M and A

Wealth Management M&A Hit Fresh Highs In Q3 2025 – ECHELON Partners

Among its predictions is that annual deal volume could reach 440 this year. The North American – and global – wealth and asset management is, commentators say, highly fragmented and due for more consolidation.

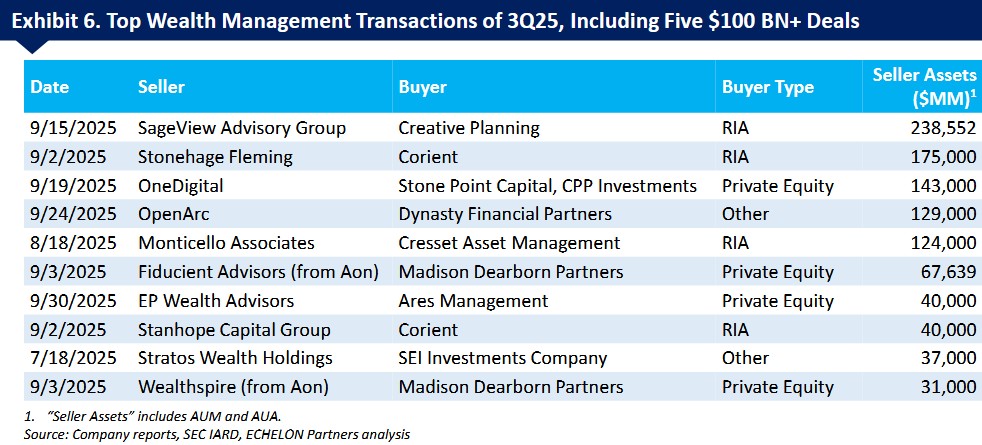

With major wealth M&A deals for the third quarter involving, for example, Corient/Stonehage Fleming and Stanhope Capital, Stone Point Capital, CPP Investments/One Digital, and Dynasty Financial Partners/OpenArc, the market for transactions is running hot.

The third quarter of this year made records for assets under management involved, according to ECHELON Partners in its latest update on corporate activity in wealth management. The firm, which advises wealth managers on such deals, said there were 13 deals involving sellers with $20 billion or more in assets. There were 125 transactions in Q3 2025, up from 102 in the second quarter and 118 in the first, and unchanged from Q4 last year.

ECHELON predicts that annual deal volume will reach 440 by the time 2025 is over, beating the prior year’s total by more than 100 such transactions and making this year a record-breaker.

The average number of assets per deal in Q3 2025 was $1.1 billion, down from the second quarter; the report said the average assets-per-deal figure should be $1.7 billion this year, slightly under the four-year average.

Strategic acquirers accounted for over 91 per cent of all transactions, while private equity investors have completed 34 direct investments year-to-date. Total transacted AuM reached approximately $1.2 trillion in Q3 alone, underscoring the growing scale of deals across both strategic and financial buyers.

The biggest deal, in seller assets AuM, was Creative Planning’s acquisition of SageView Advisory Group ($238.55 billion), ahead of Corient’s purchase of Stonehage Fleming, the UK-headquartered multi-family office, at $175 billion. Corient also, as mentioned above, bought Stanhope Capital, which had assets of $40 billion. (See chart below.)

Source: ECHELON Partners

According to the suitably bracing title of Thinning The Herd: The Race For Relevance Fueling M&A – Olver Wyman and Morgan Stanley said the global sector, which historically has been among the most fragmented in financial services, will see consolidation. Between 2025 and 2029, the consultancy and bank expects more than 1,500 "significant transactions," with up to 20 per cent of existing firms being acquired.

Commonly-cited drivers of M&A are a desire by acquirers for scale to handle rising technology and regulatory costs. The arrival of AI – and associated investment – is given as a reason by the likes of Oliver Wyman and Morgan Stanley in its report. Other causes are a desire by older advisors who own stakes in the firms to exit and retire.