Family Office

The Essential Tool That Family Offices Ignore

It’s no secret that private banking, which includes credit and lending services, is an essential tool for those who wish to preserve their wealth. So, why are family offices behind on adopting these useful strategies?

Are family offices neglecting the importance of tools linked to credit and lending? These are such long-established parts of financial history that they are taken for granted. At BNY Mellon Wealth Management, Regina Burlington, director and senior private banker, head of the global family office, private banking, examines the terrain.

The editors are pleased to share these views; the usual editorial disclaimers apply. To comment, email tom.burroughes@wealthbriefing.com

Some family offices may not use private banking because of their clients’ aversion to risk. In certain cases, this feeling has developed throughout the lifecycle of building and maintaining wealth. For example, some may have taken on leverage in the past to create their wealth, and they now associate borrowing with a degree of risk which they are reluctant to reintroduce.

This demographic is extraordinarily wealthy and that can sometimes lead to greater conservatism toward borrowing, which can include a slight aversion to debt. In short, the reluctance to borrow is a combination of a client’s profile change once they reach a certain level of wealth and the fact that they want to take risk off the table.

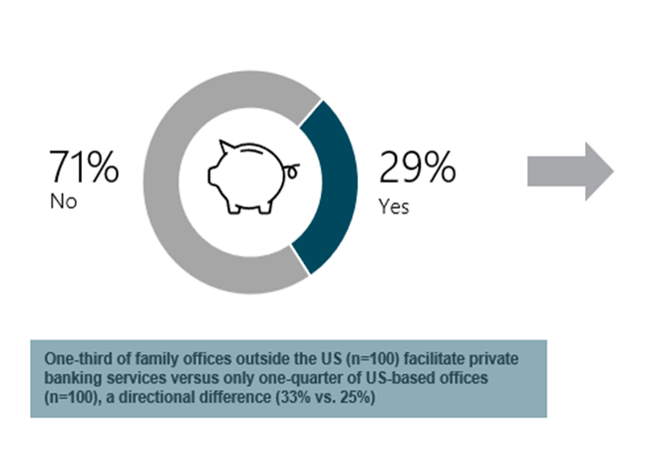

In fact, only three in 10 (29 per cent) family offices outside of the US facilitate private banking services for their clients, according to the BNY Mellon Wealth Management study, Shifting Horizons: Insights Into How Family Offices Are Responding to Rapid Economic & Social Change. The findings, which are based on responses from 200 family office decision-makers, reveal that the issue is even more pronounced stateside, as only one-quarter of US-based family offices use private banking for their clients.

Three in 10 family offices are involved in private banking

services.

BNY Mellon Wealth Management: Shifting Horizons: Insights

Into How Family Offices Are Responding to Rapid Economic & Social

Change. November 2021.

A strategy for winning

When working with family offices, private bankers can help

wealthy families meet complex spending needs by implementing

strategic lending initiatives. These needs can range from major

business investments to short-term – and in some cases unexpected

– expenses, such as a tax event or real estate purchases. The

decision to borrow ultimately comes down to arbitrage, in other

words, when it may be more advantageous to borrow than to

liquidate securities, which could potentially result in unwelcome

tax consequences as well as the disruption of long-term

investment strategies and asset allocations. In situations like

this, borrowing comes into play from a strategic point of view as

opposed to a needs point of view.

When markets are volatile, liquidating securities to meet unexpected expenses or investment opportunities is one of the worst things a client can do.

Aside from incurring undesired capital gains tax, this can lead to missed market opportunities during a subsequent recovery. Thus, it’s important for family offices to be able to meet their clients’ financing needs without disrupting investment portfolios or other illiquid, strategically placed assets.

How to Identify a banking partner

Although it should be clear that borrowing makes sense from a

strategic perspective, the private banking industry is not

homogenous, and many banks have varying degrees of experience

working with family offices. Depending on which banking partner a

family office selects, they may be able to access more

competitive rates for their clients as well as the required

expertise to custom-tailor solutions for complex financial

makeups.

Family offices should look for a private banking team that has experience of working with clients such as theirs and a keen understanding of the need for confidentiality. A banker should understand all the components of a client’s financial profile and provide borrowing strategies that go beyond cookie-cutter solutions, helping to match their assets with their liabilities and anticipated cash flows.

Complexity calls for customization

Family office clients also have complex financial profiles. An

experienced banking team must be familiar with a family’s unique

entity structures, such as trusts, LLCs and partnerships, as well

as multiple trustees and beneficiaries.

Due to these multifaceted entity structures, the banking team also needs to be familiar with the estate planning strategies employed for a specific client and why, as well as different asset allocation strategies and time horizons.

Ultimately, family offices should seek banking partners that understand the importance of creating flexible and customized borrowing structures, which consider estate plans, tax implications, asset allocation goals and other unique needs a client may have. A successful banking partner will work closely with a family office’s investment and fiduciary teams to suggest holistic borrowing strategies that can provide family offices with options to keep their clients’ wealth invested for the long term and benefit future generations.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment, private banking or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment, banking or financial options available. The information discussed herein may not be applicable to or appropriate for every individual and should be used only after consultation with professionals who have reviewed your specific situation.