WM Market Reports

Asset Tokenization Market Could Reach $16.1 Trillion By 2030 – Study

.jpg)

With more wealth managers and family offices putting money into private markets – typically less liquid than for listed equities – the need to work out new forms of access has gained ground.

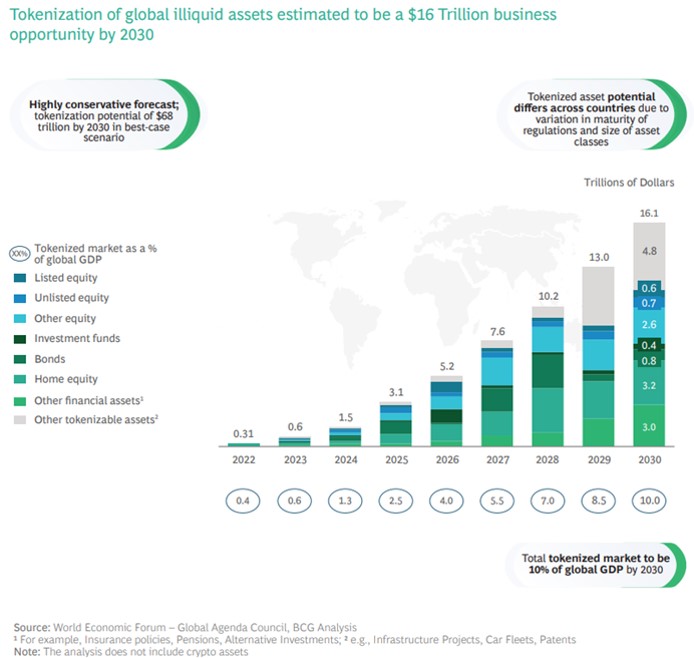

The market for “asset tokenization” – a market driven by distributed ledger technology (aka blockchain) – could be worth as much as $16.1 trillion by the end of the decade, driven by a desire to make it easier to invest in assets once beyond ordinary investors’ reach.

Boston Consulting Group and Singapore-based ADDX, a digital exchange for private markets, made the predictions in a new report. The report, entitled Relevance of on-chain asset tokenization in “crypto winter,” was written by Sumit Kumar, Rajaram Suresh, Bernhard Kronfellner, and Aaditya Kaul from BCG and Darius Liu from private market exchange ADDX.The “winter” term refers to how cryptocurrencies such as bitcoin have been mauled by the slump in technology stocks since the start of 2022. The falls were so severe that they shook confidence in the wisdom of holding such entities at all.

Asset tokenization is the process by which an issuer creates digital tokens on a distributed ledger which represent either digital or physical assets. Blockchain guarantees that when a user buys tokens representing an asset, no single authority can erase or change that ownership –ownership of that asset remains entirely immutable.

In recent years, tokenization has become an important trend and comes in two main forms – tokenization of established assets such as private equity or venture capital, and “non-bankable assets” such as fine art. In the past, investors had to put up at least $1.0 million or more for a seat at the private equity/VC table – tokenization reduces the entry size, on a similar model as fractional ownership of a house or aircraft. (This news service took a broad view of digital assets and related matters here.)

With more wealth managers and family offices putting money into private markets – typically less liquid than for listed equities – the need to work out new forms of access has gained ground.

The rise of tokenization is often most commonly associated with non-fungible tokens (NFTs). Unlike cryptocurrencies such as bitcoin, which are identical units that can be exchanged and are therefore fungible, NFTs are not interchangeable. Each NFT is a unique token on a blockchain which stores information about provenance that can be traced back to the original issuer; therefore it provides collectors with the opportunity of building a digital collection. For this reason, NFTs are popular in applications which require unique digital items, including crypto art, digital collectibles and online gaming, where some guarantee of authenticity and ownership history adds value.

Tokenization trend

ADDX said a number of institutions have begun to tokenize private

funds on its platform. Partners Group, for example, listed its

Global Value SICAV Fund on the platform in September 2021, while

Hamilton Lane’s Global Private Assets Fund launched on the

platform in March 2022.

The authors of the BCG/ADDX report said that globally, growth in tokenized assets is expected in real estate, equities, bonds and investment funds, as well as less traditional assets such as car fleets and patents. With a 50-fold increase predicted between 2022 and 2030, from $310 billion to $16.1 trillion, tokenized assets are expected to make up 10 per cent of global GDP by the end of the decade, the report said.

Business Opportunity of Asset Tokenization (2022 to 2030)

“The crypto winter has tightened the purse strings for the overall blockchain sector. Some Web3 companies will be adversely impacted. But projects that can demonstrate inherent value, scalability and the potential to enhance the traditional financial ecosystem could actually benefit against this new backdrop. Our analysis shows asset tokenization projects could emerge strongly,” Kumar said. “They are more likely to demonstrate viability in this capital-constrained environment and are therefore better positioned to attract the attention of investors, who continue to have a significant store of dry powder to deploy. This report projects that even using a conservative methodology, asset tokenization would be a $16.1 trillion business opportunity by 2030. In a best-case scenario, that estimate goes up to $68 trillion.”