Family Office

Raising The Family Office Game At Silicon Valley Bank

We talk to two senior figures at SVB about the work being done with family offices and venture capital.

With venture capital investment all the rage, and requiring the kind of “patient capital” that family offices can provide, an organization with feet in both camps is Silicon Valley Bank. It is a firm with a sense of mission in family offices’ future.

Some 14 months ago, SVB bought Boston Private, deepening its connections to the evolving family offices space as well as other business lines. When it did so, one prominent individual who became part of the SVB operation was Bill Woodson, head of strategic wealth advisory and family enterprise services; he is also the co-author of The Family Office: A Comprehensive Guide for Advisers, Practitioners, and Students. (He is also involved with the UHNW Institute, for which this news service is the exclusive media partner.)

On the other side of the US, meanwhile, is California-based Shailesh Sachdeva, managing director in the family office practice at SVB. Between them, they bring a lot of insight into what ultra-high net worth individuals, families and business owners are looking for. Family Wealth Report recently spoke to them.

Family offices are increasingly self-consciously joining forces to speak to policymakers – such as in the Archegos affair, where legislators called for tighter controls on what family offices do. This speaks to a wider need to put over the case for what family offices are and just as importantly, what they are not, Woodson said.

Family offices and venture

The increased visibility of family offices and their involvement

in fields such as VC is where Sachdeva comes in. At SVB,

venture investment in the US almost doubled in 2021 with more

than $330 million being deployed, compared with $166 million

in 2020, he said.

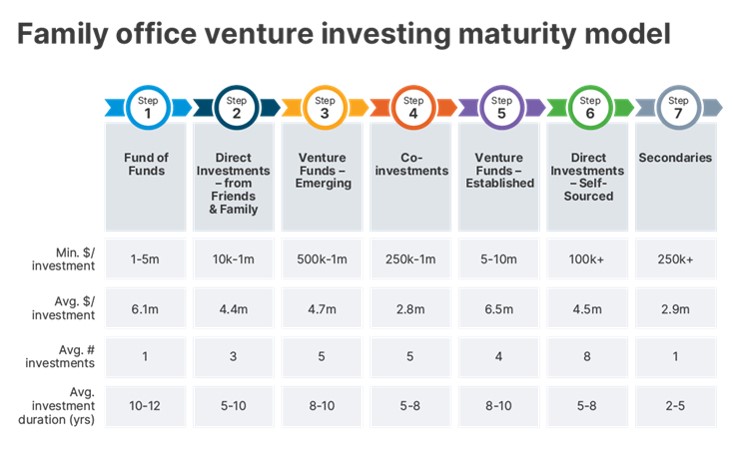

SVB has created a “maturity model” to show FOs the different stages of learning and experience in making VC investments. That journey can take years, or months if FOs are active in the venture ecosystem, he said.

“The innovation ecosystem is exploding,” he said, referring to networks of VCs, other investment groups, family offices, etc. “I don’t see a slowdown in new funds being formed. At the end of Q4 2021, there were over 2,500 US funds actively raising capital,” he said, citing SVB’s State of the Markets report. New sectors that are going to be interesting include space tech, blockchain, automation, robotics, Web 3.0.

There is interest in areas such as diversity and inclusion in the VC space, Sachdeva continued. “There is more interest in FOs investing in diverse VCs and in female-led firms.”

The macroeconomic environment – such as that of rising inflation – is becoming “a point of conversation for family offices,” he said when FWR asked about the matter. “They aren’t stopping their venture capital investments but slowing them down. They’re taking a little longer to look at each opportunity and do their due diligence. This has changed slightly from last year when there was a record number of deals – over 17,000 VC investments in the US in 2021.”

Initial contact to SVB comes from referrals from other family offices, he said.

Depending on a family office’s experience, some prefer to go for the fund of funds model of VC. “As they progress and get to know the asset class, they want to get more direct, or co-invest,” he said. Family offices can and do build deals in-house and go directly into startups.

Asked to give more detail on the SVB “maturity model” for family

offices and VC, Sachdeva illustrated it with the following

chart:

Based on SVB Capital’s Family Office report, returns from family

offices’ venture investments exceeded expectations: the average

internal rate of return (IRR) for their VC portfolios was 24 per

cent in the 12 months prior to data collection, versus 14 per

cent in 2020.

Out of the shadows

Woodson notes that while they have tended to operate in the

shadows, single-family offices are getting better known and more

willing to make a noise, in part to gain the attention of VC and

other financial players on the road.

And this rising visibility also means that business schools and wider academia are paying family offices more attention. Woodson, who wears several academic hats in addition to his SVB role, is a lecturer – Master's in Wealth Management Program at Columbia University School of Professional Studies. He agreed that family offices need the same level of attention that corporations received from writers and opinion formers such as Peter Drucker half a century ago.

“Family offices are at the same stage as family-controlled firms were 40, 50 years ago when people began to think about the processes they needed to follow to succeed,” Woodson said. Stanford University is already making some of its venture capital work accessible to family offices, for example.

“They [Stanford] have an existing corporate affiliates program through their Global Projects Center that makes available to its members Stanford’s ecosystem in early-stage technology and related ESG/SRI investing. This program has been expanded to include family offices with similar investment interests,” he continued.

Woodson said that the closest area of academic focus by most universities today is on what closely held family businesses face in leadership, succession, and governance. He said many of these schools are incorporating guidance on family office best-practices into their family business programs due to factors such as growth in the number of family offices, the need for research on a sector that in some ways is “relatively inchoate,” and because there are opportunities to engage with, help and raise awareness with family office industry players.

Schools of various kinds can offer education programs for family office executives, add family office topics to existing programs; host family office practitioner or certificate programs and build research centers for the space, Woodson said.

With all these developments, expect SVB to be a prominent player in the years ahead.