WM Market Reports

RIA Sector Sliding Toward "Mediocrity," Report Warns

The findings of the report chime with concerns mentioned to FWR that the RIA sector has an advisor attrition problem and that firms must be more prepared for succession and talent progression.

The US registered investment advisor industry has become more “mediocre” as a profession with fewer advisors thinking that their businesses offer a clear path toward career progression than was the case a year ago. The pace of advisor attrition is also increasing.

The study from DeVoe & Company, in partnership with Invesco, does not pull its punches in the report headline, entitled: 2025 RIA Talent & Growth Report, The Slide Toward Mediocrity.

While the report’s authors say it is not sounding alarms – there are signs of progress – it does raise flags. The survey received 117 responses from RIAs, primarily from firms between $100 million and $10 billion, a spokesperson for DeVoe & Co told this publication.

“For too long, firms have relied on a company's mission, its employees' loyalty, and a great culture to carry their people strategy. That is no longer enough,” it said. “Purpose is not a substitute for structure. And good intentions won’t prepare the next generation or optimize the engagement of the current one. The hard truth about today’s RIA people development is the industry is trending toward mediocrity.”

“Unless firms recommit to the fundamentals, this trend will calcify, and RIAs will experience continued erosion of their most important asset. It’s time to get back to basics and reinvest in what has always made this industry exceptional: its people,” it said.

The report chimes with comments that FWR has heard from other industry figures who worry that with large numbers of advisors in their late 50s and 60s set to retire in the next 10 years, the sector is not bringing in sufficient fresh blood. And this coincides with a multi-trillion-dollar wealth transfer, a process requiring considerable expertise in navigating business and wealth succession, tax, regulations, goals and family dynamics, among other topics.

This year’s study reveals a trend toward mediocrity across core human capital fundamentals, DeVoe & Co said.

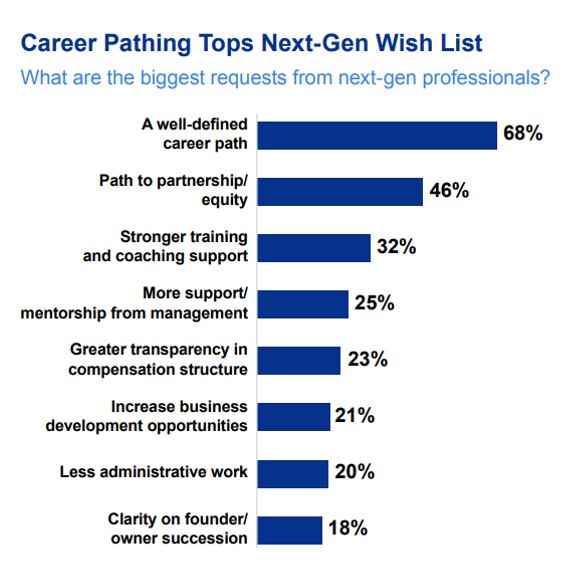

Career pathing clarity is the top request from next-gen professionals. Only 38 per cent of advisors believe that their firms offer defined career paths, down from 50 per cent in 2024.

Source: DeVoe Talent & Growth Report

Incentive compensation structures are deteriorating. Just 43 per cent of firms report having a clear, methodical plan, it said.

Another hurdle to overcome is the readiness of the next generation of advisors to lead and run firms. Some 45 per cent of firms expect a “bumpy transition” (up from 34 per cent in 2024), while only 27 per cent feel confident in their future leaders.

There is also the problem of advisor attrition: 58 per cent of firms reported no undesired attrition, compared with 68 per cent in 2024.

To meet these challenges, the report explores how firms can build a coaching culture for advisors, have clearer financial compensation plans in place, and improve the way succession is handled.

Career paths

“In an industry built on long-term planning, we’ve failed to show

our own people what their future can look like,” the report said.

“Nowhere is that disconnect more visible (or more damaging) than

in career pathing. The next generation of RIA leaders isn’t

asking for handouts or shortcuts. They’re asking for clarity. And

far too often, they’re met with ambiguity, silence, or vague

promises. The message from next-gen professionals is deafening:

`Show us a path forward.’”

“Career pathing is more than an HR deliverable. It’s a strategic lever for engagement, retention, and succession,” the report continued. “Firms that intentionally design career paths and link them to development, performance and partnership, position themselves for stronger retention and a deeper talent bench.”

The study cited a Pew Research survey, conducted in 2021, which found that 63 per cent of respondents who left jobs that year cited lack of advancement opportunities as the primary reason for doing so. The study also cited an MIT Sloan Management Review that noted that systematic career development coupled with feedback and coaching is essential to keeping top talent engaged.

Performance reviews are a key area, the report said.

“If career pathing is the roadmap, performance reviews are the steering wheel. Clear direction is meaningless if no one checks the course. Yet too often, feedback conversations are infrequent or nonexistent. And when employees don’t know where they stand (or how to improve) they stall. So do their careers. And so do your company’s results,” it said.

The study said there has been “modest progress” on annual reviews – “the bare minimum of guidance that a manager should be providing to their employees.” Nearly half (49 per cent) of firms now conduct Annual reviews, and firms offering no formal reviews at all are down to just 3 per cent, it said.

Compensation

The report turned to how compensation plans, when wisely

constructed, play an important role in fostering a healthy

business culture and encourage growth.

“Yet across much of the RIA industry, this tool remains underbuilt or misaligned, often failing to support the very outcomes firms say they want to drive,” it said.

In what the report said is a shocking finding, employees give a negative net promoter score (NPS) of -31 for their firm’s compensation plan. They were asked to rank their comp plans on a scale of one to 10, with replies translating into an NPS. The score converts one to 10 ratings into “promoters,” “passives” and “detractors.” A score below zero signals that there are more detractors than promoters.

“A negative 31 score is shockingly low. That number should stop leaders in their tracks. Compensation, one of the most tangible forms of recognition, is generating active detractors. In an already competitive labor market, that’s more than a missed opportunity. It’s a vulnerability,” the report said.

The report also notes that although more firms appear to be talking about succession, it is not yet fully translating into action.