Client Affairs

Women's Equality Day Puts Spotlight On Alternatives

Alternatives are playing an ever larger role in investment decisions but the industry reflects poorly for hiring and promoting women in the sector.

Today is Women’s Equality Day, a reminder of the 19th Amendment being adopted in 1920 giving women the right to vote, and a good time for financial services to take stock of how women are faring on pay and moving into senior roles.

It is well-documented that the pandemic has set women back on both of these fronts. In the alternatives investment space, where investors are putting much of their faith these days, representation of women lags the broader industry by some distance.

Prequin's latest study shines a light on the sector, which is home to private equity, venture capital, real estate, private credit, and other less well-lit corners of the investment universe. Figures show that there is progress overall, with growing numbers of women working in alternatives. But to use a well-worn phrase in describing the diversity picture, there is much work to be done.

Even in venture capital, the sector’s best-represented asset class, less than 14 per cent of women are in senior positions. Rather dismally, parallel research from Deloitte shows that women founders are behind just 7 per cent of global fintechs, even as these entities are becoming a dominant force in financial services.

The reckoning is that only when the wider industry reaches a critical mass of women in leadership roles will it confer rapid progress. Currently only 5.4 per cent of CEOs at S&P 500 companies are women, for example. The 30% Club is among a cast of industry networks pushing for reforms and incentives that can translate to at least 30 per cent representation of women on boards and in C-suite roles globally in the next 20 years. That appears to be the benchmark.

The alternatives assets space is indicative of the challenges. At the end of 2020, just over a fifth (20.3 per cent) of employees working in alternatives were women, up marginally from the 19.7 per cent of women represented at the end of 2019, according to Prequin.

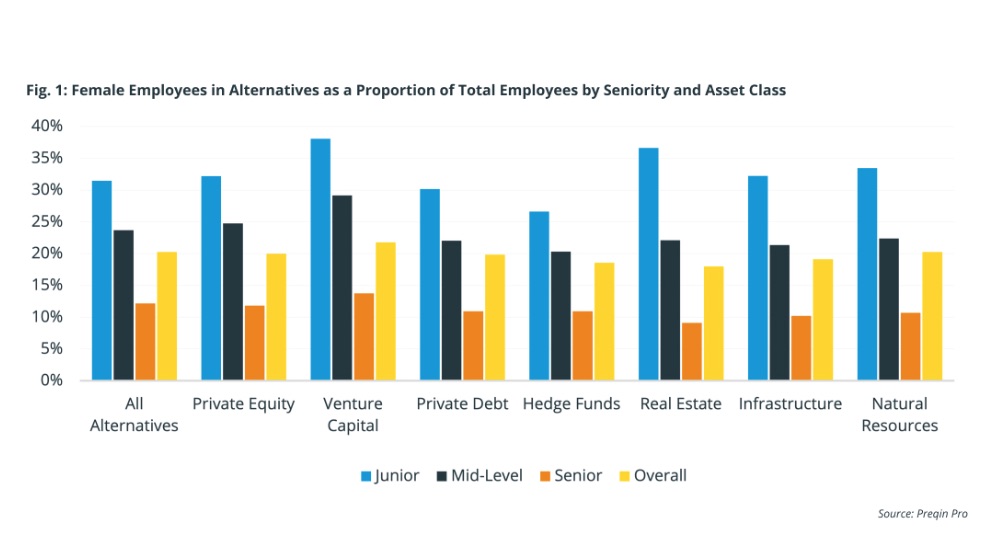

Digging a little deeper, it found that the number of females represented in junior roles in alternatives was a respectable 31.5 per cent; that dropped to 23.7 per cent for mid-level roles and slid to 12.2 per cent for senior positions.

Asian real estate firms also stood out for scrutiny, registering the lowest regional concentration of female employees of any alternative asset class at 16.6 per cent.

The chart below shows how the asset class presents for women in senior roles:

However, few would argue that the sector isn't visibly trying to change the status quo, both conscientiously and to meet tougher shareholder ESG demands. Firms are more deliberately recruiting women from a diversity of backgrounds and creating better incentives to retain them, and rehire them if they've dropped out to start a family.

“Intentional recruitment, innovation in retention, supportive reentry, as well as mentoring, sponsorship, and strong peer networks” are some of the ways the industry can act, CEO of 100 Women in Finance, Amanda Pullinger, said. She says the industry deserves credit for some important initiatives for improving gender diversity that are now paying off. "Today, more women enjoy longer, more satisfying, and more senior-level careers in financial services, and the industry is stronger, in part, for their collective presence and contributions." Pullinger, like her peers, argues that female talent needs to be cultivated much earlier, when women are just starting to form their career ambitions and catching them as they enter the workforce.

She also raises the issue that women still only manage a single-digit percentage of clients' assets, making it an “obvious next area of opportunity” for the industry to tap into women’s abundant skills.