Investment Strategies

Sustainable Growth Through Cycles: ESG's Big Opportunities - Lombard Odier IM

The Switzerland-based investment house drills into specific arguments for ESG money management, a subject arguably thrown into the air by the COVID-19 pandemic and the associated lockdowns in many nations.

This news service has, as readers know, run a raft of items about environmental, social and governance-driven investment methods. The coronavirus pandemic shakes up the ESG space in several ways. Take the “S” for society – the lockdowns affect different groups in society, such as students and retirees, very differently. In another paradoxical way, the huge interruptions to flights and travel have at least in the short run slashed air pollution. (The editors of this news service cannot help noticing how clear the air is in places such as London.) Beyond COVID-19, the forces at work behind ESG, such as calls for curbing carbon emissions and to help children in poorer countries, haven’t gone away. In some ways the crisis may even give these added urgency, although the overwhelming task of restarting economic growth and reducing massive unemployment creates challenges. At the same time, however, the financial services industry must move on from feelgood themes to specific results. Results will matter. And as the virus has shown, experts can and do disagree on the science. Not all subjects are “settled”.

The Swiss private banking house Lombard Odier has these thoughts about ESG issues. They are written by Kristina Church. She is senior investment strategist for sustainable investment, Lombard Odier Investment Managers. The usual editorial disclaimers about external contributors’ views remain. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

At Lombard Odier we have sustainability as a core conviction. We believe that it will be the most significant driver of future investment risks and returns. Many other strategies integrate sustainability into the investment and security selection process, but few place sustainability at the very core of their strategies. For investors, the greatest challenge will be to identify which investments are fully aligned with future sustainability goals, such as the transition to a net-zero emissions and climate-resilient economy. We believe there are companies that have the foresight and agility to adjust their business models, or invent new ones, so that their profits and financials can be sustainable in the long term. During this current period of uncertainty and economic and market turbulence, actively identifying these businesses and avoiding those oblivious to the need to react and transition to more sustainable business models is even more vital.

Our Climate Transition strategy seeks to identify companies that have expanded their focus to multiple bottom-lines – not just profits, but also people and the planet. We believe that the most sustainable companies are going to outperform the market and generate strong investment returns for our clients. It is important to identify transitioning businesses and solutions companies that are reacting to the shifting environment. At this time of crisis, it is even more vital to focus on the adaptability of companies, whether that be to climate damage or the economic impact from a pandemic. The strategy is structured to perform well under multiple risk-on and risk-off scenarios.

All our portfolios focus on sustainable financial models and integrate companies that provide excess economic returns, capital efficiency and cash flow generation. We have a preference for structural growth over cyclical growth, which enhances the robustness of our portfolios to key sustainability challenges and the associated upside opportunities. We also prefer stocks with strong ESG ratings and perform our own reweighting of ESG based on a proprietary CAR (Consciousness, Action and Results) model.

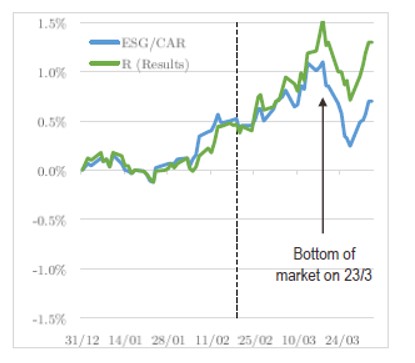

During the recent market sell-off, we have analysed how best-in-class ESG-rated stocks have performed versus poorer ESG stocks. We built a long/short portfolio, with positive weights to the better ESG stocks and negative weights to the poor-rated stocks. We scaled the portfolio to have an ex-ante risk (TE/volatility) of 1 per cent. The ESG/CAR portfolio generated +25 basis points performance since the top of the market on 20 February 2020. However, the portfolio we built based only on the Results (R) element of our CAR scoring outperformed by 75 bps. Note that these L/S portfolios can also be thought of as the outperformance versus the benchmark of a portfolio with 1 per cent ex-ante tracking error. This highlights the resilience of good ESG stocks and in particular those that do not just score well on ESG due to “greenwashing” but those that have identifiably positive ESG Results. More detailed research shows that this ESG resilience is mainly due to the E (Environment) and S (Social) components of the ESG score.

The graph below depicts the cumulative return (versus the market) on two L/S portfolios, one constructed on LOIM’s ESG/CAR score, the other on LOIM’s proprietary R (Results) score. The dotted line corresponds to the top of the market (20.02.2020):

Source: Lombard Odier Investment Managers

It is not just ESG scores that are driving returns, however, but the acceleration in climate-related action from both regulators and consumers are also driving increased opportunities for those companies positioned to thrive in a carbon-constrained world. At the same time, we recognise that no matter how accelerated this action becomes, climate damage of a highly problematic degree will undoubtedly occur globally, as is already evident today with sea level rise, severe weather events, droughts and wildfires. This offers opportunities for those companies positioned to increase climate-resilience through strengthening infrastructure, monitoring risks via meteorological and analytical tools, and managing impact through insurance activities. Many low-carbon funds do not focus on adaptation and instead purely on the solution providers or on companies that already offer a low carbon footprint, which, in our view, does not align with the scale and scope of the transition required for a low-carbon and climate-resilient world.

We believe that the current environment has created significant investment opportunities for the Climate Transition and brought to the fore the importance of active, sustainable portfolio management. The analysis differs little when trying to identify and invest in those companies which are able to thrive and adapt to a carbon-damaged world, as those able to weather a pandemic, or any other sustainability challenge that creates disruption to supply chains.

We believe that now is the time to invest in a cleaner future. It is increasingly well understood by an “alphabet soup” of authorities, such as the IMF, OECD, WHO and IEA that investing in the climate transition actually boosts the prospects for sustainable economic growth, and a cleaner economy is one that is radically better for human health and jobs. The effect of increased investor awareness combined with policymakers enforcing companies to disclose climate-change materiality is creating a powerful, positive feedback loop. The integration of climate risks into new accounting practices, credit risks, disclosure requirements (TCFD), stress tests, and the financial taxonomy is aiding this process. In combination with rising consumer pressure and technology as a further enabler, investors are becoming better able to make enhanced financial decisions related to climate change materiality, and help mobilise capital more intelligently for the net-zero economy.

In recent years, a number of cleantech and low-carbon funds have emerged that invest in poster-child technologies such as renewable energy and electric vehicles, or in low-impact sectors. Few of these funds, however, encapsulate the full extent of the climate transition required across all sectors, especially the hard-to-abate, carbon-intensive industries.

We recognise that the future economy will still require carbon-intensive industries such as transport, construction, chemicals and manufacturing – but that they will have to transform and transition. We will still need steel and cement to build infrastructure to protect cities from greater climate damage, or to develop cities to accommodate the rising urban population. Indeed, addressing climate change requires that we continue to invest in these industries so that they are able to invest in their own transformation to lower carbon-intensity. For instance, our portfolio includes Berkeley Group, a UK homebuilder. We believe this company has a leading edge in its Berkeley Modular* unit, which provides modular housing solutions, built offsite, using lean manufacturing processes which limit waste and reduce the embodied carbon in construction. This innovative manufacturing strategy, we believe, will help the company outperform peers due to both the superior quality and environmental performance of its buildings.

Many vanilla ESG investments assess companies in a backward-looking, metrics-based manner and are thus not aligned with the urgency of the sustainability revolution. There is still a dearth of quality data coupled with a lack of clear definitions and standards around the integration of ESG or sustainability into portfolios. Carbon foot-printing as practised in the market is incomplete and largely fails to cover the full scope of carbon emissions associated with a company’s business (disclosure of scope three emissions is patchy). It routinely ignores the positive benefits such as avoidance or reduction of carbon emissions associated with a company’s business model.

As part of our climate transition strategy, we seek to actively understand each company’s carbon footprint. We adjust carbon footprints for scope three emissions and also the additionality of captured and avoided emissions.

Our Climate Transition strategy is currently invested in both Svenska Cellulosa Aktiebolaget (SCA)* and Air Liquide*, two stocks which we believe have a strong additionality appeal. SCA is a paper and forest products company which has a high reported carbon footprint. But, via active forestry management, SCA successfully captures much of this carbon and also displaces more carbon-intensive materials (such as plastic or cement) in other industries. Its adjusted carbon footprint is therefore negative. Assuming a future carbon price of $150-200 per ton, it could generate $600-800 million in additional annual revenue from the 4mt CO2e the company captured in its forests in 2019.

Similarly, Air Liquide, a French industrial gas company, has a high carbon intensity ratio but a significantly lower one when adjusting for the CO2 avoided by the group’s clients using oxy-combustion process and also has an important role to play in the future hydrogen economy. Many low-carbon funds would automatically exclude both companies because of the high unadjusted carbon footprints, and would therefore miss their vital importance to the climate transition.

At Lombard Odier when we integrate sustainability as a core conviction, it is also important to distinguish between companies that are transitioning, and those providing immediate solutions to sustainability issues. The latter will be the natural hunting ground for impact investors, who typically invest in smaller companies in public and private markets. As an asset manager focused on investments in public markets, Lombard Odier seeks to identify transitioning businesses, best-placed to deliver returns to our clients in a long-term, sustainable nature.

* Disclaimer: Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or securities. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities discussed in this document.