Real Estate

Marinas: Why Family Offices Should Allocate

In this series stemming from FWR’s investment summit in Manhattan in November, this article explores themes covered in a talk about the case for investing in yacht marinas.

The authors talk about nautical marinas and why, because of

the relatively constrained nature of these assets, they’re a

class that HNW individuals and families should consider,

beyond using them if they have yachts. The writers are

Arinder S Mahal (pictured below) and Terry J Thib –

co-founders of the Capri Harbor Marina Group.

Arinder S Mahal

Mahal spoke at the Family Wealth Report investment summit in Manhattan, held last month. (See here for an overview of the event.)

Family offices today sit at an inflection point in how they allocate capital. Traditional asset classes – public equities, bonds, traditional real estate – have become increasingly efficient, increasingly correlated, and, in many cases, increasingly expensive. At the same time, the multi-generational mindset of family capital pushes decision-makers to prioritize resilience, defensibility, and the ability to participate in long-term value creation in ways institutional capital often cannot.

It is in this environment that marinas – long overlooked as a niche corner of real estate – are emerging as one of the most intriguing alternative asset classes for family offices seeking uncorrelated yield, inflation-aligned revenue, and exposure to a sector with secular demand tailwinds. Unlike many mainstream commercial real estate assets that are subject to cyclical leasing risk, marinas operate in a structurally supply-constrained, operationally sticky ecosystem that rewards careful management and patient capital.

A durable asset in a constrained ecosystem

The structural dynamics of marinas differ fundamentally from

other real estate. Waterfront land is finite. Permitting is slow,

heavily regulated, and often politically sensitive. Environmental

requirements – such as manatee protection plans, coastal

resilience standards, and dredging approvals – make new

construction complex, time-consuming, and dependent on

specialized expertise.

The scarcity of suitable land, combined with these multi-layered approval processes, significantly limits new supply. In fact, over the past several decades, net marina supply in many coastal markets has decreased as waterfront properties have been converted into residential or hospitality developments.

Yet the growing population of boaters, the steady rise in average vessel size, and increasingly stringent “safe storage” requirements from insurance carriers have created demand pressure that is both persistent and predictable. For family offices, this positions marinas as a distinctive real-asset category – one defined by irreplaceable coastal land, a resilient and affluent user base, and a competitive landscape naturally constrained by complex permitting and regulatory hurdles.

Consistent cash flow with inflation

alignment

Marinas blend characteristics of both real estate and operating

businesses – an attractive combination for family offices

that value cash-yielding assets with the potential for

operational upside. Revenue comes from multiple streams and

sources: slip rentals, dry storage, fuel sales, service

operations, and ancillary offerings such as restaurants or

retail. Many of these revenue streams are contractual or

recurring, with annual CPI-based escalators or market-rate

resets.

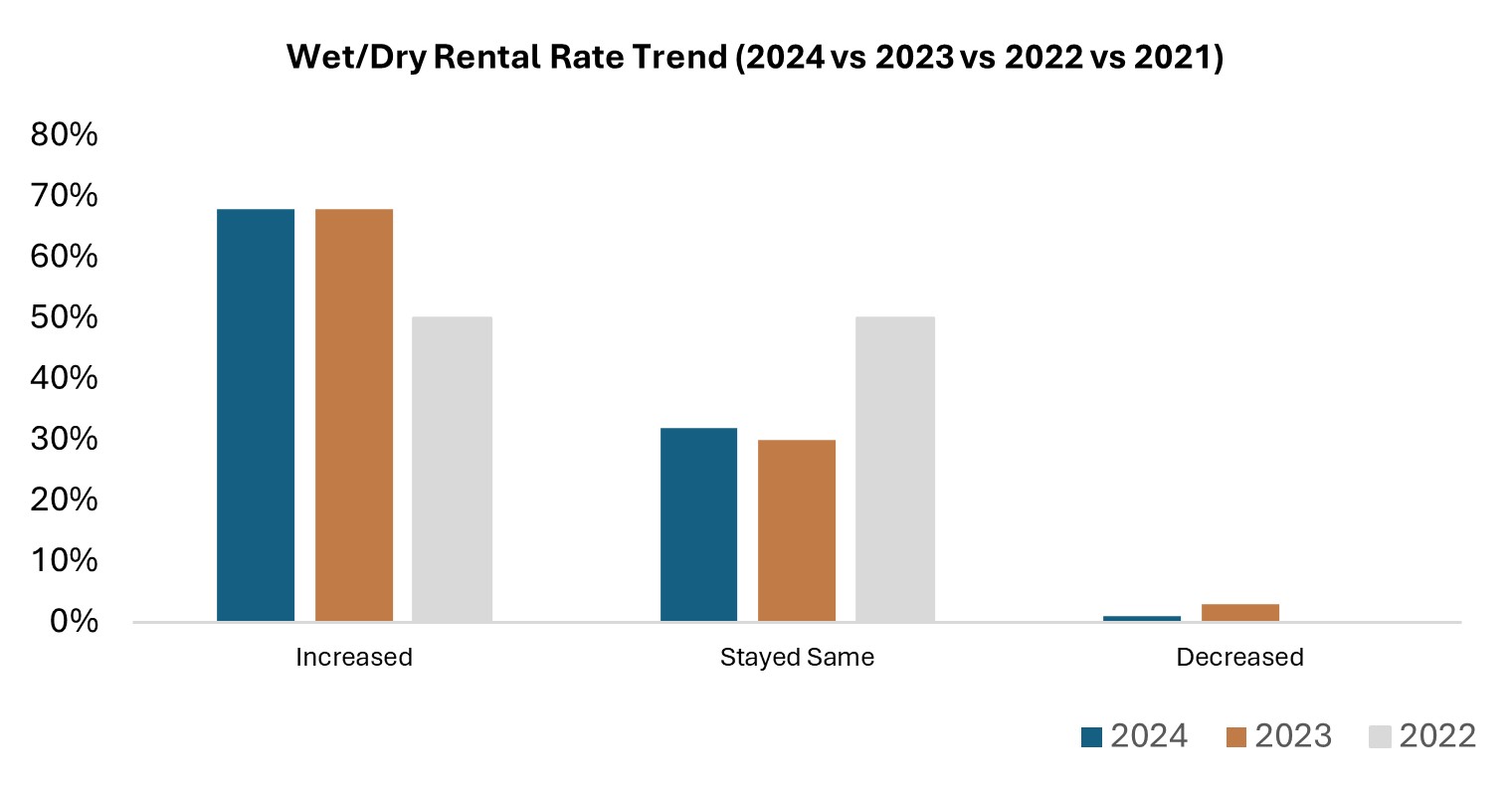

Robust rental increases

Given the high occupancy levels especially in coastal regions,

the rent rates have experienced a steady increase.

Source: Marina Dock Age Survey

Importantly, boat storage is not a discretionary cost in the same way that hospitality or retail spending may be. High-value vessel owners must store their boats safely (in many cases required by the insurance companies), and once they find a marina that matches their service expectations, they tend to stay. Occupancy in well-located (coastal) marinas frequently sits close to 100 per cent, even in stressed markets.

For family offices sensitive to inflation eroding real returns, marina leases and membership fees provide natural inflation protection. Operators review pricing annually, and because demand exceeds supply in many markets, rate increases tend to be accepted with limited churn.

Low correlation to public markets and broader real estate

cycles

One of the more compelling arguments for marina investment is its

low correlation with broader macroeconomic swings. While

tourism-driven destinations experience some cyclicality, owners

of 35+ ft vessels tend to be less economically elastic than

typical consumer groups. This customer profile creates revenue

stability that stands apart from hotel occupancy cycles, retail

foot traffic, or office leasing dynamics.

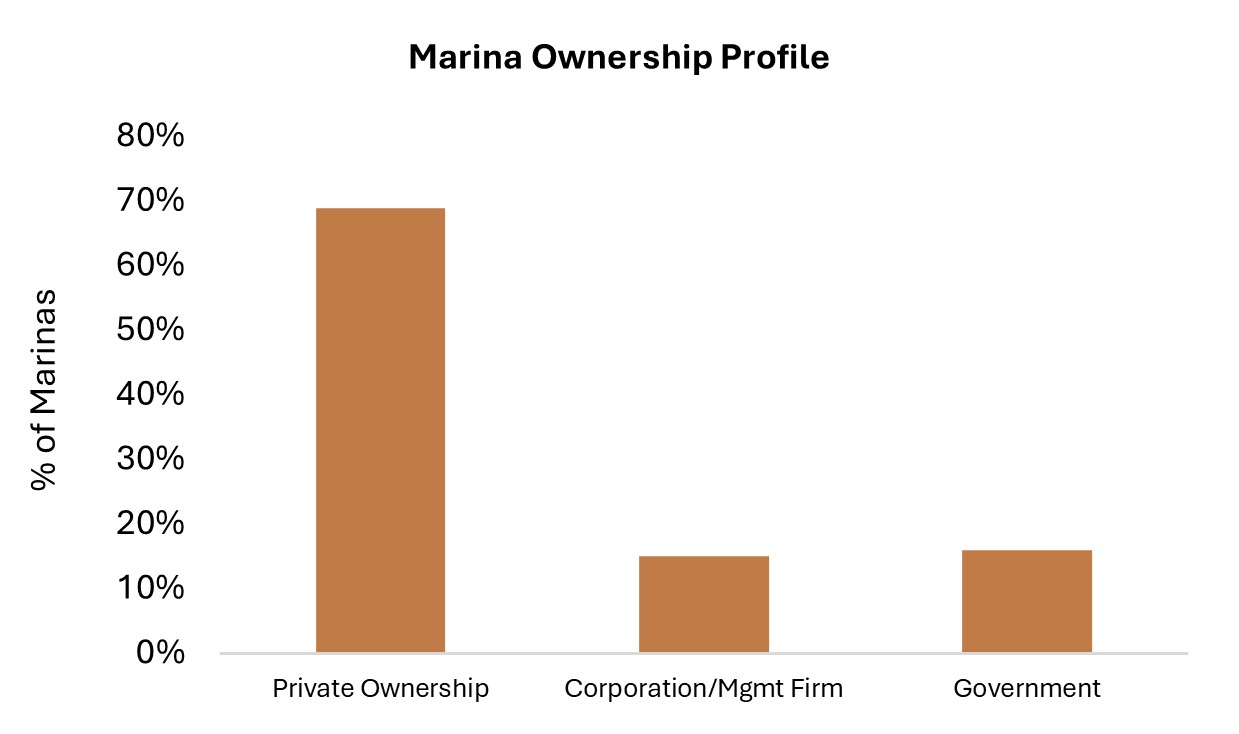

Additionally, marinas did not undergo the type of institutionalization seen in multifamily, industrial, or self-storage. Many assets remain family-owned, under-managed, or operated with legacy approaches that open the door to modernization, professionalization, and accretive redevelopment. Family offices used to buying unloved assets and repositioning them will find familiar mechanics here.

Highly fragmented market...

There are more than 4,000 marinas in the US with the vast

majority owned by small operators – the top five operators

own less than 10 per cent of the market.

Source: Marina Dock Age Survey

Operational value creation and multi-generational

stewardship

Operational improvements – modernizing systems/tech-enabling

operations, updating docks, enhancing amenities, expanding

dry-stack capacity – can meaningfully raise asset value.

These improvements also tend to have long useful lives and

contribute to the kind of long-term stewardship that family

offices often prioritize.

Moreover, marinas often sit at the nexus of community, recreation, and environmental protection. For many families, particularly those with a personal affinity for boating, waterfront culture, or coastal conservation, marinas offer both a financial return and a sense of legacy. They present opportunities to build sustainable, hurricane-resilient infrastructure, preserve working waterfronts, and support local marine economies – creating a narrative of impact alongside return.

Demographic tailwinds and rising vessel

sizes

The US boating population has expanded steadily over the past

decade, not only in volume but in the sophistication of vessels.

Modern boats are larger, technologically complex, and require

infrastructure that older marinas often cannot support without

significant reinvestment. Dry-stack facilities with

hurricane-rated engineering, deep-water wet slips, advanced fire

suppression, and premium customer services are in high demand yet

undersupplied.

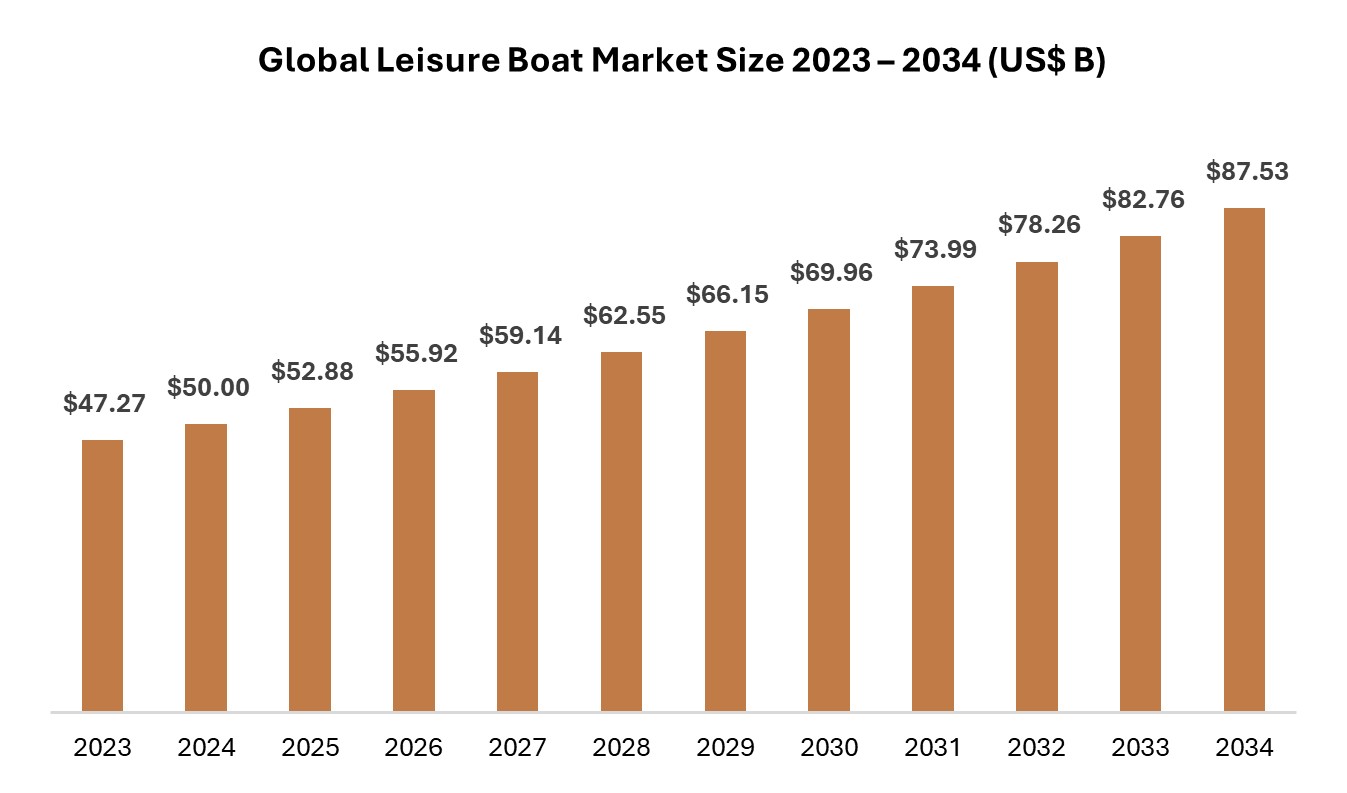

Strong market trends

Favorable demographic trends – such as an aging US

population – is a positive as most boat buyers are concentrated

in older, wealthier demographic groups. Baby Boomers are the

wealthiest generation in history.

Source: Precedence Research

This creates a natural segmentation: older marinas catering to smaller vessels and newer, premium facilities catering to the growing population of high net worth boaters. Family offices targeting the upper end of this spectrum often encounter better economics – higher revenue per slip, more defensible pricing, and a customer base aligned with luxury service expectations.

Why the opportunity today is particularly

timely

A wave of consolidation has begun, driven by both private equity

platforms – highlighted by Blackstone’s acquisition of Safe

Harbor Marinas earlier this year; and well-capitalized marina

operators. Yet the sector remains fragmented, with thousands of

independent owners considering succession, divestiture, and very

few considering redevelopment. Family offices can still capture

attractive entry prices relative to the revenue quality and

irreplaceability of the underlying land.

Coastal climate resilience requirements also favor groups willing to invest in modern infrastructure. As building codes evolve and insurers demand higher standards, older marinas may become functionally obsolete unless upgraded. Investors capable of deploying development capital – patiently, thoughtfully, and with a long-term view – stand to benefit as the market bifurcates into future-ready assets and those that can no longer meet regulatory or market expectations.

How Capri Harbor fits within this thesis

Capri Harbor Marina Group is acquiring and redeveloping coastal

marinas, with an initial focus on South Florida. Within the

broader industry landscape, Capri Harbor reflects a microcosm of

the overall opportunity – its strategy is directly aligned

with the structural forces reshaping the sector.

Capri targets the premium segment of the market serving high-value, larger vessels in supply-constrained coastal markets, where demand for safe, modern storage far exceeds available capacity. Its emphasis on hurricane-resilient dry-stack and high-quality wet slips, technology-driven operations coupled with premium amenities perfectly align with the next generation of marina infrastructure.

What differentiates Capri is its concentration on value creation through redevelopment rather than relying on existing cash flow alone. In coastal markets like South Florida, land availability is shrinking, environmental permitting is lengthening, thus assets that can be redeveloped and modernized – structurally, technologically, and operationally – are positioned to outperform over a multi-decade horizon.

Capri Harbor’s Naples Marina

For family offices seeking to enter the marina sector with a

partner already aligned to long-term stewardship, modern

engineering standards, and disciplined acquisition practices,

Capri Harbor sits squarely at the intersection of opportunity and

necessity. It captures the essence of the asset class: scarcity,

resilience, and the ability to create value through thoughtful

investment and disciplined operational approach rather than

financial engineering.

Authors

Arinder S Mahal and Terry J Thib are co-founders of

the Capri Harbor Marina Group and can be reached at

arinder@chmarinas.com or terry@chmarinas.com