Offshore

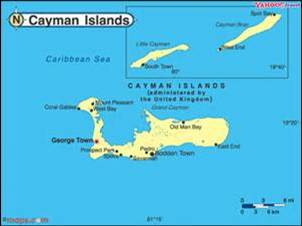

Reflections On Pandemic's Impact On IFCs: View From The Cayman Islands

As part of a set of articles looking at how offshore centers have tried to cope with the pandemic and how this frames their status as wealth hubs, we talk to Ogier, the international law firm.

As part of a series of articles examining how international financial centers have coped with the pandemic and what the experience has taught industry figures, we talk to international law firm Ogier. It gives its perspective on the Cayman Islands. The answers are from Anthony Partridge, partner, and Gregory Haddow, associate. (See a previous article here that carries comments on the quarantine rules that had, at the time of writing, been an issue for the Caribbean jurisdiction.)

How in broad terms have the travel restrictions and other

controls imposed by the COVID-19 pandemic affected business in

IFCs? Have, for example, the massive cuts in flights meant that

people thinking of moving to IFCs have had to put back plans, or

cancel them and contemplate other options?

Anthony Partridge: “Trust and private wealth work has continued

to flourish in the jurisdiction despite the lack of flights and

the restrictions on our borders. Inevitably some individuals have

put relocation plans on hold until borders are back to normal.

However, we have seen a number of clients purchase property after

remote viewings with the plan of relocating to Cayman once able."

From a more positive point of view, has the fact that

IFCs are often doing well with vaccines, have low crime and a

high quality of life been even more of a selling point

recently?

Gregory Haddow: “This depends on what qualities the particular

individual prioritizes. The jurisdiction has long been known for

its work-life balance and high quality of life and these have

been significant merits that have inevitably attracted a large

number of HNWIs to Cayman in pre-COVID times. Vaccination rates

are relatively high when compared with most developed nations

around the world. Interestingly, Cayman is also ahead of many

other offshore IFC centers in terms of percentage population

rates of vaccination with just over 84.8 per cent.(1) This is

compared with Jersey with 75.6 per cent (2), the Isle of Man with

75.5 per cent (3), Bermuda with 67 per cent (4) and the Bahamas

with just 18 per cent.(5) Some may find this additional quality

to be an addition 'selling point', however, we would consider it

unlikely to remain a deciding factor for long, especially as the

global community catches up with the Islands in terms of

vaccination rates.”

How has training and hiring on-the-ground talent been

affected or changed over the last 18 months? How, for example, do

smaller IFCs stay competitive with their larger hub rivals that

are more likely to be able to attract talent from outside the

jurisdiction?

Anthony Partridge: “The jurisdiction has always been an

attractive location for qualified individuals to relocate to. The

global pandemic, in our experience, has caused many individuals

located onshore to question their current way of working and has

driven a shift and desire to try a new way of living. This, in

conjunction with a very healthy stream of private client work

into the Islands over the last 18 months, has created a number of

new and exciting opportunities for talent coming to

Cayman.”

Have travel constraints caused a talent squeeze? If so,

how have you countered this?

Gregory Haddow: “Travel restrictions have meant that travelling

to Cayman is harder than it once was. However, in our experience,

it has not stopped those who wish to relocate here from doing

so.”

Are there any specific services that have opened up in

the last 18 months of disruptions? If so, what are they and how

has your organization responded/played a part?

Anthony Partridge: “A concierge type of service for new arrivals

to the islands has been a very successful part of this firm's

practice over the last 18 months. The firm has been able to use

its departments covering various legal service areas (such as

property, immigration, private wealth and corporate) to great

effect. Clients have been able to enjoy a 'one stop shop' for all

their relocation questions and needs.”

Have you seen consolidation of firms, new arrivals, for

example?

Anthony Partridge: “Yes. The global events over the last 18

months have created a number of opportunities for individuals in

the jurisdiction. Cayman firms have certainly been on a hiring

campaign with a number of new arrivals across a number of firms

and departments.”

Have you seen jurisdictions switching focus, moving more

into crypto and digital assets, for example?

Gregory Haddow: “We have seen more enquires in relation to

setting up structures to hold crypto assets.”

Following on from that, are you seeing specific services

or regulatory changes being designed to serve or attract frontier

markets, where adoption trends differ from established wealth

markets, and the wealthy are generally at a much earlier stage in

their wealth creation?

Gregory Haddow: “The commencement of the Virtual Assets Service

Providers Act in the Cayman Islands, which provides a framework

for the regulation of virtual asset service providers by the

Cayman Islands Monetary Authority is an example of this."

In your view what are the top five elements for an IFC to

be a compelling draw for clients?

a. good stock of reputable financial

institutions and talent

b. solid legal foundation (i.e. well-developed

jurisprudence and sophisticated statute)

c. politically stable

d. well regulated

e. good connectivity/accessibility

Data from various sources seems to suggest that IFCs

remain as important to the global financial world as ever, for

all the challenges that have come in the form of beneficial

ownership disclosures, crackdowns by certain governments, etc.

Looking into a crystal ball, where would you expect to see the

sector in a decade’s time?

Anthony Partridge: “Despite the changes in regulation, the IFC

centers of the world will remain hubs where financial service

talent will pool and collect. Even with onshore jurisdictions

legislating to make holding assets offshore less tax efficient,

industries such as the trust industry should remain active as

settlors seek to establish trust structures for reasons other

than tax efficiency (i.e. succession planning and asset

protection).”

Footnotes

1, Cayman Islands vaccination rate - Google Search

2, Jersey vaccination rate - Google Search

3, Isle of Man vaccination rate - Google Search

4, Bermuda vaccination rate - Google Search

5, Bahamas vaccination rate - Google Search