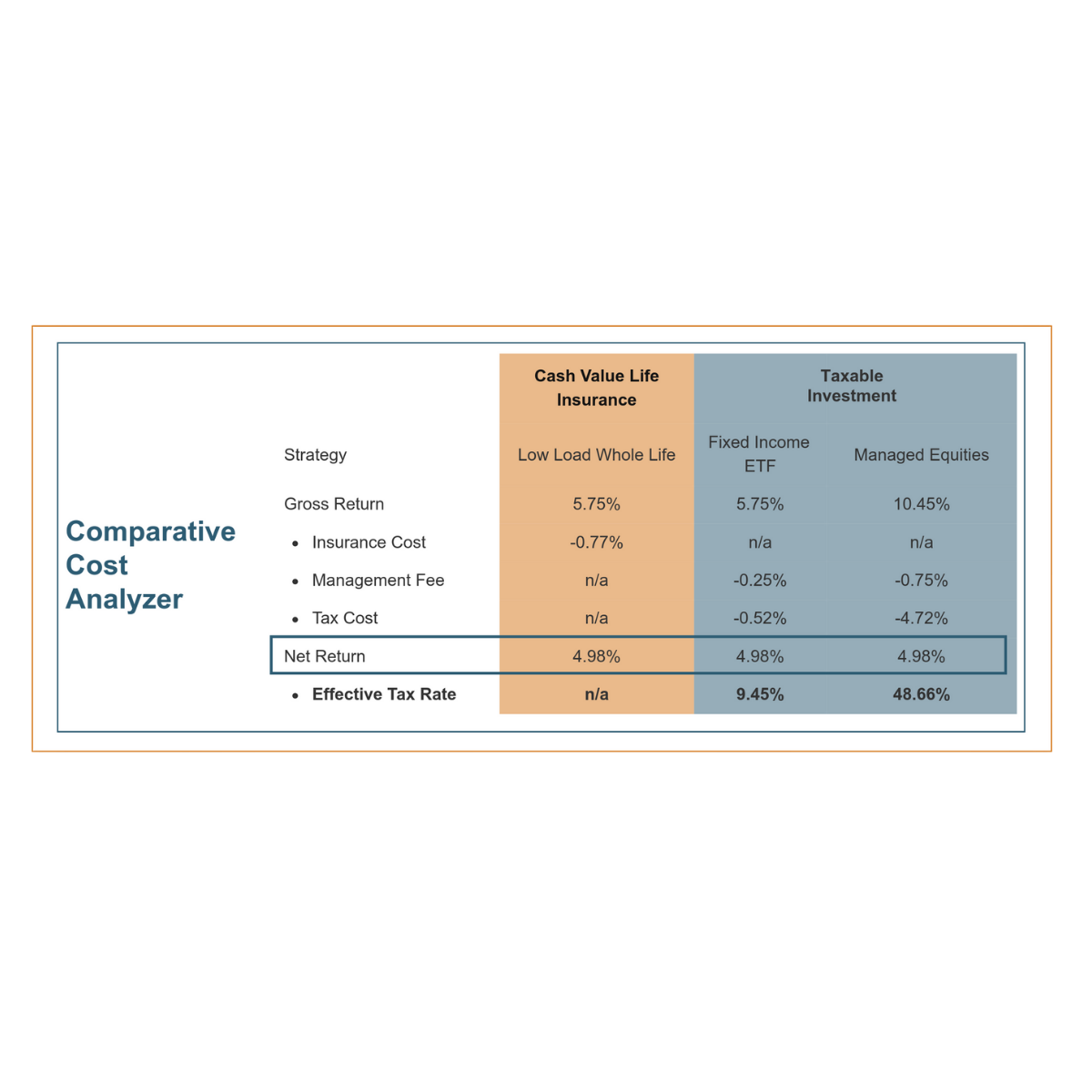

A cost analysis of cash value life insurance versus other alternatives concentrates on tax-efficiency of life insurance to demonstrate a policy’s long-term cost advantages. As discussed, life insurance cash value grows tax deferred and can be accessed income and capital gains tax-free but is subject to ongoing charges that are deducted from a policy’s account value to fund the death benefit protection element of the policy.

Alternatively, if the premium were invested in a taxable investment, the funds would be subject to taxation on realized gains and income within the resulting investment portfolio as well as ongoing investment management fees to some extent.

The trade-off made when purchasing cash value life insurance is

paying policy charges instead of taxes and management fees and

the former, when structured properly, can be more efficient over

the long term. Accordingly, a cash value life insurance policy

can be a cost-effective complement to a diversified, long-term

investment strategy. For example, a 50-year-old male would need

significantly higher returns in a taxable account to obtain the

same outcome from cash value life insurance as shown.

Conclusions

Cash value life insurance offers attractive risk-adjusted

returns, significant tax benefits, low long-term costs, and the

potential for easy and fast implementation.

It works well for tax and risk-sensitive clients with long-term planning horizons who are seeking more alpha in their overall asset allocation. Conversely, it is not a good fit for clients with short-term horizons or in poor health.

That said, once we look beneath the surface, cash value life insurance is a powerful and flexible wealth planning tool with several attractive benefits that allow affluent individuals and families additional benefits to mitigate tax increases, bolster savings and protect wealth. No other financial instrument is able to tout the versatile benefits of tax reduction, tax deferral and tax elimination.

A life insurance professional should be consulted when considering incorporating cash value life insurance into a financial plan as any strategy should take into account risk tolerance, access to capital and long-term goals. In many ways, the immortal words of LL Cool J apply to cash value life insurance today: Don't call it a comeback / I been here for years / I'm rockin' my peers.

Footnotes

8, National Association of Insurance Commissioners (NAIC)

Big Data (EX) Working Group published findings. May 2021.

9, National Association of Insurance Commissioners (NAIC)

Presentation “Use of Data for the Underwriting of Life Insurance

Products”. Eric T. Sondergeld, ASA, CFA. 2018