Strategy

Miami Wealth Managers: How We Work With Latin Clients

.jpg)

In the second part of this feature, our US correspondent speaks to organizations such as WE Family Offices, Maximai Investment Partners, Premia Global Advisors, AlTi Tiedemann Global, Citi Private Bank, and others, about the potential upside of the Latin market in Miami and surrounding areas.

Flashy, sexy, culturally vibrant and prosperous Miami, where more than two-thirds of the population speak Spanish, is a flourishing hub for foreign investment, as reported in part one of Family Wealth Report’s special feature. It’s also considered “the northernmost city in Latin America” as Antonio Gonzales (pictured below), the head of Citi Private Bank’s business in the region, puts it.

%20(1).jpg)

Antonio Gonzales

The majority of Latin clients in metropolitan Miami come from Mexico and Brazil, according to local wealth managers, followed by the next tier of wealthier countries in South America, including Argentina and Chile. Clients tend to be wealthy families or individuals who own businesses in their home country, although younger generations increasingly live all over the world. Minimums for investible assets start at around $2 million and can be much higher.

Latin clients in Miami are drawn to the safety and stability of the United States as a hedge against political turmoil in their home countries. “They’re looking for a safe haven and diversification,” said Santiago Ulloa managing director at WE Family Offices.

“They’re interested in banking and investment services and want advice on taxes, trust and estate planning and managing risk.”

Favored investments

Although Latin clients have traditionally gravitated to fixed

income investments, for asset protection and capital

preservation, wealth managers say they’re seeing more interest in

direct and alternative investments and even crypto, especially

from younger clients. A typical portfolio mix for Latin clients

is now approximately 70 per cent liquid investments and 30 per

cent private, said Lisa van Walleghem (pictured), founder and CEO

of Maximai

Investment Partners in Coral Gables.

Lisa van Walleghem

Real estate continues to be a top investing priority for Latin clients. According to The Miami Association of Realtors, foreign buyers, mostly from Latin America, account for 40 per cent of the city’s luxury real estate sales. The many new luxury high rise apartment buildings under construction on downtown Miami’s prestigious Brickell Avenue bear witness to unrelenting market demand.

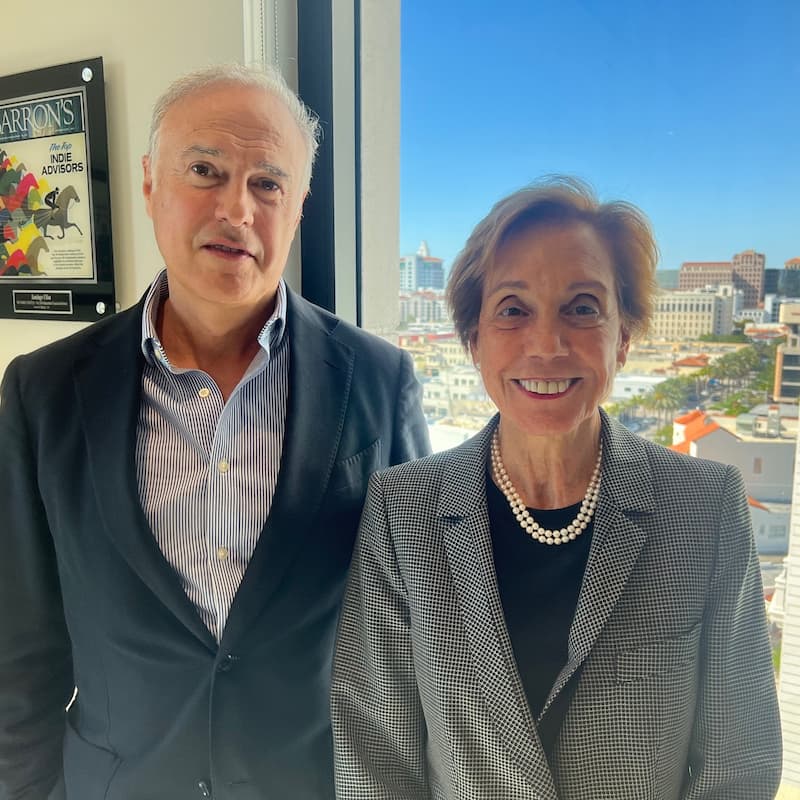

“Half our clients are from Latin America and they all want US assets, especially real estate,” said Mel Lagomasimo (pictured with Santiago Ulloa, mentioned above), managing director at WE.

Left to right: Santiago Ulloa and Mel Lagomasimo

Offshore trusts in jurisdictions with favorable legal frameworks for asset protection, tax benefits, and privacy such as the Isle of Man and the Cayman Islands are also in high demand.

“It’s important to work with a reputable attorney,” said Miguel Sosa (pictured), founding partner of Premia Global Advisors in Coral Gables. “Some clients use a structure combining a US LLC with an offshore trust.”

Miguel Sosa

“Trust is the key to this market”

While personal relationships are the key to any wealth management

firm’s business, the sensitive nature of Latin client’s

cross-border portfolios and heightened scrutiny make trust and

confidentiality even more important in Miami.

“It’s a very trust-based business,” said analyst William Trout, director of securities and investments at Datos Insights. “If you don’t have a big brand name in Miami, you need a personal connection or a connection to the local community.”

Latin clients “want to work with someone they can really trust,” said Alejandro Behrens, managing director at Maximai Investment Partners. “That’s the key for them and the key to this market."

Latin clients “want to know you for a while,” said Jose Remy, Miami-based partner at AlTi Tiedemann. US exceptionalism, said Citi Private Bank's Gonzales, is fading a bit.”

As wealthy Latin families become more multigenerational and multijurisdictional, they’re increasingly insisting on global diversification, according to Gonzales of Citi Private Bank. “US exceptionalism is fading a bit,” Gonzales said. “The NextGen live in countries outside the US and we’re seeing more ties to Europe, especially Spain and Portugal.”

Familiarity breeds success

To attract new clients, familiarity with clients’ home country is indispensable.

“Advisors must understand what’s going on in the client’s home country,” said Maximai CEO Lisa van Walleghem. “You have to be familiar with the local economy and political issues. These are clients who are always quite concerned about the risk factor from their home and feel vulnerable to political shifts.”

Multi-jurisdictional tax planning is also critical, said Premia’s Sosa. “Getting it wrong can be a nightmare for clients who have to declare taxes on all income no matter where it was earned.”

“You still have to ask for the gig”

While referrals are the primary and preferred means of converting prospects to clients, firms can’t just rely on personal introductions in such a competitive market.

“You still have to get out and network in the right places,” said Bolton Global Capital CEO Raymond Grenier. “And it’s a very limited network, I’d guess around 1,000 people. Wealth managers in Miami have to travel extensively to meet people outside the US; It’s part of the job. You still have to ask for the gig. Clients don’t come knocking on your door.”

Big brands, boutiques and breakaways

Being a big brand name helps a lot in Miami.

JP Morgan, UBS and Citi are generally considered to be the market leaders, and Lagomasino estimates that most of WE’s wealthy family office clients bank with either one of those three or Bank of America, Morgan Stanley, Santander or Goldman Sachs.

Legacy global banks are especially popular with older Latin clients, but a younger generation that is moving beyond lending and investments and seeking more sophisticated wealth planning is turning to boutique firms, said Sosa. Indeed, the Miami market is seeing an increase in family offices and smaller RIAs, including breakaway teams from the large banks.

Regional report card

A recent report from The Milken Institute, “2025 Global Opportunity Index,” focusing on Latin America and the Caribbean, underscores the optimism wealth managers have for Miami as a financial gateway.

The region’s growth potential scored above average for emerging markets and an expanding, highly skilled workforce is driving economic growth, the report stated. Mexico and Brazil continue to drive performance as the region's largest economies, generating, along with Argentia, Chile and Columbia, two-thirds of the region’s GDP.

Clearly, the market is thriving and growing. But building up a business to serve Latin Americans in Miami still “takes a lot of time,” said Citi’s Gonzales. “It’s a very selective market. You’re either really good or you’re out.”