Tax

Mitigating Tax Hikes, Creating Alpha With Cash Value Life Insurance - Part 1

This is the first half of an article setting out what the author says are the tax and value-building qualities of life insurance in the various forms in which it operates in the US.

As FWR readers know, lawmakers in Washington DC are pushing for tax hikes on capital gains, estate and income taxes, among others. Whatever the rights and wrongs of these measures, tax-mitigation is at the top of the wealth management agenda. In this detailed article, the author examines the life insurance toolbox.

The writer is Andreas Stuermann, president of Stuermann Consulting, a firm which specializes in designing, implementing and administering life insurance solutions for individual and institutional clients.

The second half of this article will be published later this week.

The editors of this publication are pleased to share these views. The usual editorial disclaimers apply. To jump into the debate, email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

When surveying affluent families and highly compensated executives and entrepreneurs about what keeps them up at night with regards to their finances, recurring themes include taxes, market volatility, balancing risk and return, maintaining adequate liquidity and protecting their assets. This article examines how cash value life insurance can be a helpful tool in the toolbox for big picture wealth planning, while living and at death.

Tax increases are on the horizon and will likely have a negative impact on the ability to sustain savings levels and meet long-term financial goals. This will lead Americans, who already face intensified pressure to save due to increased longevity, to taking more investment risk in order to meet their goals. Among the proposed tax policies in President Biden’s American Families Plan and Senator Bernie Sanders 99.5 per cent Plan are: (1)

• Increasing the top ordinary income tax rate on income over

$400,000 from 37 per cent to 39.6 per cent and adding a 12.4 per

cent Social Security payroll tax, split between the employee and

employer, for wages over $400,000.

• Moving the long-term capital gains tax rate from 20 per

cent to 39.6 per cent plus the 3.8 per cent Net Investment Income

Tax for taxpayers with more than $1 million in income.

• Eliminating the step-up in basis of property inherited at

death and replacing it with a carry-over basis after allowing

individuals to exclude $1 million in unrealized capital gains

from this tax.

• Reduce the estate tax exemption amount to $3,500,000,

minus past reportable gifts (a steep decrease from the current

2021 exemption amount of $11,700,000 per person).

• Limit the gift tax exemption to $1 million (currently at

$11,700,000, minus any past gifts made above the annual exemption

amount, currently at $15,000 per donee).

• Create progressive estate tax rates, including a top rate

of 65 per cent on estates of more than $1 billion (currently a

flat 40 per cent rate).

In addition to these federal tax increases, the average top state capital gains rate is roughly 5.2 per cent. In total, the combined federal and average state tax rate on capital gains for wealthy individuals would be 48.6 per cent under the President’s plan. (2)

These tax proposals are on the heels of the changes brought about by the SECURE Act. Passed in late 2020, the SECURE Act removes the ability to “stretch” IRA and 401(k) account balances across the lifespans of most beneficiaries. Distributions must be taken faster, leading to accelerated taxes and the push into a higher income tax bracket for many account holders.

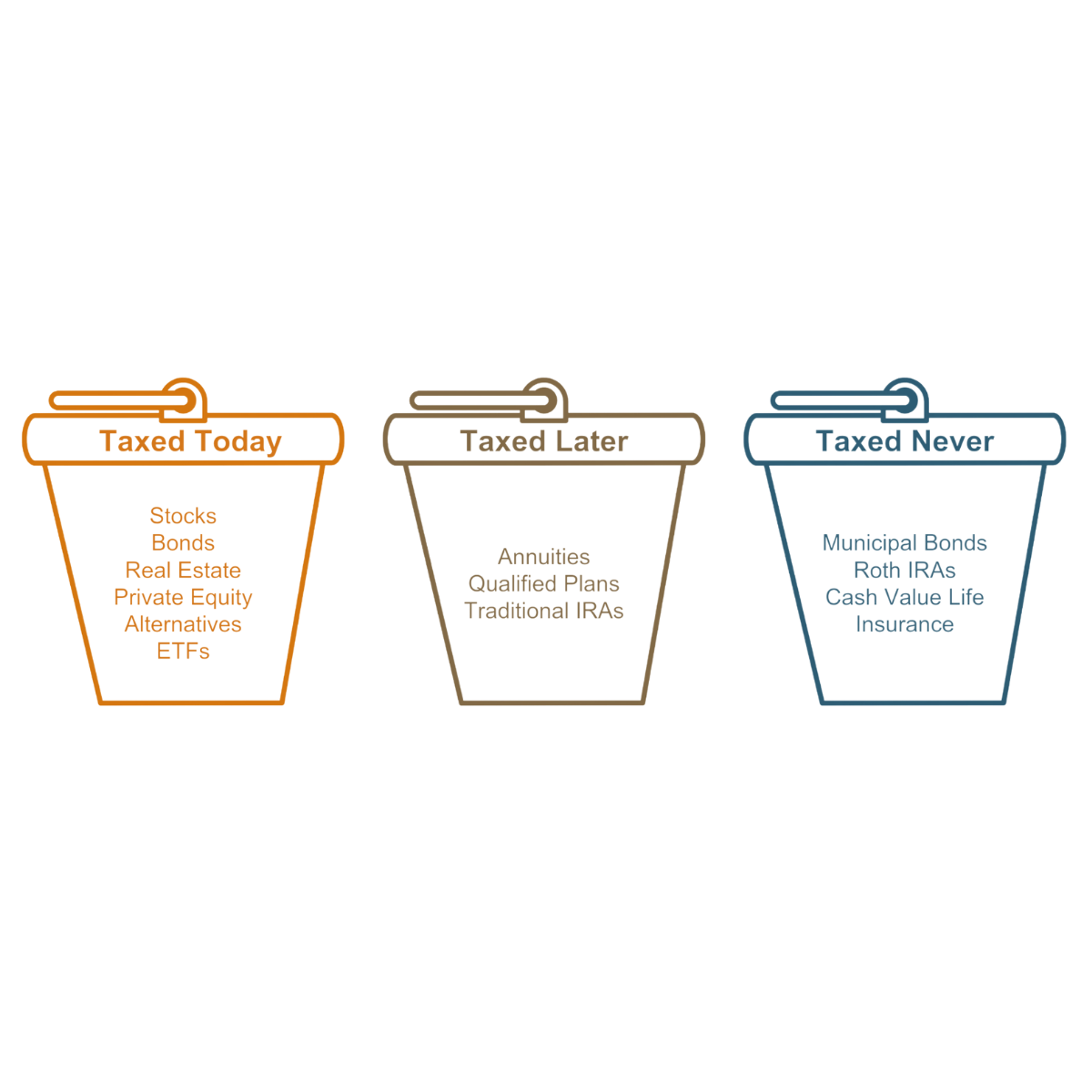

More attention will therefore be given to making tax-driven

choices about where capital is deployed. Tax diversification can

be divided into three categories:

1. Taxed Today – stocks, bonds, real estate, private equity,

alternatives, ETFs;

2. Taxed Later – annuities, qualified plans, traditional

IRAs; and

3. Taxed Never – municipal bonds, Roth IRAs, cash value life

insurance.

Every long-term investment strategy has three phases: depository; accumulation; and distribution. The depository phase is usually the smallest and the distribution phase usually the largest, making never-taxed assets increasingly appealing in our rising tax environment.

INSERT GRAPHIC – “Tax Buckets”

Affluent individuals face unique challenges when segmenting asset classes where all tax-advantaged asset classes are either unavailable to them or have limited value in their portfolio. For instance, qualifying for a Roth IRA is extremely unlikely and the funding limits of qualified plans restrict the percentage of wealth which can be allocated.

Conversely, these individuals commonly have more allocations to highly tax-inefficient and illiquid investments like private equity, hedge funds and real estate. More and more, the wealthy are turning to “Tax Never” cash value life insurance to balance their tax diversification strategy and to tax-efficiently save and build wealth.

Recent tax law changes under IRC §7702 have further increased the limits that can be invested into cash value life insurance and high net worth and highly compensated individuals are re-discovering what has been constant for nearly four decades - cash value life insurance possesses unique tax benefits which can be positioned both as a contingent asset class to balance risk and return in a portfolio and as an effective tool for tax diversification.

“Potential legislation pertaining to a number of tax increases

bodes well for the use of life insurance to mitigate the impact

of some of those increases,” says Frazer Rice, the Northeast

regional director for Pendleton Square Trust Company. Rice, whose

clients include high net worth individuals and families, views

life insurance as a solution to address a number of matters. “It

is a tool that is useful for tax-advantaged accumulation and for

tax-advantaged access to capital. Also, from an asset class

perspective, it provides the owner with a stable and

comparatively low-risk, fixed income-type of investment.”

Life insurance death benefit as a contingent asset

class

Rice is not alone in his assessment of how life insurance plays a

role in an investment portfolio. Focused on obtaining

market-beating returns (“alpha”), the investment community’s

analysis now goes beyond its traditional positioning of life

insurance which tended to only consider the expected return

realized on the income tax-free death benefit when it is paid.

This is computed by measuring the return of the death benefit

against the premiums paid overtime. Around life expectancy, cash

value life insurance generates after-tax IRRs between 4 per cent

and 5.5 per cent which is an attractive number in-between returns

expected from private equity and government bonds.

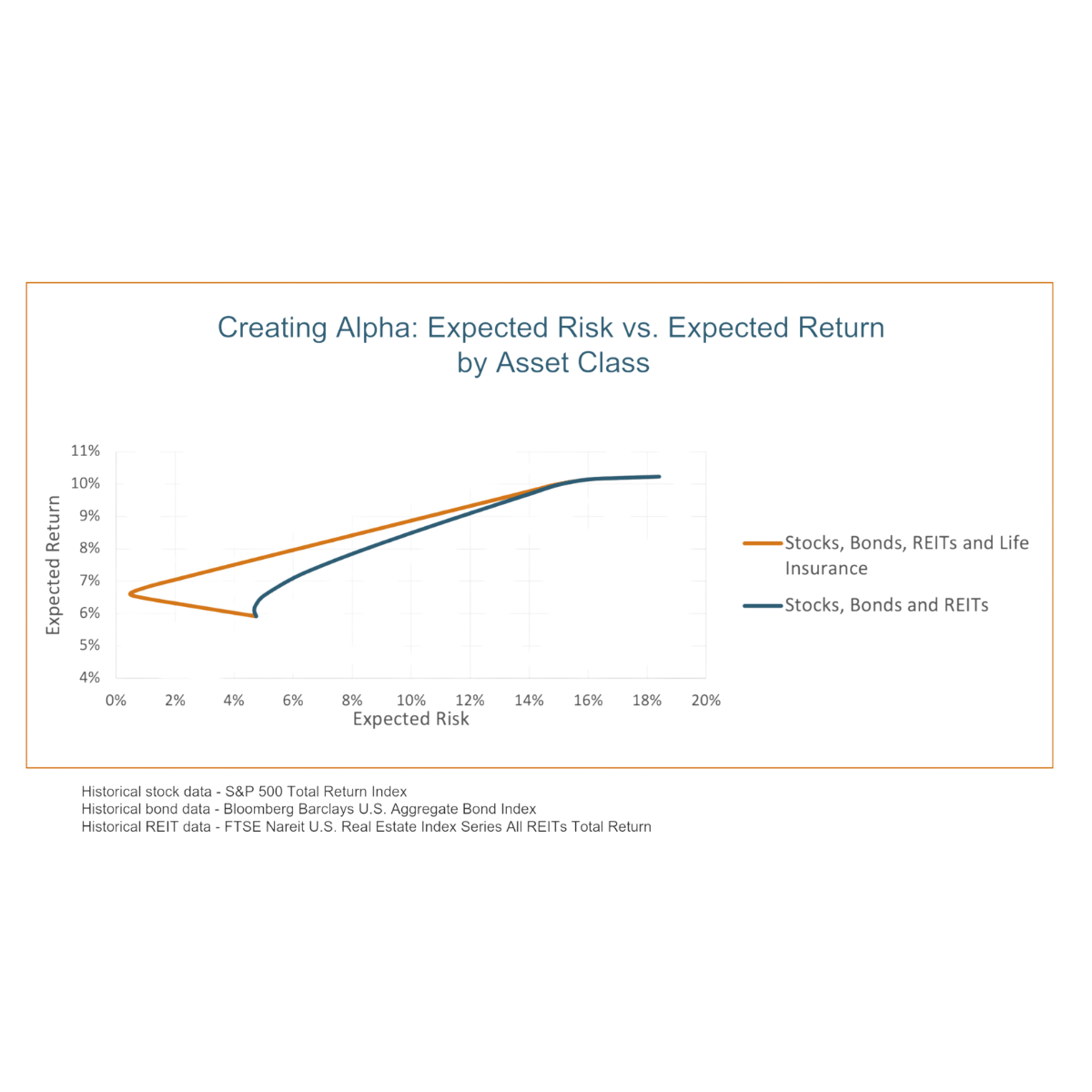

A growing number of investment professionals recognize that the traditional method is incomplete and are taking additional steps for a complete asset class analysis as laid out by economists Harry Markowitz in 1952 and William F Sharpe in 1966. Markowitz’s Modern Portfolio Theory theorized that, in addition to determining an expected return, individual portfolio assets should also be analyzed for their expected risk, which is the risk of not achieving the expected return. (3)

The second step to complete an asset class analysis relies on the Sharpe Ratio to measure the performance of an investment, such as a real estate investment or security in a portfolio, compared with a risk-free asset, like cash, after adjusting for its risk. The Sharpe Ratio characterizes how well the return of an asset compensates the investor for the risk taken and is used to compare one asset against another in order to achieve the optimal portfolio based upon a client’s tolerance. (4)

The result when analyzing cash value life insurance is that the income tax-free death benefit has a very stable expected return and a low risk of not obtaining that return. This makes it ideal to hedge against riskier asset classes such as private equity and hedge funds which are also highly taxed and lead to a significant amount of capital erosion. In effect, the positioning of death benefit in a balanced portfolio also contributes to tax diversification.

“If you want to take the analysis one step further,” says Rice, “a highly-rated life insurance company is likely to have high-caliber managers for its portfolio. Being able to count on such a level of professional management can further mitigate risk and provide a sense of comfort for a policy-owner.”

Tax and other living benefits of cash value life

insurance

Tax treatment of cash value life insurance goes beyond the

well-recognized benefits of tax-free growth and access. During

someone’s lifetime, a cash value life insurance policy can be a

preferred source of liquidity on par with cash in a checking,

saving or money market account. When structured as a non-modified

endowment (“non-MEC”), through as little as two annual premium

payments, a policy’s cash value can be accessed in the form of

extremely low interest and tax-free loans which remain tax-free

as long as the policy remains in force. (5)

The tax-free nature of policy loans means that the rate of return to the policyholder can be expected to be similar to after-tax returns of other assets bearing greater investment risk, providing tax diversification. Perhaps best of all, when there is a need for cash, instead of being at the mercy of banks and other lenders with predatory rates and conditions, policyholders can leverage their own life insurance asset to provide cash for personal and business needs.

Bruce Hyde is a partner in the wealth management firm Round Table Wealth where he serves as the chief compliance officer and a wealth advisor. “Perhaps the greatest benefit cash value life insurance offers is certainty. At the death of the insured, beneficiaries can be assured of receiving cash - cash that can be used to replace lost income or to provide liquidity for estate planning.”

Hyde explains to his clients that their money can go to one of three places when they die. “It can go to your family, to charity or to the government. Life insurance provides certainty that money going to taxes can be replaced to the family or charity.”

Depending in which state the policyholder resides, there are varying degrees of asset protection for cash value life insurance. (6,7). These protections extend to both the cash value and the death benefit with the death benefit generally protected from claims of creditors. Life insurance proceeds pass by contract and not through probate where claims against an estate are adjudicated, ensuring that beneficiaries receive the death benefit in full and income tax-free.

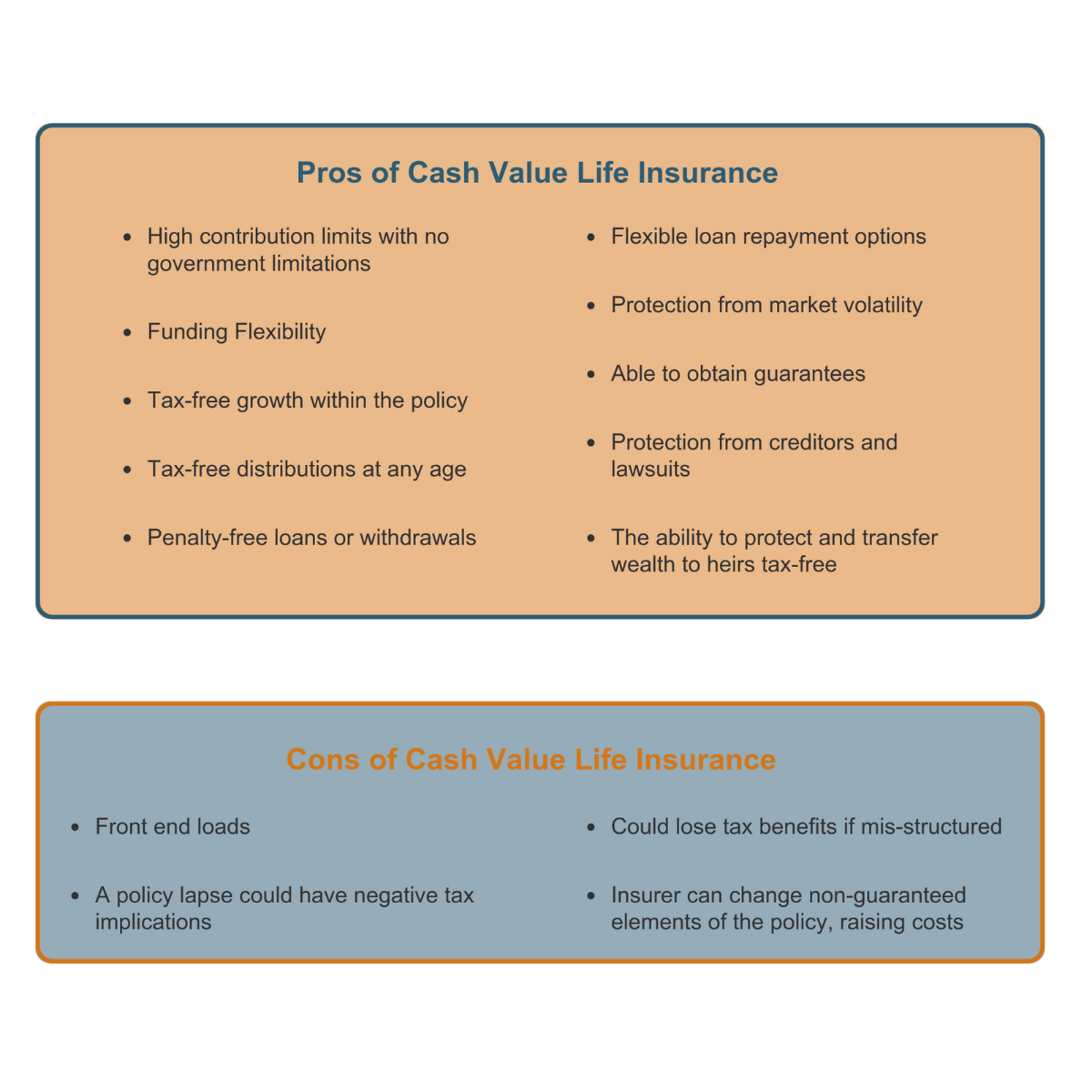

Affluent individuals considering incorporating cash value life insurance into a wealth management strategy should decide on which benefits are most important before purchasing and structuring a policy. Along with the multitude of benefits offered, there are detractors that need to be considered. Weighing the pros and cons will help with the question of suitability.