Surveys

Millennials' Financial Habits Revealed – And Why They Need Advice

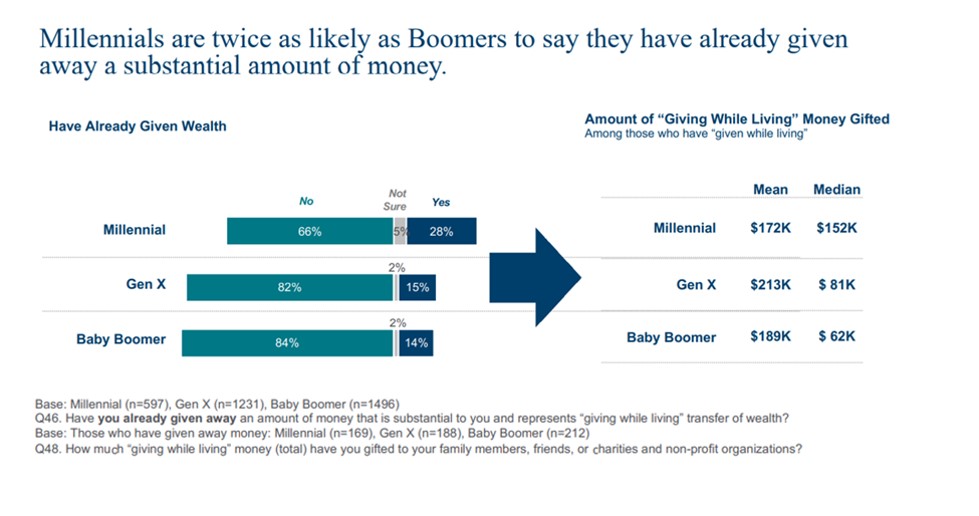

A study by Ameriprise Financial found that Millennials are more likely to transfer money to charity during their lifetimes, raising questions about whether they're thinking hard enough about long-term financial needs. And that means advice.

This news service recently spoke to Marcy Keckler, senior vice president of financial advice strategy at Ameriprise Financial. The firm has polled Millennials about what matters to them around financial affairs, including the role of advisors. The US firm compared its annual 2016 and 2022 studies, examining how much Millennials rely on their financial advisor in their wealth planning process.

The wealth management industry in the US and further afield is battling to retain and gain the business of younger generations as Baby Boomers pass away. A few years ago, survey evidence suggested that Millennials, for example, were more likely to hire and fire advisors than their parents. The desire to stay relevant explains why wealth managers make a big deal of digital offerings, ESG investing, behavioral finance, diversity and more hands-on forms of philanthropy.

One result of the survey is that Millennials like to give money away to charitable causes, but – and it may be unpopular to point this out – they might be putting their long-term financial affairs in danger, and therefore need to take advice.

Family Wealth Report: The

survey finds that advisors are important to Millennials. A cynic

might argue that this is the message that the industry wants to

convey – it is in the advice business! – but were there any

findings from the survey that surprised you, in either

direction?

Keckler: One of the surprising findings from the study

is that Millennials are twice as likely as Boomers to say that

they have given away a substantial amount of “giving while

living” money. In the study, we defined “giving while living” as

gifting sizable portions of your estate while you’re still alive.

The median amount Millennials have given is $152,000, while the

median is $81,000 for Gen X and $62,000 for Boomers.

Across generations, children were most often the recipient of this money followed by charitable organizations. Millennials were more likely to have given to charities and their parents than other generations. Nearly half (48 per cent) of Millennials gave to charities and 47 per cent to their parents.

These findings point to an opportunity for advisors to help younger clients with their giving strategies to ensure that they are not gifting money that they may need later.

Source: Ameriprise

Please provide tips for younger HNW clients on how to

manage the "full balance sheet" of their lives and how

these change across the lifecycle.

There are basic steps investors can take to manage their “full

balance sheet.” As a starting point, it’s important to set

financial goals – define your dreams for the future, both short

and long-term. Writing down goals will help you stay focused.

Next, take a good look at your full financial picture. List all of your assets, including savings, investments, equity in any real estate you own, etc. Similarly, take note of your debt and expenses. Every so often, you’ll want to check the value of your assets and debt since they can change over time.

Reviewing this information on a regular basis will also help you identify areas in your financial life to adjust and risks to address as your life and goals change. One of the most powerful parts of a younger person’s full balance sheet is future earning potential. It’s especially important that younger people protect their earning potential by considering disability income insurance, either available through a group policy from their employer or an individual policy.

Another key part of a full balance sheet includes reviewing other insurance coverage. Auto and home insurance premiums costs are usually lower for policies that have higher deductibles. Once an investor has built a sufficient cash reserve, it’s easier to afford a higher deductible in case of a claim. So it can make sense to consider auto and home insurance policy reviews to see if changes are appropriate.

Methodology

In late fall 2016, Amerprise's Family Wealth Check Up study

surveyed equal portions (900 each) of Millennials (then aged 25

to 34) with $25,000 or more in investible assets, Gen X (aged 35

to 51) with $100,000+ in investible assets and Boomers (aged 52

to 70) with $100,000+ in investible assets. The 2022 study

required all respondents to have $100K+ in investible assets. The

generational distribution is 18 per cent Millennials, 37 per cent

Gen X, and 45 per cent Boomers. To compare the 2016 and 2022

figures, Ameriprise filtered out the Millennials with less than

$100,000+ in assets and compared the generations with each

other over the roughly five-year time span.