Alt Investments

The Evolution Of Private Equity In The Digital Era

There's significant "dry powder" in the form of capital raised for private equity after what has been a tough period for the sector, which is rebalancing and likely to witness a large rise in activity during 2025, the author of this article says.

According to recent studies, private equity activity made a comeback in 2024, spiking 36 per cent in value compared with 2023. Several forecasts suggest that 2025 will mark a significant shift. Private equity firms are now sitting on substantial "dry powder" – firms have more than $500 billion in uninvested capital from funds closed in 2020 and 2021. In 2025, this capital will need to be deployed. So what's next?

To try to answer these questions and set out the territory is Anton Chashchin (pictured), founder and CEO of private fintech group N7 Capital. The editors are pleased to share these views; the usual editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

Private equity (PE) is transforming, and 2025 promises to be a year of rebalancing, with global reserves that were previously projected to exceed $1.6 trillion by the end of 2024.

This capital, raised during the more favorable market conditions of 2020 and 2021, is now ready to be deployed, creating both opportunity and a need to be used, which is going to drive increased deal-making. 2024 already saw some of that with a notable uptick in private equity activity (a 36 per cent increase in value compared with 2023), and we can anticipate that the industry is going to get even busier in 2025.

But deploying this capital efficiently requires an in-depth understanding of the opportunities that are reshaping this sector. Let’s go over the ones that, in my opinion, are going to play the biggest roles.

US monetary policy

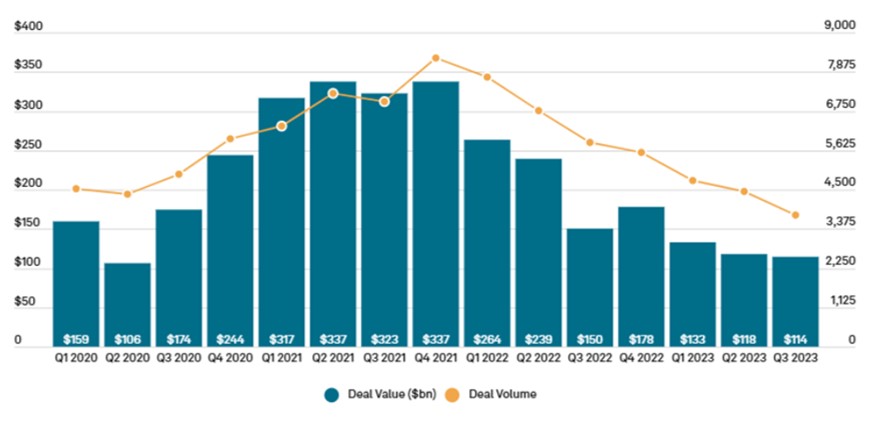

Higher interest rates in recent years have pressured PE firms to

reassess their capital structures leading to fewer private equity

deals being struck. S&P Global’s data shows quite clearly how

in the period of 2022 to 2023, both the number of deals and their

total value took a plunge.

That said, in the closing months of 2024 the US Federal Reserve lowered interest rates for the first time in four years, easing up on its monetary policy. This means that the private equity sector finally has some breathing space, which is going to lead to improved cash flow and exit opportunities. As I mentioned earlier, all that dry powder has to be put somewhere sooner rather than later, and I am confident that we will see steps in this direction as the new year progresses.

AI advancement

Another major thing that should be considered is the advancement

of technology, with artificial intelligence, in particular,

having emerged as both an enabler of investment activity and an

investment focus in itself.

AI-based data analytics are already being actively used to identify investment opportunities and enhance portfolio performance. For investors and asset managers willing to embrace these tools, the potential is immense.

Beyond that, as AI adoption accelerates, it drives demand for supporting infrastructure such as data centers and power. To my mind, this is a great opportunity for investors in digital infrastructure and energy. So, PE firms with expertise in these areas are in a good position to take the lead.

Private debt

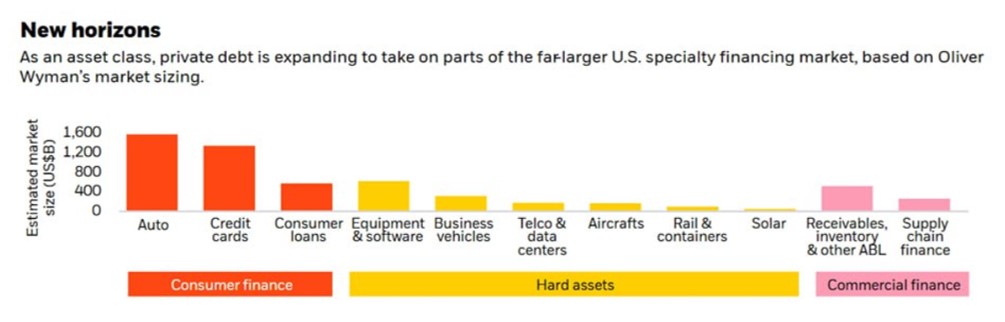

Private debt is another sector that shows a lot of promise.

According to BlackRock’s reports, this asset class now represents

over $1.6 trillion in AuM. It is increasingly absorbing funding

deals that previously fell within the purview of public markets.

At the same time, private debt investors are participating more

and more in asset-backed finance, with a $5.5 trillion segment in

the US alone, as per Oliver Wyman’s 2024 analysis. These figures

do a good job of reflecting this sector’s scalability and

resilience, and I think we are going to see further growth from

it this year.

M&As and IPOs

In the last months of 2024, the situation in M&A and IPO

markets has also shown signs of improving after a prolonged

period of sluggishness. Global exit deal values in Q3 2024 hit

$101 billion – the highest level we’ve seen since Q2 2023.

This may indicate a potential turn for the better and, if

the trend holds, I believe it could lead to a new wave of exits

in 2025.

A brighter horizon for private equity

From everything we can see of the market so far, 2025 is truly

going to be promising for private equity. As there is a more

supportive environment and growing investor interest in

alternative assets, the brightest days for PE are still ahead.

And, as we move forward, PE will, of course, benefit from new technology and data analytics, as was discussed earlier. This will let investors identify opportunities with greater accuracy and efficiency. But at the same time, this is going to push firms to innovate while addressing new challenges, because it will be essential to guiding clients toward informed investment decisions. So, success will depend on careful selection and strategic diversification of these new opportunities.

About the author

Chashchin advises business leaders, boards on growth strategies,

operational scaling, funding guidance, and advancing financial

technologies.

N7 Capital focuses on developing innovative fintech solutions, with interests across fintech, banking, IT, e-commerce, blockchain, and digital assets.