Investment Strategies

Private Markets, AI And Offbeat Opportunities Highlight Family Office Investment Summit

Wealth management professionals gathered in Manhattan this week for Family Wealth Report's annual summit on investment, and topics such as AI and private markets – and even music – were on the menu. Our US correspondent gives a flavor of the discussions.

Direct investments in private markets, artificial intelligence and under-the-radar opportunities were highlighted at Family Wealth Report’s annual Family Office Investment Summit in New York City.

Family office deal flow and venture capital, private equity and real estate investments were also summarized in opening remarks by Belinda Sneddon, managing director, family enterprise advisory services for PwC, drawing from the firm’s recently released 2025 Global Family Office Deals Study.

When it comes to private market investing, family offices have considerable advantages, according to conference panelists.

“Families can invest in what they know and take advantage of their connections and long-term time frame,” said Ira Perlmuter, CIO of IJP Family Partners. A lack of top-heavy bureaucracy and in-house expertise also helps family offices learn about companies and make direct investments “more quickly” than other investors, added Brian Sun, vice president of Potenza Capital.

For direct investments to succeed, however, sourcing and due diligence are critical. Scrutinizing deal origination is “the most important factor” in private market investing, according to financial advisor Peter Bennitt, principal of PRB Advisory: “You need to invest in people and have boots on the ground.”

In-person research and comprehensive due diligence as a next step are “super critical,” said Perlmuter. “Everybody is trying to sell you something and it’s very easy to get taken. There’s no substitute for walking the factory floor and talking to workers. You’ll never know the full story just looking at numbers.”

What’s next in AI

The rapidly evolving development of artificial intelligence is

also top of mind for family offices.

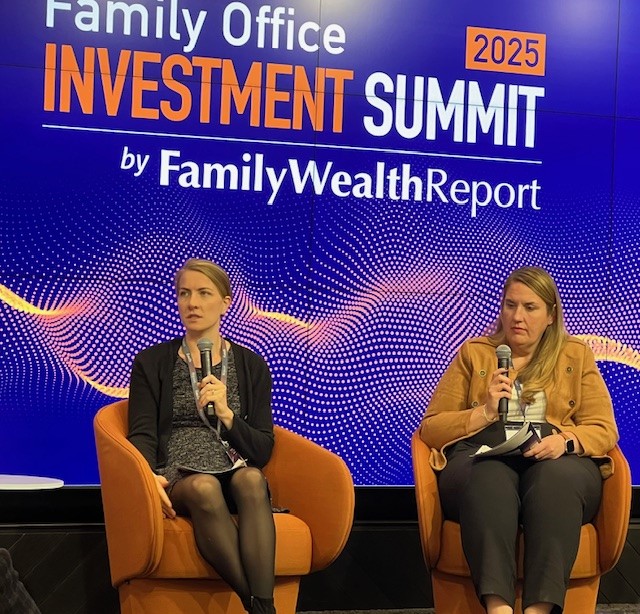

AI has been fairly widely adopted for general efficiencies such as summarizing weekly meetings, brainstorming and content creation for marketing, and drafting emails, said Kristin Christine (pictured below, with Lauren Phillips, both from PwC) director of PwC’s asset management advisory practice. Accounting is emerging as the next use case, Christine added, and family offices are beginning to use Harvey, an AI platform for legal work, said PwC senior manager for family enterprise advisory services, Peter Bixler.

Kristin Christine, left and Lauren Phillips, right.

Hyper-personalization that “unlocks a lot of human potential” will be the next iteration of artificial intelligence, said Tamara Zubatiy Nelson, CEO of Barometer, which analyzes media for advertisers with proprietary AI. That customization will be the result of users discovering how AI can help them, and family offices and wealth management firms should encourage team members to use AI as much as possible to report exactly what those needs are, panelists said.

But firms should stress that working with AI is a shift in mindset instead of adopting a new technology, Christine stressed. “You want to get people to do things differently and ask the right questions,” she said. “The less you emphasize tech the more problems you will solve.”

Offbeat opportunities

The conference also drew attention to more under-the-radar

investment opportunities, including cultural assets, rare disease

drugs and private placement life insurance.

Investors in thoroughbred racehorses may not always win but love the experience of meeting trainers and jockeys in stables, said Michael Behrens CEO of MyRaceHorse. Similarly, investors in intellectual property – for example, music royalties – now have a chance to meet and mingle with performers, said Sean Peace, CEO of SongVest. And consolidating the fragmented business of literary agents represents an investment opportunity, according to Scott Hoffman, CEO of ILP Literary.

“Mission driven investors” can do well by doing good and “literally save people’s lives” by investing in startups that are researching rare disease drugs, said entrepreneur and biotech advisor Bibhash Mukhopdhay.

Casey McPherson (pictured below), a former professional musician, told an inspiring story about how his own young daughter’s rare disease led him to the biotech business and founding AlphaRose Therapeutics. And the nimbleness of tech-savvy startups, combined with personalized medicine, is forming a new business model and ecosystem said Rob Freishtat, a physician and biotech company builder.

Casey McPherson

Although private placement life insurance is complex and costly, its tax efficiency continues to attract family office investment, said Samuel Jacobs, senior vice president for Gallagher Insurance.

The panel on cultural assets was moderated by Stephen Szypulski, who has held executive roles at Goldman Sachs and the Bank of New York. Based in New York, he advises on business strategy, investor platforms, and alternative investments, with a focus on private capital across the cultural landscape.

Staying rich and doing “mild harm” to

families

Neil Nisker, executive chairman and CIO of Our Family

Office discussed overall investment strategy, describing

himself as an asset allocator whose goal for wealthy clients was

to “stay rich versus get rich.”

Nisker strongly recommended investors read Andrew Ross Sorkin’s new book 1929: Inside the Greatest Crash in Wall Street History – and How It Shattered a Nation. Family offices considering investing in venture capital funds, he advised, should only proceed if they can get in very early with a small manager who is in the top decile.

Looking at the softer side of family offices, William Parizeau and Jennifer Richardson cautioned that they can sometimes “do mild harm” by not preparing wealthy families for the harsher realities of life.

The service mindset of family offices can prevent G2 family members from “doing things for themselves,” said Richardson, an executive coach and consultant. “We’re robbing them a little bit by not letting them develop grit and learning though difficult conversations.”

Parizeau, CEO of Matthew Pritzker Company, pointed out the “trap” of families using the family office to pit members against each other. “I don’t say ‘no’ to family members,” Parizeau said. “I say ‘yes but…’”

One solution to temper conflict is to bring in a third party, Richardson said.

Direct investing

The panel on direct investing was brought together and moderated

by Maxime Seguineau, managing partner, Raido Capital

Partners, Claire Champy, vice president of Atlas Innovate was

also on the panel; Anna Garcia, managing partner, Altari Ventures led

the fireside chat with Tamara Zubatiy Nelson Barometer. Other

speakers included Lauren Phillips, director Family

Enterprise Advisor Services, PwC; and Andrea Dykes, managing

partner, Howard

Insurance, Samuel Jacobs [Gallagher].

PwC was the conference’s venue partner.

The Family Office Investment Summit featured presentations from:

Capri Harbor Marina Group on a storage facility real-asset opportunity featuring reliable cash flow, multiple revenue streams and favorable supply-demand dynamics.

Hamilton Lane on private market analytics software and services that leverage technology to make data-driven decisions and manage private market portfolios.

Hirshmark Capital on real estate bridge lending for mixed-use, retail, industrial and multifamily properties in New York, Florida and Texas.

Rockport Companies on using oil and gas as a dependable real assets investment strategy featuring cash flow, tax advantages and tangible value.

Freedom Family Office on strategies on how to pay less in ordinary income, capital gains and estate and gift taxes.

The Wealth Counselor on using artificial intelligence as a tool to help families communicate, realign around common goals and prepare the next generation for responsible wealth stewardship.

To view the full list of speakers, see here.