WM Market Reports

Market Falls Last Year Dent Global HNW Wealth; Asia Hit Hardest - Capgemini

Unsurprisingly, the fall in equities last year - averaging a drop of 15 per cent - hit HNW numbers and wealth. Asia, recently the hottest region for newly-minted millionaires, led the decline.

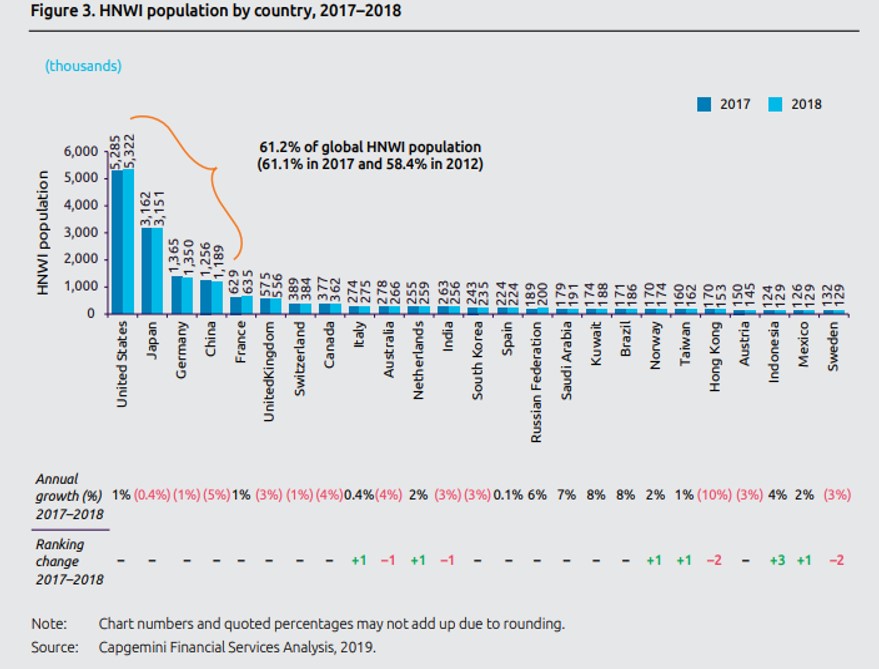

The fall in equity markets last year and slowing economic growth cut the number and wealth of high net worth individuals in 2018, with Asia leading the drop, according to the annual report on such trends by Capgemini.

China accounted for almost 25 per cent of the fall in global wealth while Europe also logged a “noticeable dip” in HNW individual wealth, the organization said. The only region that saw a rise in HNW individuals’ wealth was the Middle East, it said.

The wealth of all HNW individuals stood at a total of $68.1 trillion last year, down from $70.2 trillion in 2017. In 2011, to give a sense of the path of growth, the total figure was $42 trillion.

Asia-Pacific HNW wealth fell by 4.8 per cent; Europe fell by 3.1 per cent; Latin America fell by 3.6 per cent; Africa dropped by 7.1 per cent and North America slipped by 1.1 per cent. The Middle East rose by 4.3 per cent.

“After a stellar performance in 2017, stock markets faced turbulence in 2018. Amid high volatility, global domestic market capitalization declined by nearly 15 per cent in 2018. Multiple factors – including a struggling global economy, international trade conflicts, and rising concerns regarding tightening monetary policies – spurred market upheaval. All regions faced market capitalization decline, with Asia-Pacifc affected the most (down by almost 24 per cent),” Capgemini said in its World Wealth Report.

Asia-Pacific accounted for half of global wealth decline led by China. Europe was responsible for about 24 per cent – or $500 billion – of the overall $2-trillion decline in HNW individual wealth. The Middle East, however, saw a rise in HNW individual population numbers and wealth (6 per cent and 4 per cent, respectively), while North America was almost flat, the report said. Latin America witnessed HNW individual wealth declines of 4 per cent.

Ultra-HNW individuals accounted for 75 per cent of total global wealth decline. Ultra-HNW individuals by population fell by 4 per cent and 6 per cent respectively, and along with mid-tier millionaires (20 per cent of overall HNW individuals’ wealth decline).

Last year ultra-high net worth individuals (people with $30 million-plus in investible assets) accounted for 33.7 per cent of all HNW wealth, equating to 168,100 people; those with assets of $5.0 million - $30 million made up 22.6 per cent and those in the $1 million - $5.0 million bracket accounted for the largest slice, at 43.8 per cent.

Caution is the watchword

Choppy markets prompted investors to hunker down into cash and

cash equivalents, the report said. In the first quarter of this

year, cash/cash equivalents made up nearly 28 per cent of HNW

individuals’ financial wealth, while equities slipped to the

second position at nearly 26 per cent (down by more than five

percentage points).

People’s trust in their primary wealth manager was strong, however, inching up to 79 per cent from 78 per cent between 2017 and last year, the study showed, with North America showing the highest values.

“Despite continued strong client satisfaction, key opportunities exist for wealth firms to proactively meet rising HNWI expectations. Better clarity regarding fee structure may allay client concerns, as only 62 per cent of HNW individuals said they were comfortable with their primary wealth manager’s fees. HNWIs also said they want personalized offerings that focus on value creation,” it said.

“As the wealth industry evolves and HNWI expectations shift, firms must stay ahead of clients’ value expectations. A focus on fees and service quality will help to attract and retain HNW clients, as unsatisfactory service experience influenced 87 per cent of HNWIs to switch firms,” it added.