Alt Investments

West Coast Wealth: Flooding In And Out

Reports that many are leaving California for lower-cost states because of high taxes and stiffer regulations have been a theme of this year, but some of the leading wealth managers are doubling down there.

The big guns of wealth management are asserting themselves in Southern California, assigning more resources to cover the region's wealthy enclaves. UBS's US wealth division has been ramping up in New Port Beach and Pasadena, and JP Morgan Private Bank has just announced a serious push in the area, with strong hiring at three California offices.

Greater Los Angeles is in JP Morgan’s sights as one of the fastest growing and most dynamic economies globally. The firm believes the region has weathered the pandemic well and is well-placed to reap the benefits of rapid growth in medtech, health sciences, clean transport and LA's thriving digital media scene, boosted by rival streaming services.

The bank wants to double its advisor headcount nationwide over the next five years by adding 1500 more advisors, but says that much of that focus will be on California's wealth needs.

“We’re expanding aggressively across California. Much like our clients, we see tremendous opportunity to grow our impact across Greater Los Angeles now and in the years to come,” Olivier de Givenchy, US West Region banking head, said.

The group has offices in Westlake Village, Pasadena, and South Bay, managing more than $40 billion for clients. It is building out another regional hub in San Diego to tap the ultra wealthy communities around La Jolla.

Texas, Florida, and California are all jockeying for wealth pouring in from Latin America. The pandemic and rising political instability in countries such as Venezuala, Chile, and Peru have made the US a leading destination for families who are being forced to revisit their wealth structuring and move some of their assets to more stable jurisdictions. For some this has meant uprooting their businesses.

"I think from a social and cultural stand point, Florida (and Miami) has positioned itself for many years as the first choice destination for Latin American people and for Southern Europeans," Tomas Alonso, managing director of ZEDRA's Miami office said. Texas and Southern California (notably San Diego) have become other important destinations for Latin Americans, "especially for Mexican wealth owners, because of the proximity to Mexico, business opportunities and social networks," he added.

UBS Wealth Management has also been making strides in Southern California, adding a seven-person team managing $2 billion in its Newport Beach operation. The Swiss manager this week added another senior advisor and portfolio manager to its Beverly Hills office. Brett Moore, who is joining the firm after five-years as a portfolio management director at Morgan Stanley, previously ran a Santa Barbara-based RIA, echoing the premium wealth providers are placing on local roots and knowledge.

Despite their global associations, the big wealth brands are steppping up their game to deliver highly personalized, localized boutique services “that support clients where they live and work, and more closely connect with them around their interests and passions,” Katie Brody, executive director and head of JP Morgan's new Pasadena business, said. "We are global and local," she said.

The firm says it is devoting sizable resources to training advisors on specific industries and giving them the technical skills needed to grasp the next generation's wealth aspirations and behaviors.

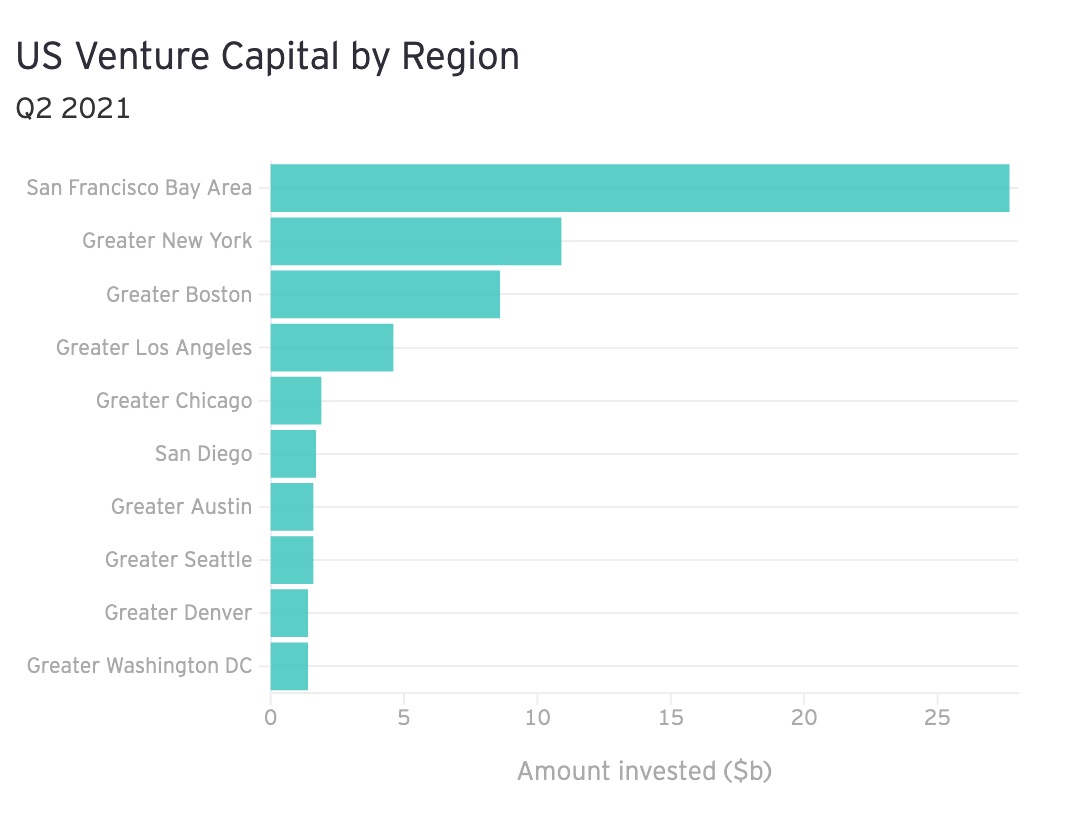

Arguably, this encompasses understanding the West Coast's thriving venture scene. Los Angeles has the third or fourth largest VC market behind the Bay Area and New York, depending on whose figures you choose. Roughly 120 venture firms have their headquarters in the city, managing around $10 billion between them. The culture reflects a young, fresh investment environment, where most venture firms have been founded in the last five years. The Los Angeles market lacks the Bay Area's ability to bring in heavy hitters for the highly capitalized late stage funding rounds, but LA along with hubs in Austin, Atlanta, and Miami are nipping at Silicon Valley's heels.

Wealth managers need to be ensconsed in these entrepreneurial communities, with their ears close to the ground, especially as the competition stiffens for private market/direct investments access.

Research from alternatives investment specialist Different shows that VCs in the the Los Angeles area are more likely to target startups in health (24 per cent), media (19 per cent), sports (11 per cent), ecommerce (11 per cent), gaming (8 per cent), and wellness (8 per cent). These themes are indicative of LA’s heavy consumer-focused economy.

ZEDRA's West Coast-based VP of global expansion, Brieanne Runsten, has also seen trends developing around talent acquisition, where firms are turning towards Latin America to find more affordable talent that is still in line with US time zones. "We are seeing Mexico, Costa Rica, Brazil, and Argentina all coming up as places where US tech companies are looking for talent. Companies want to know what hiring looks like there," she said. It is part of a broader trend of being more global and the fact that remote working, because of COVID-19, has translated well for companies hiring internationally. "It is also a way of being able to figure out ways to get into new markets; so whether it is for talent or market acquisition purposes, it is a pretty big trend right now," she said.

How much of Silicon Valley's hegemony is under threat? Runsten is doubtful that it's much.

There is so much money in venture right now and so much capital sitting around waiting to be deployed that the Bay Area will always be a big ecosystem, she counters. "I grew up in the Bay Area, and have lived in many places, and I don’t think there is a place in the world that is similar in terms of that early stage ecosystem. But we are seeing a lot more investments happening outside the Bay Area, in other hubs, that five or six years ago were just growing. Now those hubs are seeing their own unicorns. Seattle has over ten; the UK has over 100 now. It is definitely pervasive.”

Sapphire Ventures, she noted, is one example of a Palo Alto VC which is focusing more on international markets.

Last month it closed its sixth fund and largest to date bringing AuM at the investment firm to around $9 billion. "The new capital will help the firm continue to ramp investments in Series B through late-stage enterprise technology companies in the US, Europe, and Israel," Sapphire said. Marking out some of the direct investing hotspots, the firm has opened three new offices in the last year in Austin, London, and San Francisco, as well as scaling up investments more broadly in the European market.

"Investment is moving across the Atlantic into different markets looking for better pricing on companies but also with the acknowledgement that talent and good ideas are everywhere, and that it does not necessarily have to be headquartered in Silicon Valley," Runsten said.

This news service recently reported on the launch of R360, an invitation-only group for ultra-HNW individuals in the US pooling their knowledge and investment opportunities. TIGER21 is another affiliation of wealth creators, largely US based, which is looking for more international exposure. This week, the group hired a new high-profile MD in London to extend the invitation-only network's European reach.

Analysts are expecting another bumper year for IPOs in 2022, which should further boost California coffers, after a record $454 billion was invested in the first three quarters of 2021. San Mateo-based Vera Therapeutics, and San Francisco-based fintech Affirm were among the year's most successful offerings.

Routes to market are also evolving. While most of the venture-backed listings in 2021 followed the traditional IPO path, a number, including Lucid Motors, Ginkgo Bioworks, and Cazoo (UK), went public via SPACs, although appetite for the special purpose acquisition companies has cooled since catching the eye of regulators. Meanwhile fintech Wise, London's big listing for the year, and Amplitude and Warby Parker, both US companies, chose to list directly.

The battle among states to offer a low tax base is only part of the economic picture.

Few states, if any, can match California for the R&D and innovation that investors like to chase, particularly in the tech and healthcare fields. Of the roughly 7,000 corporates located in the state, around 20 per cent are devoted to research and development. The overall average for the US is (11 per cent), China (15 per cent), the UK (14 per cent) and Japan (10 per cent), according to data compiled by Bloomberg. The percentage of Texas R&D facilities, which have poached high profile companies from the Golden State, is roughly half that of California’s, according to Bloomberg analysis.