Trust Estate

Tips And Cautionary Tales From Estate Litigation Hell

The human and emotional realities of steering an estate through litigious waters are not well understood. Costs to an estate are sizeable, not just hard money but also the intangibles including lost time, stress, blown reputations, damaged goodwill to a business or a brand, and broken relationships. This is the first in a series.

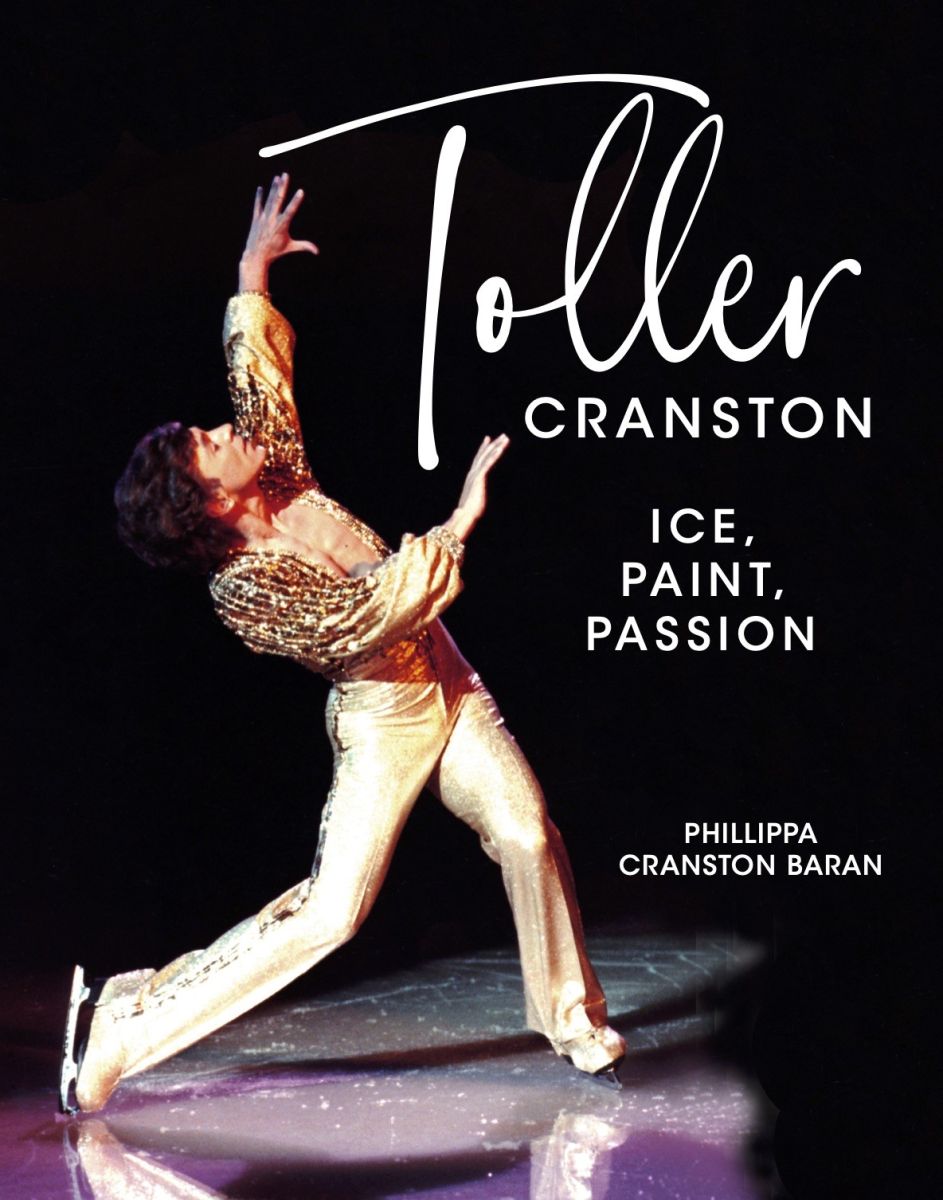

The following article has been written by Phillippa Cranston Baran, the sister of Toller Cranston, a two-time Olympian, international artist, Order of Canada, Honorary Doctorate, and member of multiple Halls of Fame. He died of a sudden heart attack at his home in Mexico in January 2015. In the absence of a valid will, Phillippa became his legally appointed executor and set about to administer an estate that included a massive property, more than 18,000 items, and 400 original works of art. Following almost 10 years of bitter and expensive litigation with the heirs, her two younger brothers, she shares lessons learned, perspectives acquired, and wisdom gained.

Toller Cranson

The editors are pleased to share such insights; we hope readers are interested in this powerful story. Remember that the usual editorial disclaimers apply to guest articles and if you wish to comment, or send suggestions, email the editors at tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

Collect the assets. Pay the bills. Distribute the proceeds. You think being an executor is easy? Think again. How do you value a business? Or price the Picasso? How do you deal with Aunt Marge? Can you keep the peace? Navigate minefields? Juggle? Plan? Decide? Adjudicate? Outwit, outlast, outplay? In far too many cases, being an executor is not something you do, it’s something you survive. Estate administration is not for the faint of heart. You don’t need a law degree. You need a balancing pole, a finely tuned "Spidey" sense, and maybe a crystal ball.

I speak from experience. I survived a precedent-setting litigation over the contested estate of a national icon that involved two countries, two languages, three currencies and no valid will. It took almost 10 years, and it cost a bundle. There are lessons to share that you will not get from Siri or Alexa who tend to think of estate administration as a planning issue, a legal question, or a tax problem. Estate administration is as much about wisdom, judgement, courage, and perseverance as it is about disbursements, beneficiaries, and trusts.

Bigger estates and bigger bucks = much bigger

problems

Recent reports note that in Canada and the US, $3.2 billion

dollars of inherited wealth changes hands every day as the

greatest transfer of wealth in human history, roughly one

trillion dollars, moves from Boomers to Millennials (1).

Furthermore, it seems that 68 per cent of people (137 million)

North American adults either refuse to make a will or die without

a will because they forget, procrastinate, don’t think about it,

don’t know how, won’t make the effort, or don’t think they have

enough of an estate to bother.

With or without a will, a lot of money is at stake. Estates are bigger and more complex. Families are bigger and more complex. Difficult family dynamics (in-laws, out-laws, kids, step-kids, partners) lead to misunderstandings, resentments, jealousies, and mistrust. When people become suspicious, issues become litigious. Whether there are wills, no wills, or contested wills, estate litigation is the fastest-growing area of law.

Toller Cranston’s estate contained 18,000 items and 400+ original paintings.

Toller House

Where it all went South

After I had completed the estate administration in Mexico, sold

the properties, and transferred two 53 foot containers of

artwork back to Canada, my brothers sought to have me removed as

estate administrator. Without evidence, and notwithstanding

responses to objections, responses to undertakings, mandatory

mediation, three sessions of discovery, and countless written

submissions, they alleged that I failed to report cash, produced

exaggerated or illegitimate receipts, used estate funds to buy a

property in Mexico, and improperly removed tens of thousands of

dollars’ worth of paintings.

They filed more than three hundred objections to my accounts. They provided zero evidence. Not a shred. In October 2020, there was a three-week trial during which I was on the stand for eleven freaking days. You can read the transcripts. (2) Or Google Toller, Estate, Fraud for more interesting commentary.

At the end of the day, there were five items out of hundreds of accounting entries that were disallowed including an inadvertent duplicate entry that was readily corrected and two items that were bribes that I had paid to officials in Mexico to facilitate the permit process. It amounted to a few thousand bucks on a $6.5 million estate.

The judge ruled that my administration was “responsible, reasonable, appropriate, ethical, and professional.” My accounts were passed. My brothers were nailed for $325,000 in punitive damages. One of them appealed. He lost. The appeal was decided by a three-judge panel in an astonishing twelve days and was accompanied by yet another whack of costs.

It was brutal and it was long, but I am incredibly proud that the Toller Cranston case has become a precedent. In future, those who make false accusations, file unreasonable objections, fail to define the issues, and fail to provide evidence will pay a substantial penalty. Lose big. Pay big.

The lessons

Since I am aware that estate lawyers and financial advisors have

been using the Toller Cranston case as a model, I thought that it

might be helpful to share my experience. Being an executor will

challenge you, test you, and sometimes (often) fill you with

immense joy and pride. You will discover what you are made of,

and what you are willing to fight for. When you know that the

decisions you take are right for the situation, or make sense in

the circumstances, you will not second guess yourself and waste

energy on unproductive freakouts.

This is what I have learned:

-- It helps to define guiding principles: iron-clad guardrails. A rock-solid framework will keep you focused when things get nuts.

-- Never do anything that you can’t explain and defend. Keep records. When you can’t get a receipt, and there may be many times when it is not possible or feasible, make a note of what you did, when, and why. Courts love paperwork.

-- Estate administration is not only about dollars and cents. It is about value. Your job is to act in the interests of the estate, not to maximize every cent on behalf of the beneficiaries despite what they may think.

-- Conserve your energy. It’s easy to get sidetracked and go down rabbit holes. You don’t have to respond to every spurious accusation. Ignore the BS on social media. Don’t engage. Develop a thick skin. Take the high road.

-- Pay for expertise where you need it: legal and accounting obviously, but also appraisals, and valuations. Seek quality advice. Don’t cheap out.

-- Remind yourself that every person you encounter on the journey is human. The lawyers, accountants, realtors, and advisors have skills and expertise that you need, but you have skills and expertise that the estate needs.

-- You don’t have to be perfect. Most jurisdictions require that you meet the standard of "ordinary prudence," not perfection. It is not rocket science. It's integrity and common sense.

-- You are in charge. You call the shots.

-- Build relationships. Establish a network of people who can help you, support you, educate you – lawyers, accountants, advisrs, appraisers, auction houses, art historians, consultants, dealers, and most importantly, existing clients and customers.

-- Manage relationships. Maintain calm, respectful, transparent communications. How you treat people is critical in getting through bureaucracy, getting cooperation, and getting things done.

-- If the estate involves artwork or other valuable assets, concentrate on protecting the value whether it is paintings, a business, or a collection of vintage cars. Protecting the value of the asset is more than simply dispersing it, selling it off, and cashing in. You might sell off widgets. You don’t have a fire sale on art.

Being an executor will require every ounce of stamina and all the mental, emotional and physical fitness that you can summon. You will make mistakes. Don’t beat yourself up. Ordinary prudence, amigo. You’ve got this. Remember to breathe. Laugh. When it gets awful, it starts to get funny, and then it begins to get better. And yes, what doesn’t kill you makes you stronger.

Oh, and make sure that your own will is in good shape. And

that you review and update every few years.

You do have a will, right?

Footnotes

1, The Jackpot Generation, MacLeans Magazine, OCTOBER

2024 ISSUE

https://macleans.ca/society/the-jackpot-generation/

2. To read the case for yourself, see here.

Further reading.

The case was widely covered. The following are good

summaries: Losers in Toller Cranston estate litigation

ordered to pay $325,000 in costs

Posted by Lynne Butler, BA LLB, Monday, May 31, 2021

and Toller James Montague Cranston (Estate of): Lose

Big, Pay Big

By Hull & Hull LLP | June 1, 2021

About the author

Phillippa Cranston Baran has a BA from Queen’s University and an MA in film from UCLA. She is an award-winning writer/producer, former university film professor, and current president of Toller International.

The 2024 biography of her brother, Toller Cranston, Ice, Paint, Passion has won 10 international awards. Her new book, Executor, Battle Scars and Wisdom: Lessons from the 10-year soul-destroying, financially horrifying, and utterly uplifting precedent-setting battle of the Toller Cranston estate will be released later this year.