Art

OPINION OF THE WEEK: What We Can Learn From Online Art Sales Data

The world of art auctions can be fascinating in its own right and also has lessons for the wider wealth management industry. The editor takes a look.

More than three years ago when the pandemic hit, in-person art auctions, fairs and gallery exhibitions were slammed, and only a part of that business was able to migrate to a virtual world. And for all the breathless talk about how so much of our lives are moving online, it turns out that people really do need to see and enjoy art in the flesh.

The Art Basel and UBS Global Art Market Report, published last week, noted that during 2022, the event-driven market resumed its more regular schedule. Dealers and auction houses reported a further cut in the share of their sales accounted for by e-commerce in 2022. Following two years of unprecedented growth, online-only sales fell to $11 billion in 2022, a 17 per cent decline year-on-year from their peak of $13.3 billion in 2021, although still 85 per cent higher than in 2019.

What such data suggests is that while the online auction and sales channels are becoming more important, people in this sphere are keen to enjoy the hustle and bustle of in-person events. That doesn’t mean that some of the transactions they get involved with won’t have an online element, but it does suggest that they want to view art “in the flesh,” as it were, as much as is feasible.

As we noted in the report when it came out, events such as art auctions and exhibitions can be barometers for how prosperous – or not – high net worth individuals think they are and how willing they are to splash out and enjoy the wealth they have. And beyond the aesthetic enjoyment, there’s also the investment angle – returns on some forms of art can be strong in certain periods.

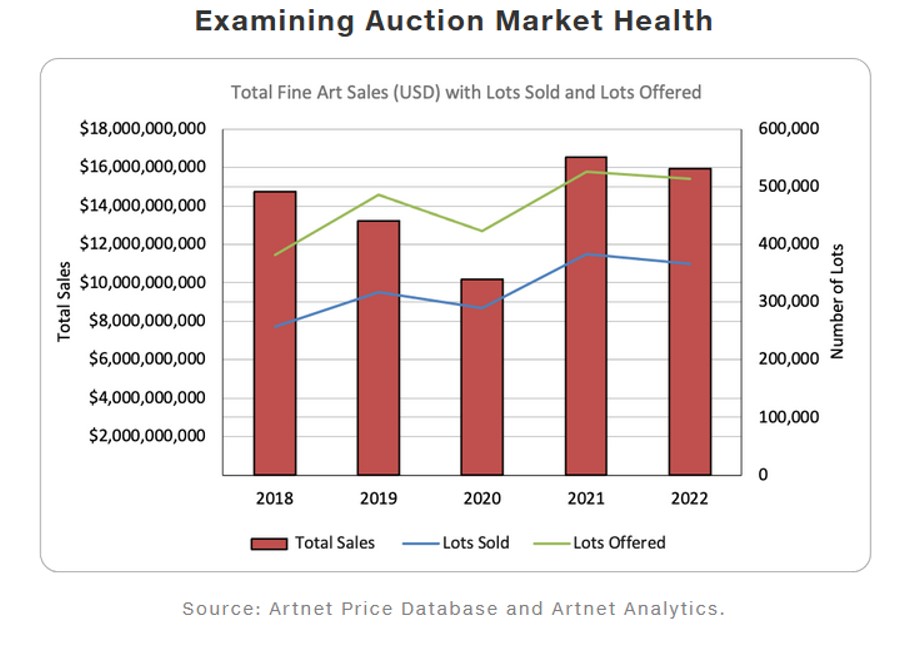

There’s been a recovery, for sure, in art sales since the annus terriblis of 2020. In another report, by Morgan Stanley and Artnet News (March, 2023), Total sales of fine art reached $15.9 billion in 2022, a roughly four per cent decline from the $16.4 billion sold in 2021 but still the second highest annual total since 2018. The report’s authors said this result is noteworthy because its five-year sample includes two pre-pandemic years and two post-pandemic years bookending an “anomalous” 2020.

The virtual model of exhibitions in the art and museum world hasn’t gone away, however. Even without a pandemic, not everyone can afford the time to fly to a museum or gallery, and technology is now so good that it is possible to see artistic wonders over a screen. I’ve taken a virtual tour around the Vatican, for example. The Getty Research Institute has a suite of virtual exhibitions on subjects as varied as Indian cities to Bauhaus archictecture. You can also go on a virtual tour of spaces such as the National Gallery in London or some of the houses designed by Frank Lloyd Wright.

Beyond marveling at the technical wizardry of all this, what lessons are there for wealth managers? Even before Covid-19 struck, there was much talk and some action on the digitalization of value chains, wider use of interactive videos, “gamification” of the client experience, and augmentation of RMs with more tools. None of these developments have lost force. And the pandemic accelerated them. There has also been a squeeze of sorts – people think that bit harder about whether a business trip or an in-person meeting is worth the time on the road or the flight. Where budgets are tight, in-person events will have to be more fun, and generate more return on investment than before.

Gone are the days, I suspect, of interminable business conferences where you had to listen to people drone on about “client-centric offerings” and the like, and rush for the networking break over bad coffee. Family offices will have meetings among members to discuss the financial stuff over Zoom or Teams, but go for the quality time together for a bit of fun instead. I see this happening in our industry quite a lot: wealth managers love to hang out with others and swap stories and gossip, but they want more value out of this than, say, 10 years ago. It means that putting on events requires more work, more imagination, and more willingness to try something different.

Back in the early weeks of the pandemic, it was possible to buy into the whole idea that physical events would be off-limits for years, and that people would only reluctantly attend them. The psychological as well as economic impact of lockdowns cannot be underestimated. But it does appear, from where I sit now in April 2023, that the appetite to "get out there" and meet people has largely returned. That's an optimistic note on which to conclude.

As ever, if you have reactions, suggestions or stories for us, email me at tom.burroughes@wealthbriefing.com