Philanthropy

Philanthropy In 2019, 2020 And Beyond

An expert on philanthropy and regular commentator sets out the big themes in the sector and what are likely to be unfolding issues in the next few years. She examines areas as diverse as reputation management, tax changes, generational differences, Donor Advised Funds, Qualified Opportunity Zones, and much more.

We are pleased to share the following views from Susan Winer, chief operating officer and a founder of Strategic Philanthropy, a US-based organization advising individuals and families about giving and philanthropy. She has written before for FWR. As the year draws to a close and the "giving season" is in full swing, it is a suitable time to lay out some issues and look forward to the coming year. (We are also running a set of articles about philanthropy, starting with an overview here.) Susan is also a member of our editorial advisory board. The usual disclaimers with guest contributions apply and of course any reader who wants to respond and add their views is most welcome to do so. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

In the past I’ve written a year-end article about the philanthropic landscape and what advisors, and high net worth clients, should know. This year I decided it would be interesting to look at some of the key events and activities that are, to some degree, changing the way philanthropy is practiced. The topics and events reflect the broad conversations we’ve had with clients and advisors about relationships between high net worth individuals and families and their advisors, donors and their money and/or donors and the organizations and institutions they are or intend to support.

What should donors, and their Advisors keep their eye on in 2020? A few of the questions, concerns and topics that have been raised include:

• The ubiquitous use of the term “family

office” and the confusion this has engendered about what a family

office is supposed to be;

• Why family offices are not more invested in

supporting their clients’ philanthropic interests;

• The shift in control of wealth to women and

Millennials and the fact that advisors have yet to fully

understand or address the priorities of these constituencies;

• The global geopolitical climate and the

changing role of government in providing a safety net for

marginalized and under-served populations was a frequently

mentioned issue area;

• The expanding conversation about impact

investing and the growing desire (by advisors and investors) to

gain greater clarity around what is involved with aligning

investments with philanthropy;

• The improper use of charitable gifts to

achieve personal gain or reputational change (Sackler and the

admissions scandal) and whether this was going to pose a

challenge to donors wishing to make gifts to major

institutions;

• The increasing number of natural disasters

directly attributed to climate change and the challenge of

balancing trying to respond to requests for support when the

global devastation seems to be exponentially increasing;

• The accelerating growth of Donor Advised

Funds as the charitable vehicle of choice; and

• Qualified Opportunity Zones and the question

of their intent; job creation and neighborhood improvement versus

how the purchased Opportunity Zones are being perceived.

I cannot address each of the aforementioned topics and do them justice in this article, so I’ve selected a few that are directly related to philanthropy and have tried to identify the key takeaways and what it means for donors. In each of these topic areas there is a lot to explore. But in all instances, high net worth/ultra-high net worth clients are going to be talking about this with their advisors or will want to talk about it. In subsequent articles we’ll tackle some of the other critical questions and concerns HNW and UHNW individuals and families have raised.

Impact investing. Depending upon who you are it seems, this term refers to Mission Related Investing, ESG, equity participation in a social enterprise…. no wonder donors are confused. Further, for many donors the relationship between “impact investments” and their philanthropic investments are not always addressed. As a result, donors are not maximizing the impact they can have on issues they care deeply about.

Impact Investing is increasing in market share with an expected growth of 58 per cent in the next five years, as clients seek to leverage their charitable intent with their philanthropic and investible capital. Environmental, social, and governance (ESG) asset allocation increased by 71 per cent between 2016 and 2018 from $2.4 billion to $4.1 billion according to US SIF Foundation. While ESG remains a favored selection for individuals and families; family offices have shifted their focus to community-based investing and their participation is growing. In fact, Campden Wealth’s 2018 Global Wealth Report states that one-third (32 per cent) of family offices are now involved in impact investing – an increase of 4.2 percentage points over the previous year.

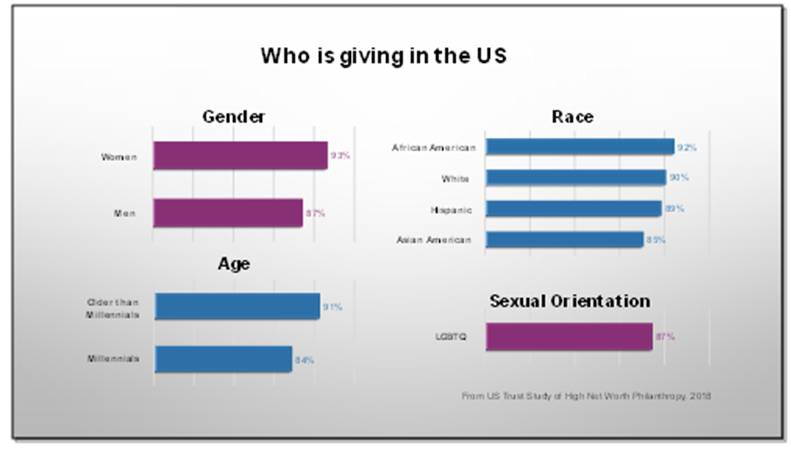

Further, impact investing, however it is defined, is of significant interest to a more diverse population, the same people who are making the most number of philanthropic gifts. As noted in the chart below, women and Millennials consider philanthropy a priority and these are the same individuals who will be managing the largest number of financial portfolios, investments and charitable distributions over the next decade and longer.

What you and your clients should know. When impact investing is part of the conversation with clients, we call it responsible investing wherein investment decisions are determined not just by ROI, but by how they can affect change in key issue areas such as the environment, food security, immigration, drug policy and the overall health and wellbeing of corporate America. We encourage clients to use the same lens on their financial investments as they do on their charitable investments.

To that end, advisors should know what their client’s charitable mission and vison are and help them to align their investments with that mission. Having the conversation with clients about correlating the impact their money can have if deployed in a more thoughtful and strategic manner goes a long way to helping them achieve both their financial and personal objectives. Providing clients with information about determining the projected return on impact investments can mitigate one of the barriers to entry by investors into the impact market.

There have been several efforts to develop metrics around this, the most recent entry that is rapidly gaining traction is the partnership between the Rise Fund, a $2 billion impact-investing fund for growth-stage companies managed by TPG Growth, and the Bridgespan Group, a global social impact advisory firm. They have produced a forward-looking methodology (Impact Multiple of Money (IMM)) to estimate - before any money is committed - the financial value of the social and environmental good that is likely to result from each dollar invested.

University gifts and the Sackler family. In 2019 philanthropy was top of mind in the media, but not necessarily for the right reasons. The opioid crisis and attendant lawsuits made the Sackler family name front page news, not just for their role in promulgating opioid addiction, but because they had for many years been high profile donors to museums and institutions around the world. The Smithsonian, the Metropolitan Museum of Art, Harvard University, the Guggenheim and the Louvre, among others, have been the recipients of millions of dollars. The Sacklers sought to use their considerable funds to create a legacy for the family name. Many public figures have used charitable gifts; time and money, as a way of rebuilding their reputations. Jeffrey Epstein, for example, immediately used philanthropy as a way to re-enter his elite community when he got out of prison…the first time.

As with the Sackler scenario, high profile and wealthy families began “buying” their children access to prestigious universities and colleges. Hundreds of thousands of dollars went to assuring placement without the need to meet the school’s academic requirements. Many of the gifts were claimed to be charitable gifts to the institution. There is nothing new about what happened this year. In 2014, Steven Cohn the hedge fund billionaire, gave $5 million to USC through his foundation. The university hailed the gift at the time as the largest ever received by its School of Cinematic Arts for student aid. What the press release didn't note was that the gift followed the school's decision to admit Cohn's twin daughters. The most current scandal over gifts to institutions has caused a growing number of nonprofits to scrutinize where their donations come from before accepting them. Lawmakers, both at the state and federal level, are looking at creating laws to reform admissions policies and “police” charitable gifts.

What you and your clients should know. First, when discussing a major gift with a client, understand the motivations behind the gift. What is it for? What are the client’s expectations in terms of how the funds will be used? How well do you know your client? You perform a valuable service for your client if you help them think through the gifts they want to make and ensure that they understand the importance of transparency, communication and that they are building a long-term partnership with the recipient(s) of significant gifts. Philanthropy can help to firmly establish a legacy for someone, represent what they care about and serve as a statement about what they value. But in this environment, the more a donor can disclose about motivation, focused interest, use of funds and how they want to build on the relationship they are establishing, the better.

Donor Advised Funds. According to National Philanthropic Trust (NPT), contributions to Donor Advised Funds in 2018 totaled $37.12 billion, an increase of 20.1 per cent over 2017. Private Foundations, on the other hand, are not being established at as significant a rate. The growth of DAFs is not without controversy because payout; gifts to organizations and institutions is considerably less than the funds coming into DAFs. To put it into perspective, (again according to NPT), there are approximately nine times the number of Donor Advised Funds as Private Foundations with an estimated $121.42 billion in Donor Advised Funds and an estimated $872.65 billion in Private Foundations. However, grants from Donor Advised Funds to qualified charities totaled $23.42 billion in 2018, equating to just over 43 per cent of the estimated $54.03 billion granted by independent foundations to charities.

Private Foundations are required to distribute five per cent of their average net assets annually to qualified 501(c)(3) public charities, however, there are no formal requirements for distribution for DAFs. Lawmakers, and the IRS are exploring minimum payout requirements and other restrictions. While these conversations have gone on for a few years, many experts feel that 2020 will be when the issue is taken even more seriously, particularly given the fact that revisions to the 2017 tax law are being drafted and this may well be one of them.

Some public charities are trying to proactively move funds out of DAFs. For example, Fidelity Charitable sweeps funds that have been dormant for three years or more, and grants the money itself in individual funds. If a donor has made no gifts for seven years, then Fidelity will grant the entire balance of the DAF to one or more charities approved by Fidelity Charitable trustees.

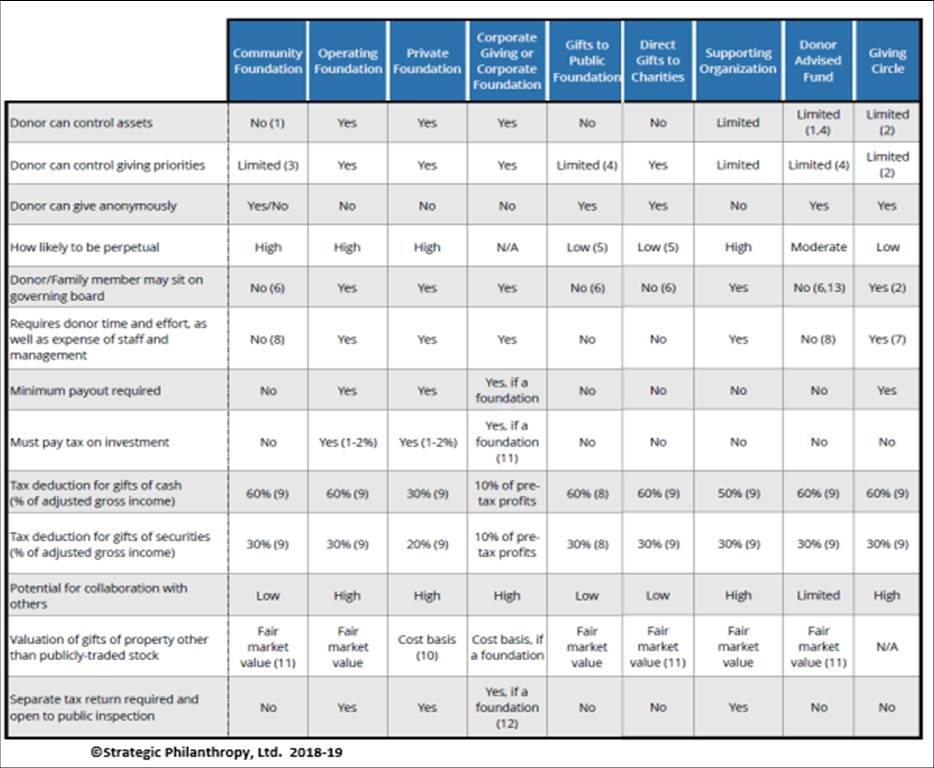

What you and your client should know. In determining the most appropriate charitable, vehicle what are the priority considerations for your client? Helping a client understand the reasons why a DAF might be a good vehicle choice or whether a Private Foundation is a better choice, or what other vehicle might be more appropriate is an important conversation to have. The following chart, from Strategic Philanthropy, Ltd’s, 5th Edition of its Charitable Planning Desk Reference® for Advisors is a good way to help clients understand how to decide on a vehicle.

Since Private Foundations are required to pay out 5 per cent of the assets in the foundation every year, donors sometimes think that with no such restriction on DAFs that they don’t have to make charitable decisions immediately or even in the near (within a year or so) term. Helping your client to understand that “parking” the funds in a DAF does not serve anyone. It is no longer their money so they cannot take any out of the DAF for personal use, so why not begin to use the funds for their original intent: to address and tackle issues that they care about. You do both your client and the community at large a great service by guiding them in this way. And if your client has no idea what to do with the DAF funds, direct them to an expert in philanthropy to help develop a strategy and focus for the funds.

Opportunity Zones. This is a relatively new investment opportunity established as part of the 2017 Tax Cuts and Jobs Act. Qualified Opportunity Zones are designed to spur economic development and job creation in distressed communities throughout the country and US territories by providing tax benefits to investors who invest eligible capital into these communities.

Just as contributions to a Private Foundation or a DAF afford the donor a tax benefit, Opportunity Zones offer a significant tax benefit for doing something that will, or should, address societal issues and provide support to marginalized populations. The problem, however, is that investors in many of the designated opportunity zones are not necessarily creating jobs or supporting economic development. They are holding on to the properties, or the use of the property does not directly benefit the community in which the property is located. Community activists, non-profits serving disenfranchised populations and woke city and state officials are increasingly concerned about the misuse of a tax benefit for a wealthy segment of the population.

What you and your clients should know. For many investors Opportunity Zones are viewed as another way to help address issues and “do good” within a community. The average poverty rate across the 8,762 Opportunity Zones is estimated to be nearly 31 per cent, in contrast to a national average of 12 per cent, and the unemployment rate of 14.4 per cent is well above the 3.8 per cent national average, so in theory the program offers significant advantage to residents in the designated zones and the surrounding communities.

For charitably inclined clients, Opportunity Zones are another way to advance their charitable agenda, particularly if they align this investment with grants they might be making through one of their charitable vehicles. Treating an Opportunity Zone investment in the same way as one would an impact investment makes sense for many investors. It achieves a double bottom line return, or in this case more…first the tax benefit, second the community change benefit and finally financial return on the investment as a whole, once completed.

But before your clients seriously invest you should talk with them about what the property will be used for. What are the goals of any Qualified Opportunity Zone Fund they are considering? Are the intentions aligned with your client’s own charitable goals or in conflict? Are the timelines of development in keeping with the impact strategy your client wants to employ? Helping your client understand the realities and opportunities connected to this program is an important way to help them advance their philanthropic agenda through all of their investments.

Finally, keep an eye on the calendar. Investors have only until December 31, 2019 to invest in an Opportunity Zone and get the entire 15 per cent tax reduction the program offers, although Senator Tim Scott who co-sponsored the bill that created Opportunity Zones is trying to push back the deadline.

The big picture. Year end is when everyone is scurrying to get their financial house in order and make the charitable gifts they’ve been thinking about all year. But it is also a good time for advisors and clients to begin to think about the upcoming year…what are the anticipated changes and plans that your clients have? How will this affect their financial or legal situation? What can you do to help them be more thoughtful, more innovative, more “present” when it comes to the deployment of resources? What can you do to deepen the relationship with the next generation(s) of your clients? In all of these conversations philanthropy plays a central role, because, for many of your clients it is central to who they are and the footprint they want to leave.