New Products

What's New In Investments, Funds? - Addepar

The latest in funds and investment news from across North America.

Addepar

Addepar, the wealth

management tech platform, recently introduced a new investment

sentiment barometer targeting the portfolios of high net worth

and ultra-HNW individuals. It tracks the actual transactions

investors make.

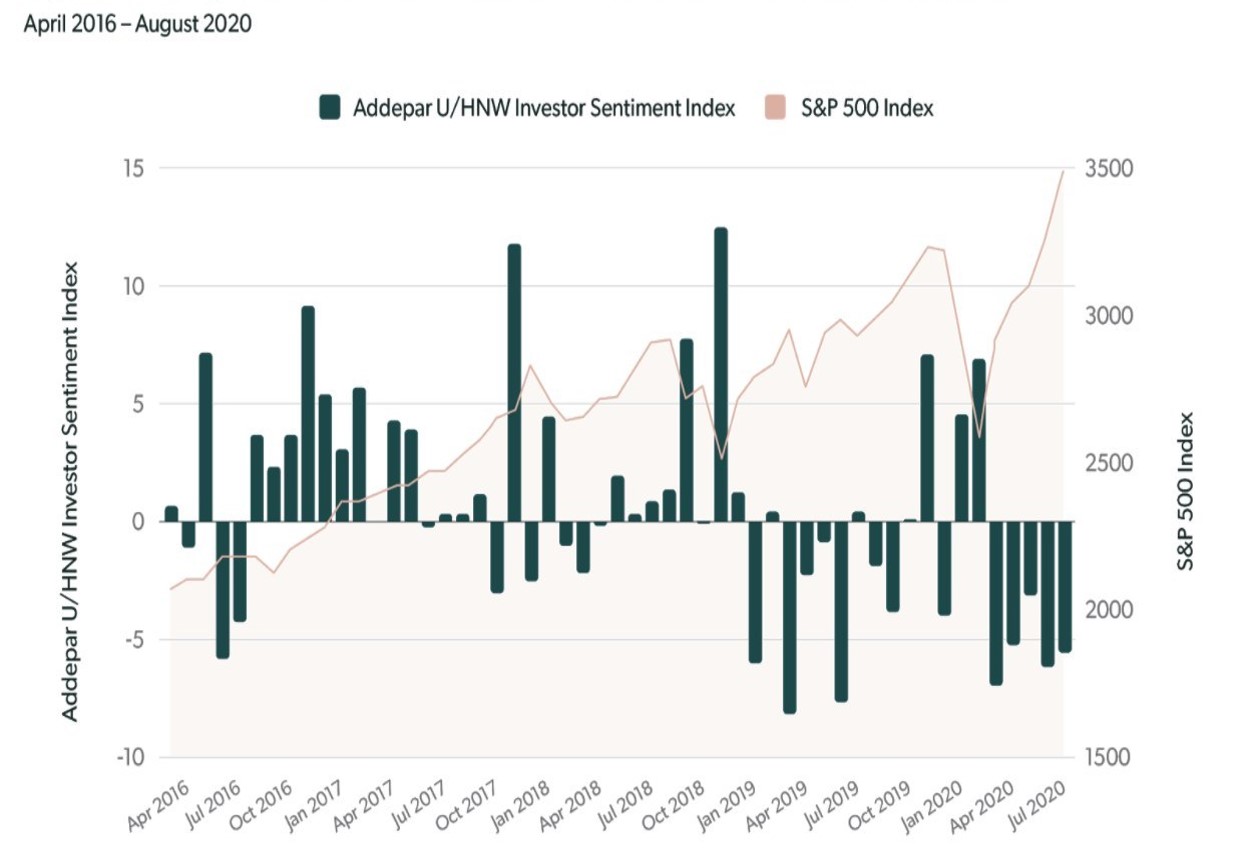

The new offering is called the Addepar Investor Sentiment IndexSM. It tracks investor sentiment drawn from US equity transactions captured on the Addepar platform. The platform analyzes activity across more than 10,000 portfolios from investors each with more than $10 million in total assets each.

The index follows the aggregated data of actual transactions. The index is also weighed so that small moves by large investors don’t skew results, as can happen with some market indices, Addepar said in a statement.

"Earlier this year, Addepar surpassed $2 trillion in client assets aggregated on the platform. Using the critical mass of data we have curated, we are meaningfully compounding the value we can bring to Addepar's clients by complementing our category-defining software with relevant and timely analytic insights," CEO, Eric Poirier, said.

"Addepar has taken a novel approach to measure sentiment. Their preliminary results showing the contrarian investment behavior of sophisticated investors is striking and worthy of continued attention," said Professor Chris Geczy, Academic Director of the Jacobs Levy Equity Management Center for Quantitative Financial Research. He is also academic director of the Wharton Wealth Management Initiative, The Wharton School, University of Pennsylvania.