New Products

Wealth Manager Launches Behavioral Investing Institute

The launch is designed to build understanding of this field among wealth advisors and highlights how what had been a fringe academic area is now spreading out into the mainstream of finance and business.

The business of behavioral finance continues to become more mainstream, with a US wealth management shop creating an institute to train advisors and organizations.

Toews Asset Management, a New York-based firm advisory firm with $1.8 billion in assets under management, has launched the Behavioral Investing Institute. The firm said the BII will concentrate on putting insights from this approach into action on the ground where it can make a difference to clients’ wealth over time.

Toews is an SEC registered investment advisor founded in1994.

“We do not teach abstract theory or add to an advisor’s vocabulary of phrases that end in with the word, `bias,’” Dan Kullman, director of education and training at Toews Asset Management, said. “The Behavioral Investing Institute teaches actionable steps that can guide advisors to make adjustments and improvements to their businesses that potentially lead to better relationships with clients. We want to help advisors address emerging investor issues and behavioral biases that could impact their decision-making. It’s important to understand these triggers to create an exceptional client experience and attempt to enhance relationships.”

The area of behavioral finance was given added impetus when Richard Thaler won a Nobel Prize in economics in 2017. It is gaining new fans in the North American wealth industry searching for a new edge. A recent study of more than 300 advisors by Charles Schwab Investment Management, Cerulli Associates and the Investments & Wealth Institute, has found that 81 per cent of advisors now use behavioral finance techniques when talking to clients, rising from 71 per cent in 2019. Big gyrations in markets, as seen in the March equity selloff, followed by the recovery, and now the tech-led selling of recent days, are reminders of how emotion as much as hard fact can drive developments.

“We built the Behavioral Investing Institute coaching program after nearly a decade of research, training and feedback from real advisors,” Felipe “Phil” Toews, CEO of Toews Asset Management, said. “We feel behavioral finance is an overlooked component of financial services and one that requires hands-on coaching to be truly grasped and put into practice. Now, arguably more than ever, is a time when financial advisors should be equipped with all the tools to sustain, improve and grow relationships with old and new clients. An understanding of decision making, investor tendencies and portfolio design is a core component of what we want advisors to take away from our training.”

The BII trains advisors individually or in groups. The program attempts to help advisors transform and differentiate their practices by becoming behavioral coaches for their clients. To achieve this, the Institute assesses how behavioral guidance tools are used in changing how clients perceive and emotionally respond to different market environments. Each advisor or institution will have a behavioral finance expert to walk them through every step of the process.

The move is a way for advisors to win and retain clients and this explains much of the current momentum when newbie advisors are setting up RIAs or working out how to re-set their value propositions in a competitive environment.

“Clients, traditionally speaking, hire a financial advisor to manage their money — not realizing that person should be a behavioral coach too,” Toews’ Kullman said. “We see this as an opportunity for advisors to grow their businesses in an increasingly uncertain market environment by improving their knowledge and ability to work with clients, even in more dire situations.”

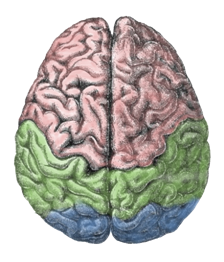

A new discipline

The discipline harnesses what is known about human psychology to

understand that the decisions people make with savings,

investments and spending aren’t as coolly rational and objective

as one might think. Humans don’t, so the argument goes, start off

in life with a mental “blank slate” but instead carry habits and

tendencies that are products of millions of years of human

evolution. (Some of these notions can be controversial – the

field known as evolutionary psychology, drawing on ideas from

Darwin and others, can carry political implications such as

male/female differences.)

BF practitioners in this area generally seem to argue that the more humans understand how they think, and how they can be biased, paradoxically, the more rational their choices could be. For example, a person who knows that they have a short temper in certain situations might be more careful about avoiding such situations; a person with an addictive personality might take care to avoid getting into environments where temptations exist, and so on.

In the US, the Securities and Exchange Commission in 2010 - when memories were still raw from the financial tsunami - issued a hefty report for the Library Of Congress, entitled Behavioral Patterns and Pitfalls of US Investors. The SEC has continued to track this area. Watchdogs say investments and services must be “suitable”, but if advisors don’t fully understand how a client might panic in a financial wobble, for example, how can they advise them in a compliant way? It might be too far to say that advisors are putting customers “on the couch”, but it seems not far off. Regulators in the UK and Singapore, for example, are also looking at this area.