Direct co-investment offers a way to tap into the world of private markets without incurring some of the costs of using a “co-mingled” fund. And, if handled correctly, investors can still spread risks in a way that they could not achieve by doing everything themselves, argues Morgan Stanley Wealth Management in a recent paper.

“Today, private markets are responsible for a substantially higher portion of innovation and value creation than in prior years, which makes them very attractive for investors pursuing alpha. As private market portfolios mature and return enhancement continues to be a primary investment objective, investors may seek to augment their exposure by accessing direct co-investments in targeted sectors and strategies alongside favored fund managers at more attractive fees,” the US bank said in the report. The paper is entitled A Tug Of War: Public Versus Private.

“Since individual direct co-investments may be deemed high risk, investors are well advised to deploy a portfolio approach tailored to their own needs. In this manner, investors will be better equipped to balance the potential for upside return against sizable downside risk while seeking to benefit from significant potential diversification flexibility,” it said.

However, azfter fund vehicles have dominated private equity and venture capital, the focus is switching toward direct investing, Morgan Stanley said. For most investors, this means that they can cut fees paid to fund managers, reduce the risk of putting money into a “blind pool” and carry out their own due diligence on investments. This also moves away from the “co-mingled” funds model that has been the norm in recent years.

According to one online definition, direct co-investing is "when an investor invests alongside a sponsor in a direct investment and the investment is not part of a greater GP-LP blind pool fund relationship with the sponsor."

Morgan Stanley said co-investments benefit from a variety of forces: Private equity fund managers that want to make bigger deals are constrained by portfolio construction guidelines that cap the amount of equity per deal. Managers may have discretion to allocate a portion of excess capacity to other prospective limited partners. High net worth investors are still a relatively untapped market for private equity funds.

Investors can gain exposure to direct co-investments either through a co-investment fund, which are typically diversified portfolios of co-investments within a 10-year fund structure, or investment in individual co-investment deals. As a rule, individual direct co-investments are structured as or through special purpose vehicles , with the SPV investing alongside a lead sponsor’s fund vehicle, Morgan Stanley said.

Secular shift

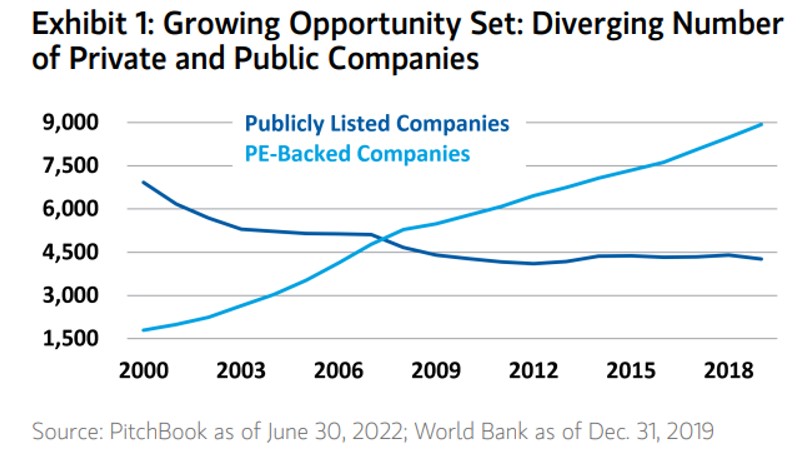

There is a secular shift in favor of private markets as firms take longer to float on stock markets or even decline the listed route at all. In its nine-page paper, Morgan Stanley noted that between 2000 and 2019, the number of publicly traded US companies collapsed by almost 40 per cent to 4,200. Conversely, the number of private US companies backed by private equity firms surged by almost 500 per cent, from 1,800 to 8,900.

Also, there are fewer than 3,000 public companies with annual revenue greater than $100 million, while there are more than 14,000 private businesses with comparable revenue levels.

There are various reasons for the shift. It is getting easier for private equity and venture capital to attract funds. And it continues: PricewaterhouseCoopers predicts that private markets’ AuM will rise to almost $15 trillion by 2025, versus $4.9 trillion in 2021. Another driver is the Sarbanes-Oxley Act, introduced in the early Noughties after the Enron accounting scandal that significantly added to regulatory burdens on listed firms. A third headwind for public firms is the chore of handling quarterly results and having to deal with skittish investors.