Investment Strategies

Weathering Shocks: Strategic Allocation For Portfolio Resilience

.jpg)

As has happened in previous crises, many assets this year have moved in tandem with one another, claims BlackRock as it seeks to illustrate how to make portfolios more resilient.

The world’s largest asset management firm, BlackRock, sets out ideas on how investors can make their portfolios more robust after what has been a traumatic few months due to the effects of COVID-19. Even though – as of the time of writing – many equity indices are only a short distance from their 2020 starting levels – there is a long way to go. Underlying economic data promises to be grim reading. Even before the pandemic, investors may have fretted that a 10-year bull market was going to turn eventually. It is worth noting that at the time of this article going to press, some equity market indices are almost flat on the year. The MSCI World Index, for example, was down by just over 2 per cent as of 5 June - an astonishing recovery from the lows of March.

The views here reflect the US asset management house as a whole, coming from Ursula Marchioni, chief strategist EMEA, iShares, BlackRock. This news service is pleased to share these thoughts; it does not necessarily share all views of guest contributors and the standard editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

Year to date, investors have been challenged by heightened volatility and significant drawdowns in risky assets, driven by concerns over the economic cost of the coronavirus outbreak. The pandemic is on track to deliver a sharp and deep economic shock, as social distancing policies have brought economic activity to a near halt across the globe.

Permanent economic damage can still be avoided provided that bold policy actions are taken - this includes drastic public health measures coupled with coordinated monetary and fiscal policies which we see being adopted. Yet, the majority of portfolios have suffered significantly. Many assets moved in tandem with each other, prompting investors to question their asset allocation processes and correlation assumptions. In this context, building portfolio resilience in strategic asset allocation (SAA) – or the broad mix of asset classes which a long-term investor will hold - has never been more important.

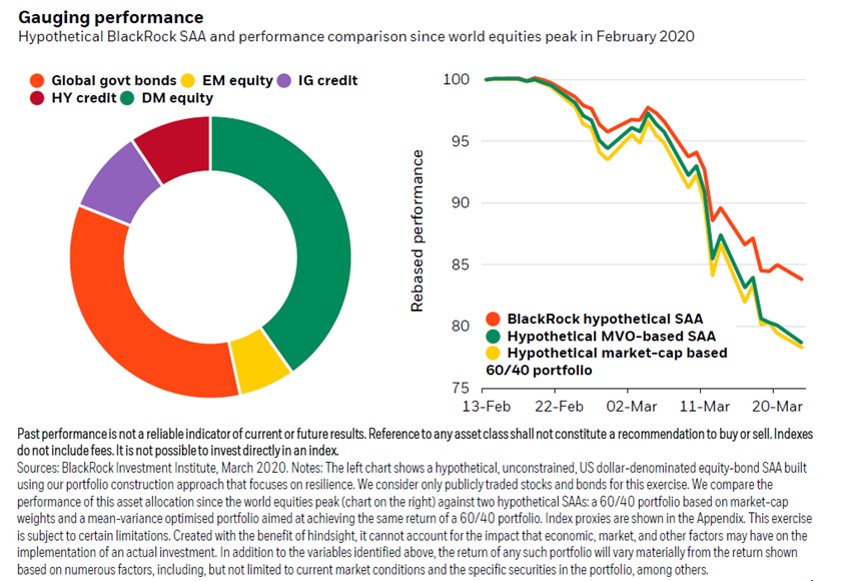

To bring this concept to life, a BlackRock analysis shows how a hypothetical portfolio comprising public assets designed for resilience would have fared in the market volatility, compared with a traditional mean-variance optimised portfolio and a market-capitalisation weighted portfolio split between 60 per cent stocks and 40 per cent bonds. The result? An overweight towards government bonds; diversified regional equity exposures; and a credit underweight which would have helped in the recent events.

Investors acknowledging that what they might have done before won’t necessarily work now, are correctly questioning how to position their portfolios to anticipate further market moves and changes in medium-term macroeconomic assumptions.

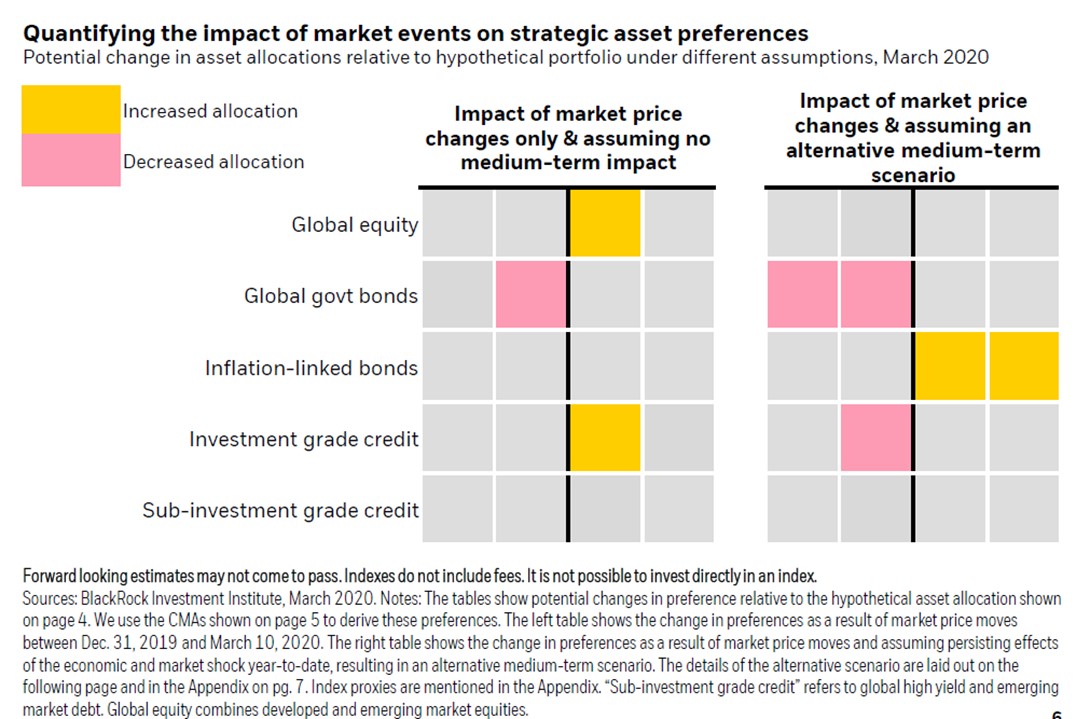

To address this, we have considered two possible scenarios: one characterised by a pure price shock and the other, more severe, where, alongside a price shock, we also have a fundamental change to the assumptions that serve as the basis for predicting markets’ behaviour.

In both scenarios, we recommend maintaining exposure to government bonds - even though they will yield lower expected returns and present reduced ballast properties versus the past, as well as face competition from potentially a more preferable risk-off asset: inflation-linked bonds.

Many portfolios have below-benchmark exposure to equities after the sell off. We do not envisage a repeat of the global financial crisis, and favour rebalancing back up to starting levels rather than dialling down risk. This conclusion holds – although less strongly – even in a scenario of supply chain reform, as equities remain a key source of return.

The case for corporate credit is more nuanced. For the past few years, we have been underweight credit assets in strategic portfolios, as a combination of equities and treasuries was preferable in a late-cycle environment and given prevailing spread levels. The sizeable spread widening is clouding this view.

Absolute returns look more attractive now, and the potential benefit this offers could offset some of the increased risk of a spike in defaults and downgrades. Yet we can see that spreads remain particularly volatile in the near term, particularly in high yield. The sharp dislocation in oil prices also muddies the outlook for high yield given the energy sector's heavy weight in benchmark indices.

The importance of introducing resilience in portfolios is greater than ever. What this means in practice will depend on investors’ specific situations, constraints and objectives.

A visual representation of these views is shown below.