M and A

Wealth Sector M&A Remains On Upward Track Despite Pause For Breath - Study

There has been a dip in M&A turnover from recent strong figures but the overall direction of travel remains strong, fueled by a number of forces, including a desire for scale as wealth grows, and succession planning by owners seeking exits.

Merger and acquisition activity in the US registered investment advisor space has passed the 100 mark in the middle of 2021, far surpassing the total of 67 deals reached in the same period a year ago, and highlighting how consolidation and other forces are driving activity, figures show.

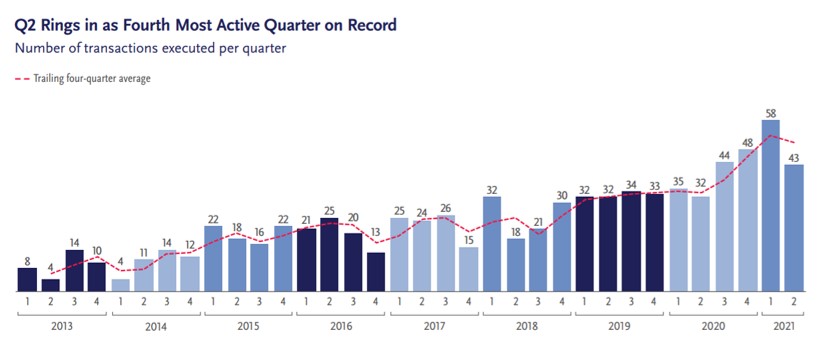

DeVoe & Company, which tracks M&A deals in the RIA space, said in a report yesterday that there were 43 deals in the second quarter of this year, the fourth-largest deal-flow figure on record, following 58 transactions in Q1 and 48 in the final three months of 2020.

In recent months Canada’s CI Financial, US-based Mercer Advisors and CAPTRUST, among others, have been snapping up RIA businesses. A desire for scale comes with increased client and tech spending demands, coupled with some RIA owners’ wish to retire and seek exits. FWR has noted, meanwhile, that the mass of M&A activity seen among RIAs hasn’t yet been mirrored by comparable levels of transactions among multi-family offices. (See an interview here with wealth sector consultant Jamie McLaughlin, who went into detail as to why this is the case.)

The report said a decline in deals in Q2 may suggest that the industry is digesting a round of activity, but future trends remain strong.

“Following the blockbuster month of January, recent M&A could be considered fairly strong but unimpressive. The industry caught its collective breath in February and has slowly picked up speed. The increasing pace is anticipated to accelerate. Like a runner stepping on the gas as they approach the finish line, M&A activity is now ramping up to a full sprint before year-end,” it said.

Consolidator firms and RIAs are the most active deal-makers and banks are getting back into the game, the DeVoe report said.

(See chart below that highlights the trend at work.)

Last week, ECHELON Partners, an investment bank and advisory firm to wealth management, reported in its second-quarter report that there were 54 deals announced in 2Q21 – a decline from the record-setting activity seen in 4Q20 and 1Q21. In ECHELON’s case, that firm said it expected activity to increase moving into the second half of the year, spurred by sellers looking to take advantage of buoyant markets and eager to avoid any change in tax policy.

Minority deals dominated Top 10 M&A deals, ECHELON said. The top three spots as measured by AuM transacted were all minority deals conducted by private equity investors: (1) Leonard Green’s investment in Mariner Wealth Advisors, (2) Charlesbank Capital Partners’ investment in Lido Advisors, and (3) Pritzker’s investment in Steward Partners. These three deals alone accounted for over $50 billion in AuM transacted in 2Q 2021.

Examples

DeVoe noted that Mercer Advisors initiated the most transactions

among consolidators. Their company record of 10 announcements so

far this year compares with seven total transactions for the firm

in 2020. Other Consolidators with five or more transactions

through the year’s first half included Beacon Pointe Advisors,

CAPTRUST, Focus Financial Partners and Wealth Enhancement Group.

RIAs that occasionally or opportunistically acquire RIAs expanded their transaction share by four percentage points (to 38 per cent) versus 2020. These buyers, which do not have M&A as a central plank of their business strategy, typically capture between 35 per cent and 40 per cent of transactions, the report said.

The Congress Wealth Management acquisition of $2.4 billion Pinnacle Advisory Group was the quarter’s largest RIA-RIA transaction. Congress, on the selling end of a transaction with CI Financial just over a year ago, credited its new parent for providing the resources that made the Pinnacle acquisition possible, it said.

The acquisition of Viridian Financial Advisors ($826 million of AuM) by Edelman Financial Engines announced in May is a “noteworthy move” by the industry’s largest RIA, the report said.

Banks

The report said that bank acquirers account for only 4 per cent

of transactions year to date, their four acquisitions in 2021

surpassed total annual bank volume for each of the past two

years. Three of these four transactions were initiated in the

second quarter. Bank acquisitions have historically had their

challenges. Despite this, bank executives now look to be

reconsidering and selectively focusing on the right transaction.

Firms below $500 million have had less time or energy to refocus on M&A. From a peak of 27 per cent of transactions in 2019, selling firms in the $251 million to $500 million segment dropped to a 14 per cent share year to date. On an annualized basis, this is the segment's lowest share since at least 2014. Buyer interest may also be playing a part, as acquirers that historically focused on this segment (such as Mercer and Wealth Enhancement Group) have shifted their strategy to target larger firms.

“We expect this segment to increase sale volume over the next quarter or two, as their owners shift their focus toward succession and external sales – and become the next 'falling domino',” the report continued.

Succession factor

“While a growing number of transactions tend to be growth

motivated, succession planning continues to play a major role in

driving M&A activity. Second-quarter sales involving

Stewardship Financial Advisors, ET George Investment Management,

and Integer Wealth Advisors, for example, all cited succession or

continuity concerns as factors driving a transaction. The

important influence of succession planning on M&A will likely

remain for some time,” it added.