Uncategorised

WHAT THE CONSULTANTS SAY: Scorpio On Importance Of "The Wealth Journey"

In the latest in a series of comments about global wealth management from consultants, Scorpio Partnership looks at the "map of wealth" and many of the issues the industry and clients now face.

This publication has approached a raft of consultants operating in the wealth management sector to give their views about a range of challenges and opportunities for the industry in different parts of the world. A number of articles will be released in these pages in the coming weeks and we hope readers find them stimulating. The articles have been sought by this publication and also by Bruce Weatherill, of Weatherill Consulting, and also chairman of ClearView Financial Media, publisher of this news service.

This article, entitled What wealth needs next: Making the wealth journey count by adapting approaches, proving value, and improving engagement, is by Sebastian Dovey, managing partner, Scorpio Partnership. The views of Dovey and his colleagues appear regularly in these pages; we are delighted to share these insights.

HNWs are on the move. Fast.

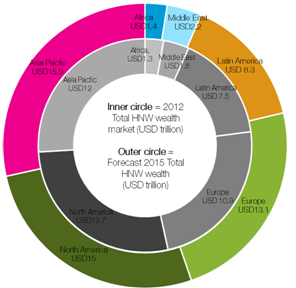

The rise of these fortunate millionaires across the globe has been well documented. Asia, for instance, is now clearly taking control of the balance of global wealth. This is likely not to reverse. We are moving into a new global order of wealth.

Indeed, predictions are widespread that the community of HNWs in Asia alone will double within 36 months. By 2015, there will be just shy of 3 million millionaires in the region. In China alone the number of centa-millionaires could eclipse the total global number within a decade.

The map of wealth

Source: RBC Wealth Management Capgemini World Wealth Report

Keeping up is going to be tough. And most wealth managers are already breathless.

But for those that pause and think what this wealth creation sprint means, there are some open questions. How will these HNWs value their relationship with their financial institution in the future? What will make wealth management worthwhile to them? And what will the industry need to do next?

The world is complex. So much so that recently we hired an artist to sketch out the issues we are seeing and capture this on a page. The reason being that we have become convinced that many people that know us do not really know what we are thinking and what we are seeing about the future.

All the issues of wealth today in one picture

The vision of complexity is captured beautifully here. Indeed, what we propose is that the next article we write will be based on the readerships selection of any one of the key topics raised. We not only have thoughts on every point, we also have evidence to back it and plans for how to capitalise. This text is a little test to see who has read this far – as long as we get more than 25 responses toward a topic area, we will undertake to share more thoughts.

In the meantime, let’s get back to that issue about sprinting wealth….

This article will examine elements of the questions. It will seek to show there is evidence of a subtle, yet fundamental change in requirements among HNWs today. The requirements of opinion, knowledge and advice are on the up. This change will have a major impact on the way in which wealth managers will delight these clients on the fast track of wealth creation.

WHAT’S IN THE NUMBERHistorically, without any sense of irony, the industry has always believed that its past is the best prediction of its future. For instance, in Asia and arguably in many other parts of the globe (if one listens purely to ad hoc stories), the clients of the past have, in their opinion, only ever wanted supportive execution desks.

Based on this ideology, looking ahead, as the regional HNW client population swells, these wealth professionals believe success will be more brokers and better prices to meet the wave of demand.

Evidence to back this argument by the wealth professionals typically includes information on how many advisors a client maintains. The theory goes, particularly in Asia, that the greater the number of advisors used by a client the more of a market jockey a client actually is. On that rationale, for instance, the APAC HNW is almost twice as much of a trader than an American HNW.

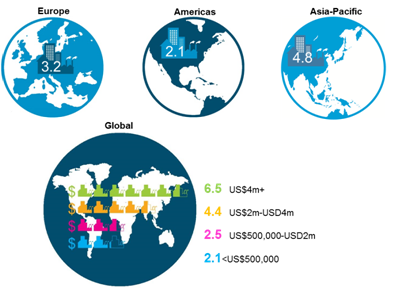

The number of wealth professionals engaged by an HNW

Such evidence is pretty overwhelming it seems. But what if there is a different reason for this number? What if this relationship multiplicity is pointing to a transitional situation – which is a quest by clients to find a better valued relationship? What if, on actually looking at trend evidence (which we do) there is a much clearer pattern emerging around the future value of wealth advice.

In fact, unparalleled insight from the consumer (more than 35,000 now by the way) built carefully by over years and years indicates that many HNWs find frustration in having to have a series of different corporate relationships purely in order to get access to different types of necessary expertise to solve their wealth needs.

Why is it not possible, they wonder, to get a team of specialists in one institution that can complement each other and provide a fuller wealth solution? Why indeed?

THE HUNT FOR CONFIDENCE

Increasingly, client insight is showing that the HNW clients are not actively seeking out as many multiple relationships as the industry believes. Interestingly, this is most pronounced in Asia. This number typically grows over time because of the transitory nature of many professional advisors in the industry.

In fact, many HNWs openly state that if they could avoid this multiplicity in relationships they would. They increasingly long for the consistency of one relationship.

More importantly, although the HNW client may be making a fortune fast, they do not necessarily have the confidence that they know how to keep it. And the strong sentiment is that their traditional wealth advisor/broker is not going to be the best source of insight on how to do this. So, the growing number of relationships is down to the client hunting out a more valuable relationship.

And to date, the millionaire, whether they are Tokyo or Toronto or any point in between is a little frustrated by what they are finding.

This under-confidence of the client is very marked based on research. It is likely to surprise many observers who believe that with the possession of wealth comes the possession of wealth management expertise. Indeed, the possession of wealth can make the holder of it very lonely indeed.

In reality, the HNW client base is often very aware of their deficiencies and when it comes to wealth they know that information is king. Currently, they value sources that can fill this need and the regions HNW are seeking out providers that can make a difference here.

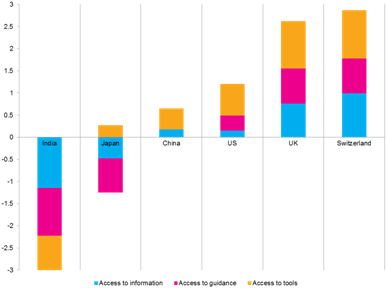

Evidence of this is based on recent insight of millionaires which presents an interesting comparison on the levels of confidence of a millionaires in a wide range of global markets. For example, if one compares the attitudes of millionaires in Asia (using Japan, China and India as examples) with millionaires outside Asia (using the US, UK and Switzerland as examples) one can see the marked difference.

As analysts of what wealth needs next, this insight goes some way to showing that the investor is conscious of their need for good information and support when it comes to wealth. If they were to find it, all in one place ideally, they would become much more confidence. And satisfied.

The level of investment confidence among millionaires

Most notably, for instance, Indian investors have the least self-belief that they have the materials needed to make informed investment decisions. These are the same country where the wealth population will double within three years.

THE SWITCH TO A STRATEGY AND AWAY FROM A TRADELooking to the future, the future HNW is actually clearly trending toward an interest in a more complete wealth relationship for better value. This is particularly pronounced in Asia as a whole, but it is also strong in Europe. This is posing some questions in our mind around the efficacy of many operating models in wealth management.

The single point of contact option could be a limitation on an institution’s capability to offer full value in a holistic relationship. A way around this may be, by the way, a strengthening of the digital engagement – but that is a whole other story if you want us to tell you about it.

To assess this situation, let us look again at Asia. Here, a large numbers of operators in the region present a full range of capabilities in their marketing, but in reality they tend to focus on direct trading solution. After all, these are the firms that believe their past is the guide to the future and thus the single advisor model picking stocks is the tip for the future.

These fast track wealth creators want more. And they have the speed of initiative to find it.

Evidence of this progressive shift of interest among HNWs in the region toward a more complete wealth need is now emerging. Among Asian HNWs there is a growing recognition that this expertise is rare to find.

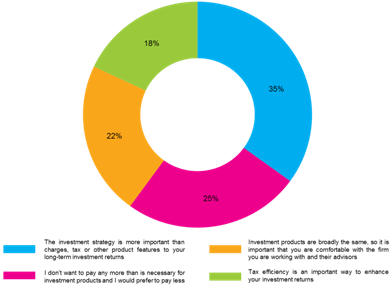

The future investment strategy issues for Asian

millionaires

In line with this, when considering the wealth creation plans of these individuals, we see a nod toward getting strategic assistance when it comes to obtaining quality advice over investments.

Clearly, preferences in the region extend well beyond a purely transactional relationship. While this is the early signs of this change what is clear is that the community of wealthy investors are much more switched on to the idea and with emergence of a much more interactive wealth world (using digital elements) of the future they are going to value firms that are switch on.

Based on these guideposts of insight, the question quickly becomes: what makes the up the ultimate constructive and valuable relationship? In the quest to answer this, there are some interesting findings beginning to emerge that may show a new world order for the wealth management industry.

UNDERSTANDING THE WEALTH DIGERATTIWhile the investments issue is at the heart of the wealth management story, the surrounding influences of the digital world are now beginning to have their impact on the value of the relationship. The key is that information is, literally, everywhere. But the challenge is to get information channelled n a tailored manner to one individual client at a time. This is expected to be very pronounced.

The reason for this assessment is based on evidence from a growing number of research initiatives. In fact, HNWs are among the most digitally interested consumers in the finance across the planet. They are pushing the boundaries of the wealth model in so far as they want and expect multiple touchpoints.

These sprinters to fortune are also managing to double click along the way.

The industry is still a touch reluctant, to put it mildly, to embrace the world of digital. On one level it is based on a fear that this will devalue the one-to-one personal relationship that is at the heart of most competing models.

Slowly, ever so slowly, the industry appears to be realising that rather than undermine the personal relationship, the digital arena is likely to actually improve the value of the relationship. Here, it is the millionaire fast trackers that are forging ahead. On all counts of preferred communications (see below) the suite of digital elements are above the rest of the world.

Notably, the scale of interest compare to the rest of the world is significant in our view. For example, the world of social media, networking and the use of smart phone platforms is so much more pronounced. For the institutions that integrate these areas in their relationship, they will be underscoring their value to clients not just now but a long way into the future.

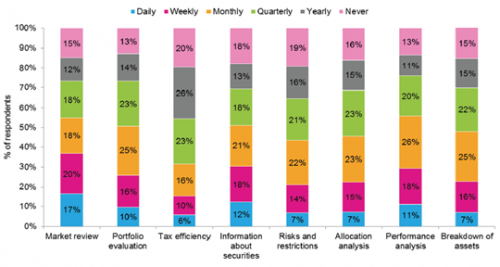

Building out the channels for now and in the future

How often do you use your wealth management online to carry out the following actions?

GETTING IT ON-(LINE) WITH CLIENTS

The initial reaction of the wealth management industry to the evolution of digital, and particularly social media, has been a combination of horror and hesitation. But given that wealth is fundamentally now a consumer industry, the need to react to the needs of the client is paramount.

The key is that online will become a part of all relationships, in all walks of life for virtually everyone. It is unrealistic to believe that wealthy clients are not going to want to interact with the digital world.

This is nowhere more evident than in Asia, where clients are among the most digi-literate in the world. In fact, our insight is showing that HNWs in the region place only 13% more importance on personal meetings than they do on access to a mobile phone app. This group want to talk with their providers over a number of different lines - a positive indication that an advice based model may have some success here.

But private banks still need to do more to read the symptoms early and respond to client demands. In the case of digital, these institutions have been slow to really understand the value in ‘getting online’ with clients and relatively sluggish when it comes to creating and implementing comprehensive digital strategies that actively connect with clients.

Even on more mainstream sites like Facebook, just half of the leading wealth management institutions are responding to potential clients and actively seeking out others. In contrast to the retail space, where three-quarters of companies respond to comments or questions via this form of social media, the proportion is extremely low.

The reality of wealth management social media

The experience that clients want is broad and if an advisory model is really to take hold the wealth managers need to start using those information channels that their clients deem relevant.

With these changes in the interactivity of wealth management, a new approach to long-term advice, planning and investment is starting to add a little more colour to this current service offering. This goes well beyond investment strategy and attempts to engage with each individual client psyche by understanding what a client wants to achieve and what makes them happy.

Only time will tell whether regional institutions can become masters of this new type of relationship, and whether Asian clients believe it is of any value. The digital world is just one piece in the puzzle. Yet, as anyone knows that has attempted a jigsaw puzzle, without all the pieces, the picture will never be complete.

MASTERING THE ART OF THE INTANGIBLE

Happily, the industry is not unaware of the changing requirements of the private client across the globe. Recent insight in Asia alone indicated that the industry expected the provision of high quality advice to be the primary issue within 24 months that they will need to address.

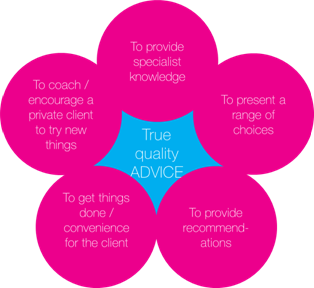

The question, to our minds, is determining what exactly “high quality advice” is in both the eyes of the client and the advisor. The research earlier in this piece pointed to elements of the influence on the future of advice. The challenge continues to be the combination of delivering a service which is often intangible. In this final section, there are a few pointers to the future for the relationship model.

Crucially, the research is now consistently showing that values for a wealth consumer are not just quantitative, they are qualitative too. Indeed, true value is where both elements blend well.

The challenge is identifying the variables that constitute the value. The insight iis showing the core needs that will delight a client boil down to five elements: information, contact, options, creativity and convenience.

Depending on the needs, the emphasis of these elements will naturally adjust. For instance, an elderly retired client seeking income will have a different set of influences to a thirty-something high flying professional that has just begun to race past the first few million.

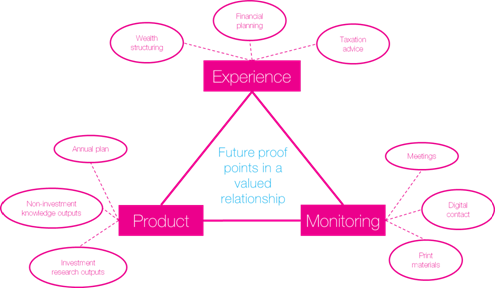

The intangible proof conditions of a valued relationship

What is striking is that clients are also becoming very specific about what it is they will expect to see in these five areas to prove value to them. The above five areas merge in to three areas where a wealth management business has the capacity to influence: experience, products and monitoring.

This is good news, as it clearer for wealth managers what they need to do to satisfy a client in a way whereby they are happy to pay for the solutions. And that, after all, is the essence of the model.

The tangible proof conditions of a valued relationship

What are the main activities that are demonstrations of value in

a relationship?

Delivering the above consistently is going to be the challenge. Indeed, expecting one person to be able to do this is likely to be too much to ask. The traditional brokerage-oriented businesses may struggle with this. Indeed, it is likely to be a more complete wealth management entity that can take this issue on and deliver a sustained relationship that is valued.

LOOKING ONWARDSSo how can financial institutions better serve the needs of their clients? Well, firstly, by accepting that while clients are not uniform they can be studied intelligently and good evidence will lead to better decisions. Ultimately, different investors will want different things when it comes to wealth management. The brokerage model certainly won’t die out, but there are also some strong indications that Asia’s wealth is also searching for something else.

Secondly, it is by having a very clear idea about who you are and what you can offer. It is often said that we now operate in an over-saturated wealth management market. And while the space is exceptionally competitive, there are very few institutions that have the capacity to cater to the diverse preferences of this group at the quality that they deserve. We disagree on many levels with this – the competition only serves to force the better firms to distinguish what they can do best.

Finally, the voice of the client is now beginning to sing harmoniously. HNWs both want and expect more for their money. Institutions will prosper if they meet these expectations in a new and innovative fashion. Those firms that are brave enough to listen and respond will do well. The rest will just have to continue hoping for a good outcome.