Strategy

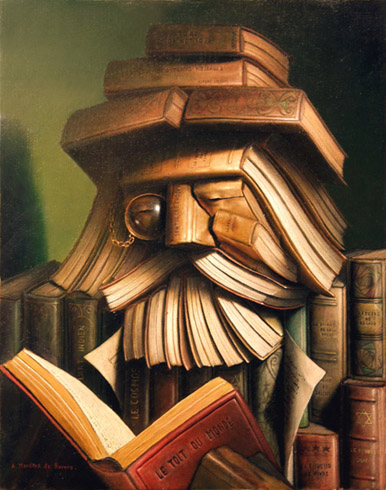

BOOK REVIEWS: Wealth, Business Books For 2018

A round-up of books on finance, business and technology sent to the reviewer this year and which caught the eye.

As the end of the year winds down here’s a chance to take a look at some of the books on business, finance and economics that came into our offices for review.

Capitalism In America: A History, Alan Greenspan and Adrian Wooldridge. (Published by Allen Lane. 486 pages.

Co-authored by the political editor of The Economist and the former chairman of the US Federal Reserve, the book examines why the US rose from being a rural economy a couple of centuries ago to the high-tech powerhouse it is today. The book explores drivers such as the willingness of entrepreneurs to overturn – sometimes ruthlessly – business models in pursuit of profit, as well as factors such as relatively free markets and a positive culture for business. Recent years, they say, give cause for concern, as seen for example in a fall in labor force participation rates, sluggish productivity and lower business start-up rates.

The book is also refreshingly free of fashionable paranoia and doom-mongering about China, arguing against protectionism. Wealth managers who want to know where the next cohort of HNW individuals are coming from should read this book. Every page contains facts, often startling in their range, such as showing the impact of farming tools on raising productivity. Whatever one thinks of Dr Greenspan’s time at the Fed, for example, he’s certainly involved in a remarkable study of business.

In Pursuit of Wealth: The More Case For Finance, by Yaron Brook and Don Watkins. Ayn Rand Institute Press. 242 pages.

The authors write a no-holds-barred defence of free markets and challenge a popular argument in recent years that the 2008 financial crack-up was largely the fault of “unregulated capitalism”. Even if readers are not on board with the philosophy of the writers, there’s a lot to think about here, such as how they explain the fact that, contrary to many accounts, financial markets were often heavily regulated in certain ways, and that regulations, and other state activity, caused a good deal of the mayhem. There are also plenty of references and footnotes for readers to follow up on. A spirited defence of finance that also touches on history, such as going back to why charging interest on money was wrongly condemned, and why.

Wealth Actually: Intelligent Decision-Making for the 1 Per Cent, by Frazer Rice. Lioncrest, 355 pages.

Rice – who spoke at a recent Family Wealth Report conference in New York, sets out a “holistic” view of wealth management that helps wealth holders to be clear about what their money is for, how to talk to children and other relations, and how not to let their money control them, as is all too easily the case. Written with a nice, light touch (there are few good gags in here), Frazer’s prose style is engaging, making it easy for readers to digest his points. The reviewer liked his descriptions of what issues arise when businesses are sold; his description of areas such as venture capital is also excellent.

The Wise Inheritor’s Guide To Freedom From Wealth – Making Family Wealth Work For You. By Charles Lowenhaupt. Praeger. 152 pages.

The book has an engagingly non-technical style, written in a way that simplifies matters concerning inheritance, philanthropy, family communication, fairness, parental expectations and the mechanics of wealth transfer. (The author of this review read it in a few hours.) The author covers the topics without dumbing down the subject or becoming at all condescending. Lowenhaupt enlivens the book with real-life studies (the names are removed to protect client privacy), and these really jump out of the page. There is one example of a family where the patriarch, his wife and children lived in humble circumstances without any obvious trappings of great wealth, and one day the children were told of how they stood to inherit a fortune. How Lowenhaupt relates how they adjusted to this and beat early mistakes is one of the highlights of the book.

Expatland, By John Marcarian. CST Tax Advisors. Published three years ago (2015), the reviewer came across this work recently and liked how, by creating a sort of fictitious “expatland”, the writer, who is a chartered accountant, runs through a list of issues that those living abroad need to contend with. With millions of affluent people living outside their home countries for extensive periods of time, there’s a great need for simple, unpretentious explanations of the issues. Marcarian writes about all this well, and does so in 252 pages.

The Wealth Elite, by Rainer Zitelmann. LID Publishing.

421 pages.

This is an academic study into what drives men and women to

become entrepreneurs, and explores their emotions and thoughts.

It brings a rigorous sociological approach to a section of the

world’s population. It is a contrast to the majority of

academic studies which have tended to focus more – perhaps

understandably – on the less well off. (Dr Zitelmann is an

investor and publicist with a background in media and academia:

for a time he worked as an historian at the Freie Universität

Berlin. This is not a light read, but it will prove a valuable

resource for business students in future.)

Dr Zitelmann has also published The Power of Capitalism: A Journey Through Recent History Across Five Continents. LID Publishing. 233 Pages. This book examines a range of examples (some of them harrowing, such as China during the 1950s and 60s), to show the case for free markets as opposed to state central planning. While Dr Zitelmann’s book on the super-rich was a more academic item that avoided overtly philosophical or political views, this second book is much more argumentative, but rather than start with theory, it draws on a mass of examples. At a time when free trade and open markets are under attack from Left and Right, it is instructive that an academic from Germany should produce such a book. Again, the facts and figures in here, and the bibliography, reflect the scale of research Dr Zitelmann puts into his books.

Blockchain Revolution by Don Tapscott and Alex Tapscott. Update on the 2016 edition. 358 pages.

The book is absolutely packed with detail on how, the authors argue, distributed ledger technology can, given the right conditions, revolutionize finance, law, politics, human networks and much more. Written a breathless style and with an infectious enthusiasm, the book is good for setting out the broad terrain for those who have read about blockchain and bitcoin but who want to know what the hype is about. Recent rapid falls in the price of bitcoin may have taken some glitter of this area. The authors address a number of “showstoppers” that could derail this tech, and their responses and ideas are often convincing. Skeptics may need persuading that blockchain is quite as transformative of all areas of life as is claimed. The foolishness of politicians and venality of some businesses cannot be waved away like a magic wand – blockchain isn’t a sort of silver bullet for certain problems (and to be fair, the authors don’t claim it to be so). Whatever their political biases, the authors don’t impose these on readers and let the facts in many cases speak for themselves. There’s a huge list of references for further reading and research.

Like or not, wealth managers are going to have to get used to lots of commentary about this tech in the years ahead and need to be informed. The reader can do a lot worse than to start with this book.

The Wealthtech Book: The Fintech Handbook For Investors, Entrepreneurs And Finance Visionaries (Wiley). 318 pages

The book collects dozens of commentaries from industry figures – some of whom will be familiar to readers of this news service – and does so in a logical way, leading readers from basic themes through to specific case studies. Running to 71 chapters, there are nine main segments on digitizing client advice and wealth management operations; a look at different digital platforms and products; the use of the distributed ledger technology known more widely as blockchain; some case studies of wealthtech businesses that have been successful; views about innovation, some global views of technology and finally, thoughts about what might come next.