Strategy

OPINION OF THE WEEK: Wealth As A Service: Looking Beyond ‚ÄúCrazy Rich Asians‚ÄĚ

The author of this opinion piece explores the promise and challenges of serving mass-affluent wealth management clients in the Asia-Pacific region. The article has lessons for other regions, including North America.

In this incisively written comment piece from Yash Shah, an associate partner for Synpulse, a global management consultancy, argues that Asia’s mass-affluent client segment deserves more love and attention from wealth management businesses. Drawing on data and examples, he explains this position. This certainly adds to conversations about the smart way for banks and others to position themselves in the next few years.

And it is relevant not just for Asia-Pacific but other regions too, such as North America, so we hope readers in the US, Canada and elsewhere find this stimulating.

As always, the views of guest writers aren’t necessarily

shared by the editorial team. We invite replies and debate. So

get into the conversation! Email tom.burroughes@wealthbriefing.com

Introduction

Wealth management has seen consistent and sustained growth

globally, becoming increasingly competitive over the pandemic

years, and thus, providing differentiation opportunities to

wealth managers. Hyper-personalization and digital or hybrid

advisory, which benefited from a sharp rise in the number of high

net worth individuals (HNW individuals), have become key methods

for capturing client assets across the wealth spectrum.

Global surge in wealth management demand

The global wealth management market, as projected in the

World Ultra Wealth Report 2022, is anticipated to

generate a revenue of $850.90 billion, growing at a compound

annual growth rate (CAGR) of 7.1 per cent from 2021 to 2028. Data

from the 2022 Credit Suisse Global Wealth Report also

shows that there was a ‚Äúrapid rise in millionaires‚ÄĚ in 2021,

where the global population of ultra-high net worth individuals

(UHNW individuals) with a net worth of above $50 million grew by

46,000 to a record high of 264,200. The trend line clearly points

toward an accelerating demand for wealth advisory and

management services across the world map.

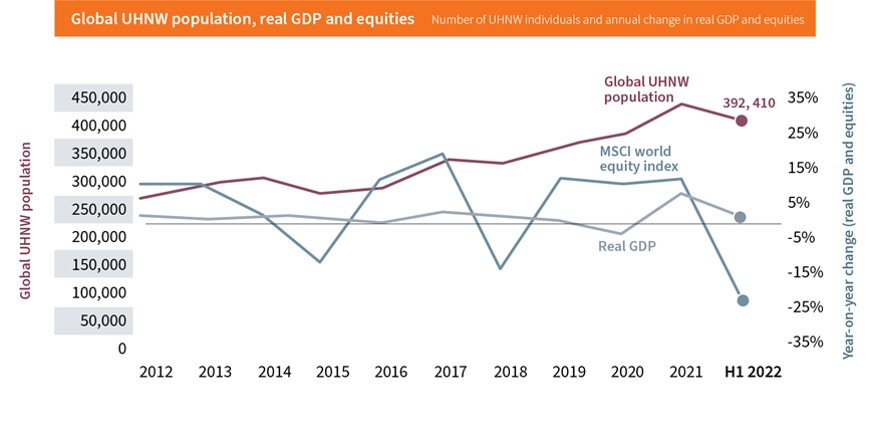

Figure 1. Global UHNW growth from 2012 to 2022

The underserved Asian wealth segment

If we zoom into the hotspots of this rising wealth management

demand, it is not surprising to see a healthy distribution

between the developed Western countries and emerging Asian

economies. Based on a Boston

Consulting Group report, with $47.3 trillion in private

wealth currently, behind only North America’s $50.8 trillion,

Asian economies are set to grab the top spot within the next five

years. This has motivated all the major wealth managers to

add ‚Äėgrowing in Asian markets‚Äô to the top of their to-do lists.

However, the fastest growing wealth segment in Asia is still left unserved: the mass-affluent. With a 9.6 per cent annual CAGR, the mass-affluent segment has already outpaced its HNW counterparts. In addition, this large pool of assets is predominantly held in cash positions, and over a third of this pool is not receiving any active wealth management advice. This presents a tremendous untapped opportunity for global wealth managers to increase their footprint and for local financial institutions (FIs) to enter the wealth management arena.

Figure 2. Global mass affluent financial wealth

Mobile-first wealth management at scale

Many might be unfamiliar with emerging market universal banks and

insurance firms, but they are by no means small. Owning a

significant share of the retail segment in their respective home

locations, these banks have a refreshed focus

on carving out the mass-affluent segment and offering

wealth management services regionally to this banking population.

The proven way to achieve this is with a modular advisory

offering that leverages digital channels backed by a performant

and sophisticated wealth platform as its central building block,

particularly in the post-Covid-19 era.

Southeast Asia added 20 million new internet users in 2022 alone to the current total of 460 million. Investing digitally is not only an expectation but also a preference for the average MA investor. Moreover, a significant reduction in client acquisition and retention costs paired with the evolving business owner and investor profiles are driving this wave of digitalization.

While we have established that digitalization can help regional banks to unlock the mass-affluent wealth pool and achieve a strong profit potential, winning and retaining this client base is a complex affair.

FIs need to start with investing in digital channels, wealth platforms, and a financially literate workforce, which will enable an efficient operating model. This requires substantial upfront investment in technology, infrastructure, and human capital, with a high risk of cost and schedule overruns.

To launch such a wealth operating model, top management needs to 1) align on the long-term digital strategy and roadmap and 2) dedicate necessary resources ‚Äď time, talent, and money. A high level of commitment will help the Tier 1 FIs to create a moat around their wealth managers' offerings, and thus create high barriers of entry for Tier 2 and 3 banks and wealth managers, with access to limited capital and liquidity.

It's not all gloom and doom though; an alternative is to engage trusted wealth service and platform providers. Tier 2 and 3 wealth managers can outsource the technology and operational aspects of their business to these platform providers while focusing on client servicing and retention. This will help to create a more distributed wealth landscape for the mass affluent customer to choose their wealth management provider of choice but, more importantly, lead to the democratization of Wealth as a Service (WaaS).