Asset Management

Private Investments: Three Things To Consider Before Joining The 40 Per Cent Club

The 40 per cent club refers to institutions with 40 per cent of total portfolio allocation committed to private investments. They do this for good reason argues Cambridge Associates' managing director, and more should follow their lead.

With lock-up typically 7 to 10 years, calculating liquidity is key to private investing and many high net worth families are overly cautious in estimating their liquidity needs. But there is growing access to a more flexible private market where "new and developing funds can be perennial top performers," said Maureen Austin, managing director with the global investment and research firm Cambridge Associates. As this publication continues to look at the growth and golden returns of alternative investments, the following commentary makes the case for why increasing private allocation is a good bet for families with continuity concerns and what rules they should follow to comfortably join the 40 per cent club. The editors are pleased to share these views and invite readers to respond, although this publication does not necessarily endorse all views of guest writers. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com.

In recent years, families of substantial wealth and family offices have paid increasing attention to the role of private investments in portfolio construction – and with sound reason. Higher private investment allocations have proven to play a critical role in generating greater returns over generations, and there is no better time to revisit private allocations than now. Private investors with substantial wealth may be well positioned to reap the rewards of a higher allocation to private investments, particularly if they understand the dynamics that lead to a successful program: how to calculate true liquidity, control risk through diversification, and select the right managers.

The 40 Per Cent Club: Membership Has Its

Benefits

The 40 per cent club refers to institutions that have chosen to

commit 40 per cent of total portfolio allocation to private

investments. These investors have done so for good reason. As an

example, let’s look at historical investment trends of endowments

and foundations. Analysis by Cambridge Associates indicates that

institutions in the top quartile of performance have one thing in

common: a minimum allocation of 15 per cent to private

investments. For those with allocations above 15 per cent, the

median return differential to those with less than five percent

was 160 basis points. The data also shows that top decile

performers have steadily increased their allocations over the

past two decades, pushing in many cases north of 40 per cent.

.png)

Due to continuity concerns of future generations and their ability to withstand illiquidity, families with multigenerational wealth may be especially well positioned to consider allocating 40 per cent or more of their assets to private investments. Assuming these families have alignment with GPs, the requisite long-term time horizon, patience, and ability to act quickly, they stand to benefit from higher returns. Here are three things to consider before joining the 40 per cent club.

1) Liquidity Needs

In considering any investment strategy, an investor’s ability to

accurately calculate liquidity needs is key. Yet many

overestimate their true liquidity needs and, as a result, miss

out on significant return potential.

By definition, the long time horizon and lock-up nature of a private investment makes the investment illiquid. Typical holding periods are seven to ten years; however, the full realization of a private investment may be longer. But illiquidity does not translate into greater risk, unless liquidity needs have been miscalculated.

For many families with multigenerational wealth, the portion of the portfolio needed for liquidity may be much lower than their allocation to illiquid investments would suggest. Comparing cash and fixed income relative to spending needs, including projected capital calls, can serve as a basic starting point in determining if there is adequate coverage to enable a greater allocation to illiquid investments. We often find that investors overstate their liquidity needs in absolute terms, but also overestimate the liquidity of certain asset classes. The global financial crisis, for instance, demonstrated that many erstwhile “liquid” securities were anything but liquid.

2) Deliberate Diversification

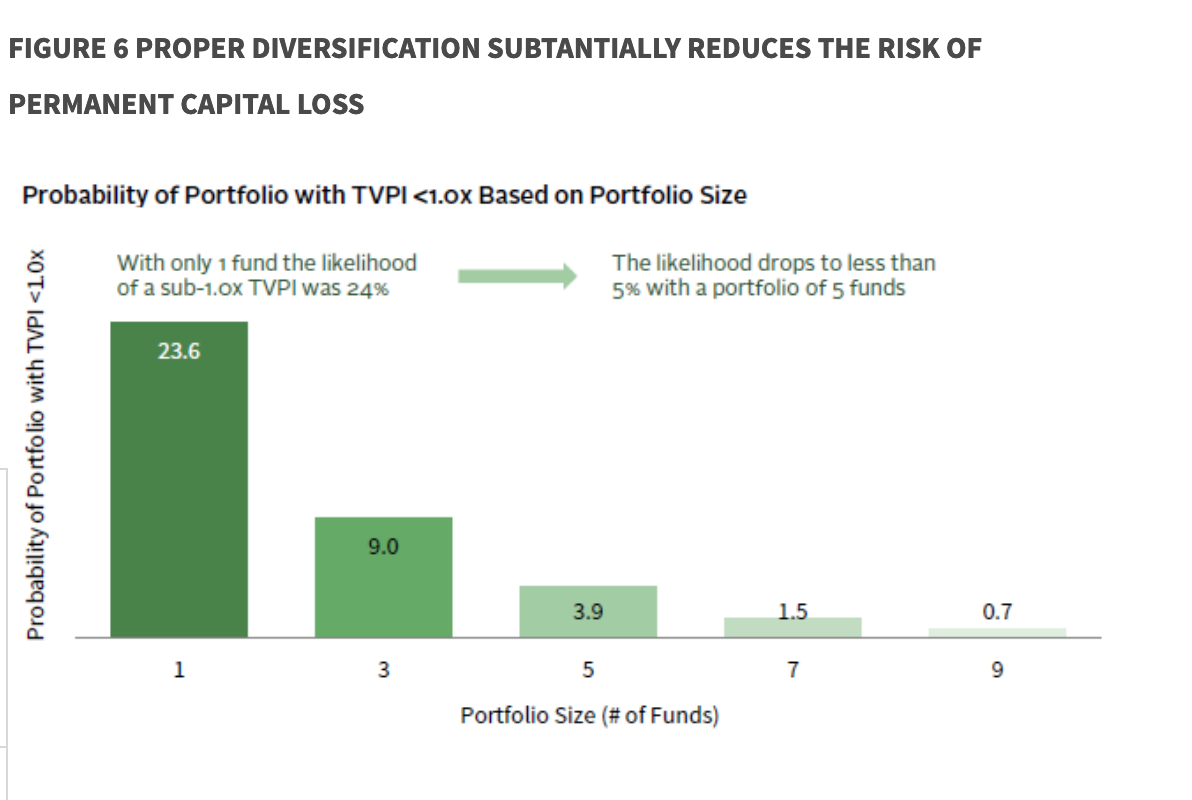

With the hype around “hot deals and unicorns,” investors can be

tempted to over allocate to a homerun bet, with disappointing

results. Not only does diversification lend access to new and

growing markets, but analysis shows that, with proper

diversification, the risk of permanent loss of capital is low.

Figure two illustrates that the risk of permanent capital loss

was less than one per cent when randomly selecting nine funds

from a database of more than 3,000 funds.

Of course diversification is just one strategy. With any

investment, understanding return potential is critical. The

opportunity set for private investments is diverse, offering a

wide range of investment strategies that have potential to

deliver attractive returns at different stages of the economic

cycle.

3) Skillfull Manager Selection

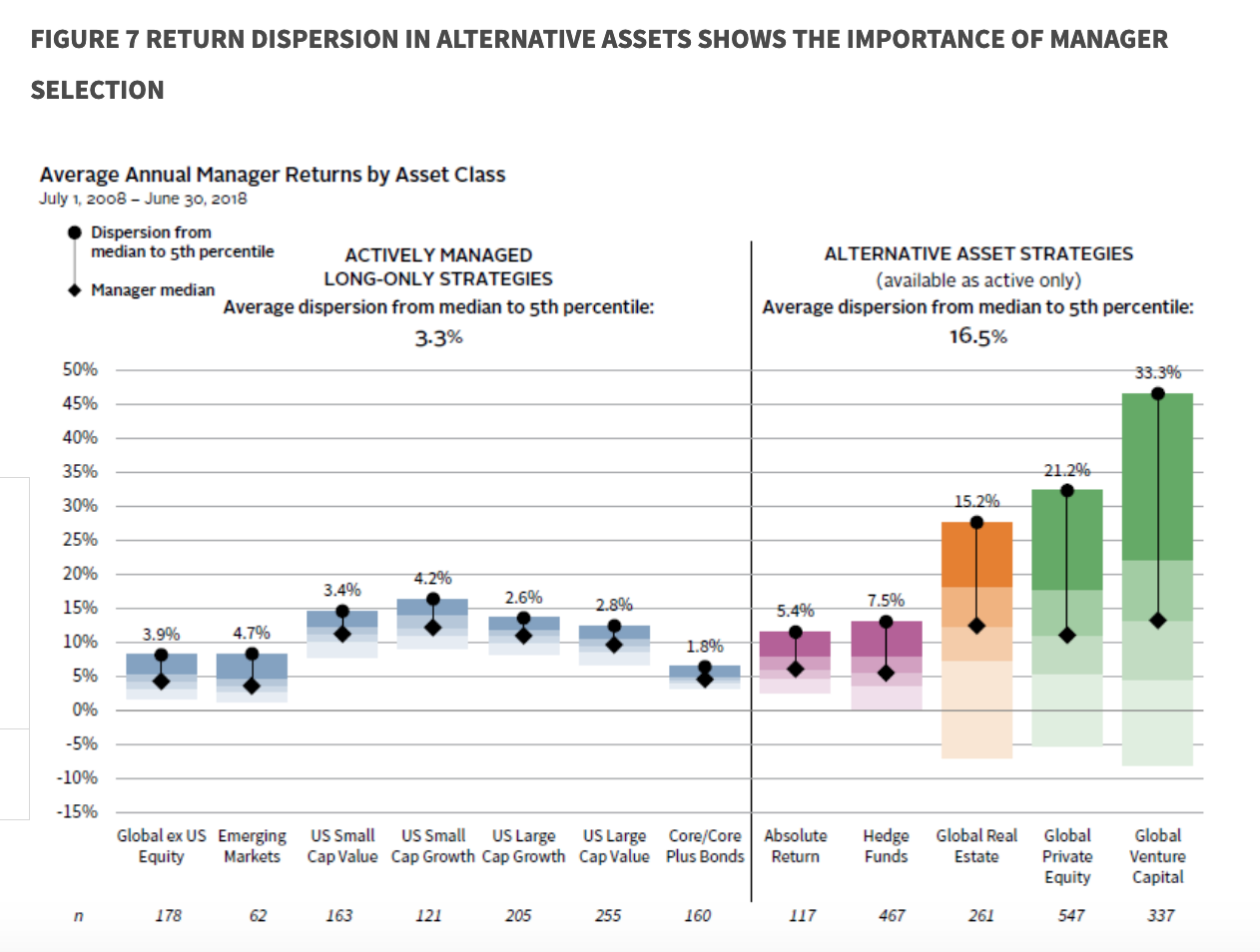

Private investments come in many shapes and sizes, and building a

well-diversified portfolio across vintages, geographies, and

sectors takes skill, time, and discipline. Furthermore, the wide

return dispersion among private investment funds highlights the

complexity and importance of the manager selection process, as

illustrated below.

Direct investments, co-investments, and secondary purchases are attracting more interest from families, in part because they offer a lower cost method of accessing private investments, and also allow for immediate capital deployment. For many families, heritage as business owners also makes direct investing (versus fund investing) appealing. While these direct investments can offer significant return potential in their own right, the complexity, risk, and resources required to evaluate these opportunities is even greater than is the case for fund selection. Finding the right manager skill and expertise, and applying a rigorous process across many dimensions, are critical to both fund investing and direct investing.

We’d all like to go back in time and place that bet on the winning horse! Likewise, with investments, it is easier to think about how an early investment in a particular fund or company would have benefited a portfolio than it is to gain comfort in a new opportunity. With private investments, many families assume there is less risk in the “famous” funds and lament the inability to gain access. However, new and developing funds can be perennial top performers. Newer funds are usually led by experienced partners from established firms who have decided to break out and raise much smaller amounts for their initial launch. The smaller size of these funds allows managers to remain nimble and focused on attractive investments in their core area of expertise.

Membership Brings Benefits For Generations To

Come

For most institutions, investing with a long time horizon is

imperative to sustaining their organization’s mission into

perpetuity. This is true for families with continuity concerns,

as more people must be supported in each subsequent generation.

But it is not just the superior return potential that makes a

conversation around allocating more to private investing

important for families. Many private investments offer tax

advantages both in the near term and as part of a wealth transfer

strategy. For the most part, private investment returns are taxed

as capital gains rather than income. As taxable investors know,

it is not what you make but what you keep that matters. Higher

returns, compounded over time in a more tax-advantaged manner,

are quite appealing. Joining the 40 per cent club is a

conversation worth having for generations to come.