Real Estate

Toronto Sets Temperatures Soaring As It Leads UBS Property Bubble Index

A global real estate "bubble" index produced by the world's largest wealth manager points to the hot-spots.

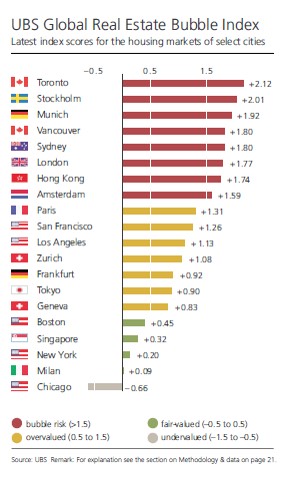

A UBS monitor of real estate “bubbles” shows that Canada’s Toronto tops the list of cities with overheated brick-and-mortar markets, while Stockholm, Munich, Vancouver, Sydney, London, and Hong Kong are also still at risk of such worrying status.

The only undervalued city in the Swiss bank’s annual Global Real

Estate Bubble Index, based on analysis of 20 cities, is Chicago,

with three quarters of cities at risk of a bubble or

overvalued.

The index measures the risk of a property bubble on the basis of

such patterns in select global financial centres. It uses the

following risk-based classifications: depressed, undervalued,

fair-valued, overvalued and bubble risk. Even in the cities with

the clearest signs of a real estate bubble, it is not possible to

predict exactly the timing and duration of a correction, UBS

said.

Asia

Singapore property markets are fairly valued. Singapore has

cooled down its housing market via a variety of regulatory

measures. For six years now, real prices have been falling

modestly and are now 18 per cent lower than at the previous peak

in 2011. The housing market has dropped back to fair valuation

levels, with risks declining in 2017 compared with last year. A

housing market turnaround seems to be in the cards.

In Hong Kong, regulatory steps to reduce price growth have proved

ineffective. Residential market prices reached an all-time peak

in midyear. The city features the worst housing affordability of

all financial centres. The average living space per person

amounts to only 14 square meters (150 square feet).

Tokyo’s housing market continues to decouple from the rest of

Japan. Since 2012 real prices in the capital are up 25 per cent,

while they are down 10 per cent nationwide. Low interest rates

are sustaining the local boom, but housing is becoming

increasingly unaffordable as income growth lags behind. The

expected long-term decline in population limits the upside.

In Sydney, all sub-indicators point unequivocally to elevated risk in the housing market. The dip in prices in 2015-16 proved short-lived. Prices rose 12 per cent in the last four quarters and are now 60 per cent higher than in 2012. Incomes increased, however, by only 2 per cent in inflation-adjusted terms.

Oh Canada!

Toronto, a new entrant into bubble territory, tops the Index in

2017. As in 2016, Stockholm, Munich, Vancouver, Sydney, London,

and Hong Kong are also still at risk of a bubble, along with

Amsterdam, which was merely overvalued last year. The only

undervalued city in the study is Chicago, with three quarters of

cities at risk of a bubble or overvalued.

London’s inflation-adjusted housing prices are almost 45 per cent higher than five years ago and 15 per cent higher than before the financial crisis a decade ago. But real income remains 10 per cent lower than in 2007.

Prices are gathering pace in Europe. Over the last four quarters the UBS Global Real Estate Bubble Index rose in all European cities in the study. Sharp increases were measured in Paris, Amsterdam, Frankfurt and Munich. All European cities in the study, apart from Milan, are at least in overvalued territory.