Offshore

Let's Take A Close Look At Puerto Rico's Tax Code And Its Requirements

This article examines the evolving tax regime of Puerto Rico.

In all the international financial centers and jurisdictions that we cover, one that is perhaps not so widely appreciated and understood globally is Puerto Rico. The island is the easternmost and smallest of the Greater Antilles, bordered by the Atlantic Ocean to the north and the Caribbean Basin to the south. Puerto Rico, which has been a US territory since 1898, is a self-governing commonwealth of the US.

The jurisdiction has its own, distinctive culture and, on the financial side, a tax code that can be very appealing for those wishing to cut their tax burdens – provided certain conditions are met. Such jurisdictions have their challenges, of course. Given the desire by many internationally mobile citizens to re-think where they live, the island deserves attention. The following article, by Bianca Ko and Robert W Dietz, CFA, of Bernstein Private Wealth Management, provides guidance on an important piece of legislation – “Act 60” – and what the key pros and cons are. The editors of this news service are pleased to share this content; the usual editorial disclaimers apply. To comment, email tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

Puerto Rico has become a popular destination for entrepreneurs, investment advisors, and individual investors in the United States, thanks to Puerto Rico Incentives Code, or Act 60 of July 1, 2019, as amended (Act 60). The legislation spotlights Puerto Rico as an attractive locale for US investors to gain certain tax benefits while still enjoying the benefits of US citizenship. Yet before diving in, it’s essential to understand the ins and outs of these tax benefits and the requirements that come with them.

Income tax advantages

Act 60 aims to “promote Puerto Rico’s sustainable economic

development” by attracting high net worth individuals and service

individuals to the island (1). The main draw? The chance to cut

the effective tax rate on key income streams by 90 per cent or

more by taking advantage of the unique interplay between the

Internal Revenue Code (IRC) and Puerto Rico’s tax regime. But

these benefits don’t accrue automatically. Instead, they require

careful planning, strict adherence to residency and sourcing

rules, and ongoing compliance with both Puerto Rico and US tax

authorities.

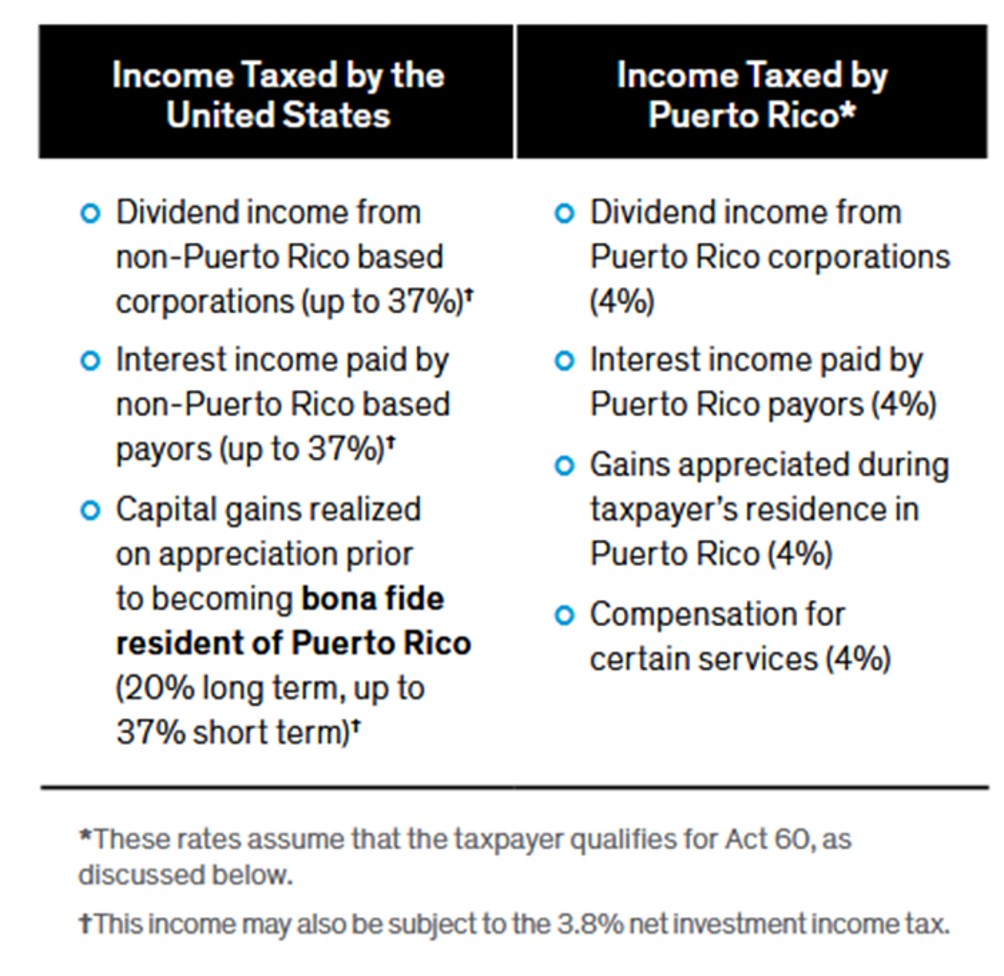

Generally, the United States taxes its residents – including citizens with permanent residence – on their worldwide income. However, bona fide Puerto Rico residents avoid federal income tax on their Puerto Rico-sourced income, even if they are US residents (2). Under the recently amended Act 60, taxpayers relocating to the island may reduce taxes on their Puerto Rico-sourced capital gains, interest, and dividends to just 4 per cent by obtaining a tax decree from the Puerto Rico department of Economic Development and Commerce (DEDC) on or after January 1, 2026. (3)

The phrase “Puerto Rico-sourced” is key since Puerto Rico residents are still liable for US taxes on income derived from mainland sources and those outside the US. For example, interest and dividends from a US corporation based on the mainland will continue to be subject to US federal income taxes, even if the taxpayer becomes a bona fide resident of Puerto Rico. In contrast, capital gains from the sale of intangible property, such as stocks, will only be subject to US federal taxes on the portion of the appreciation that occurred before the taxpayer established bona fide residency in Puerto Rico (4). Act 60 clarifies that “Puerto Rico-sourced” capital gains are limited to the portion of appreciation that occurred while the taxpayer was a bona fide resident of Puerto Rico (5).

Businesses and individuals providing services in certain

industries may also take advantage of Act 60. Those involved in

eligible export services – such as research and development,

consulting, professional services, or investment banking and

other financial services – may qualify for a 40 per cent income

tax rate on their net income (6). What’s more, distributions from

the earnings and profits of these businesses may be treated as

dividends from Puerto Rico, also taxed at 4 per cent (7).

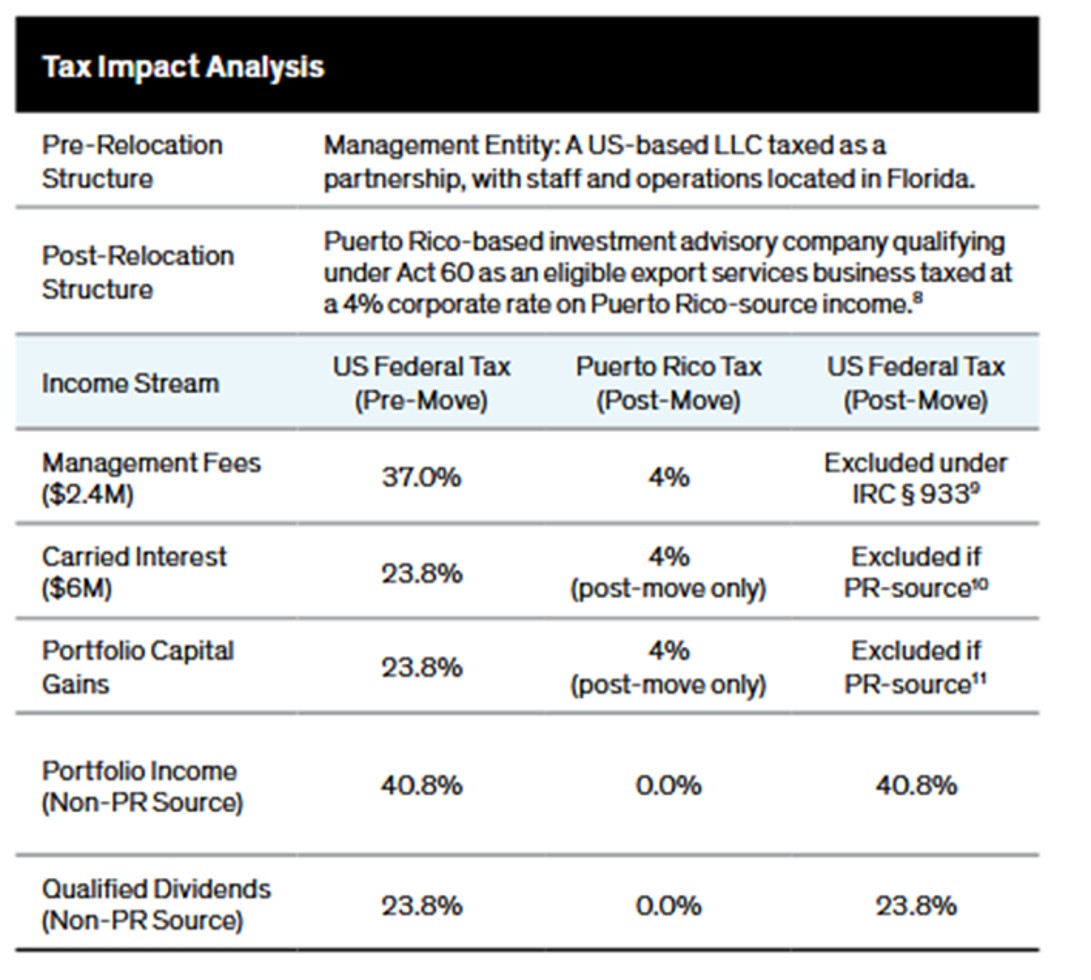

(Footnotes 8, 9, 10 and 11 in the chart are highlighted below this article.)

A private equity fund manager relocates

Take Bill, a founding partner in a private equity firm with $1

billion of assets under management. Bill holds a 15 per cent

stake in the firm and currently resides in Miami, Florida –

though he’s contemplating a move to Puerto Rico in 2026. He

typically earns $2.4 million per annum in management fee

income along with $6 million in carried interest that qualifies

for capital gains treatment. Besides the income he derives from

operating the fund, Bill maintains a $10 million personal

investment portfolio consisting of public and private securities.

Once he is up and running in Puerto Rico, he’d like to structure

his new funds in a tax-efficient manner.

After relocating, Bill may restructure his advisory and management services business to benefit from the 4 per cent corporate tax rate by clearly identifying Puerto Rico as the point of origin for performance. Since the management fee income stems from services performed, it may be eligible for the 4 per cent tax rate as well. However, his existing carried interest valued at $18 million will remain subject to 23.8 per cent US federal capital gains tax when paid out over the next three years. Bill hopes to receive similar payouts from his carried interest in the new Puerto Rico entity in three years. These payouts may benefit from the Puerto Rico tax rate of 4 per cent, too.

In addition, capital gains on any post-relocation appreciation on Bill’s $10 million personal investment portfolio will be excluded from US federal taxation under IRC § 933, making them subject solely to Puerto Rico’s 4 per cent tax rate.

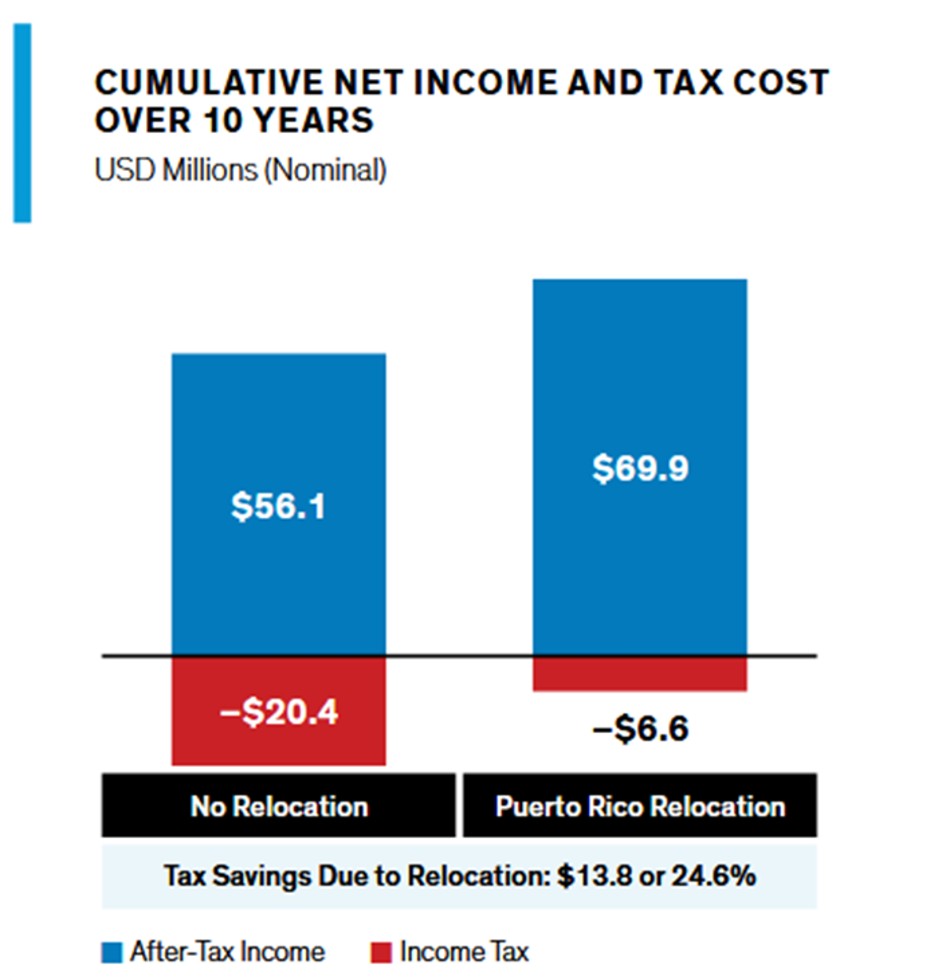

Assuming annual expenditure of $750,000, our modeling shows that Bill’s move to Puerto Rico could enhance his annual after-tax income by 25 per cent, saving him up to $13.8 million in taxes over 10 years. Bill’s savings would be even greater if he had originally lived in a state with a high-income tax rate, like New York or California.

While Act 60 offers meaningful tax benefits, it is worth noting that these apply solely to income tax. In other words, US citizen residents in Puerto Rico are still subject to federal estate and gift taxes on their worldwide assets.

Eligibility and compliance requirements

Investors interested in this incentive program must first ensure

their eligibility, as not everybody with an address in Puerto

Rico qualifies for Act 60 treatment.

Decree requirements

If a taxpayer was a Puerto Rico resident between January 17,

2006, and January 17, 2012, or becomes one after December 31,

2025, they are ineligible. (12)

Bona fide residence

To qualify for Act 60 treatment, a taxpayer must be a “bona fide”

resident of Puerto Rico who satisfies the presence, tax home, and

closer connections tests provided by the Treasury Regulations

(13).

There are five different ways to satisfy the presence text, with varying degrees of complexity (14). The simplest way is to be physically in Puerto Rico for at least 183 days during the taxable year (15). There are alternative day-count tests as well (16).

In addition, a taxpayer must not have a “tax home,” or principal place of business, outside Puerto for any part of the taxable year (17, 18). Note that a tax home may differ from a place of residence. While this requirement applies to the entire taxable year, special rules govern the year of relocation (19). For instance, if Bill moves his tax home from Florida to Puerto Rico in a given year, he may not fulfil this requirement until the following year.

Finally, a taxpayer must show a “closer connection” to Puerto Rico than to the continental US (20). This is a facts-and-circumstances test, which includes, but is not limited, to facts like:

-- The location of the taxpayer’s permanent home and

family;

-- Personal belongings, including car, furniture, clothing and

jewelry;

-- Social, political, cultural and religious

affiliations;

-- Driver’s license and voter ID car; and

-- Charitable organizations to which they contribute.

Investment requirements

In addition to the bona fide residence test, a taxpayer must

fulfil certain investment requirements. First, the taxpayer must

contribute $10,000 per year to a non-profit organization

operating in Puerto Rico (21). At least 5,000 of that donation

must be to an organization directed towards eradicating child

poverty (22).

Within two years of receiving their decree, the taxpayer – either by themselves or with a spouse – must also purchase property that will serve as their principal residence in Puerto Rico (23).

Filing requirements

US resident taxpayers who are bona fide residents of Puerto Rico

should review the filing requirements for both the Internal

Revenue Service and the Department of the Treasury in Puerto

Rico. Generally, US taxpayers living in Puerto Rico for the

entire year who meet the residency requirements will file only a

Puerto Rico tax return (Form 482). This filing is typically due

on April 15 of the following year, with extensions available. In

addition, taxpayers taking advantage of Act 60 must file certain

annual reports (24). The annual reports, which carry a filing fee

of $5,000, must include receipts for their $10,000 nonprofit

contribution.

Finally, once the sales closes, taxpayers must submit proof of their purchase of a primary residence in Puerto Rico. In each subsequent annual report, the taxpayer must attest that they maintain exclusive ownership of the principal residence, either solely or jointly with their spouse.

Puerto Rico’s Act 60 presents a compelling opportunity for investors seeking to reduce their tax burden through strategic relocation. But it’s not for everyone. Investors must ensure their eligibility for the incentive program, carefully plan a move to Puerto Rico – while potentially severing ties with the continental US – and stay abreast of investment and filing requirements. Noncompliance or superficial relocation efforts can result in disqualification, which carries significant financial repercussions. Professional guidance is essential to navigate the legal, tax, and operational intricacies of Act 60, maximize its benefits, and avoid costly pitfalls.

Footnotes.

1 Act 60 Statement of Motives.

2 IRC § 933(1).

3 Act 60 Sections 2022.01, 2022.02; House Bill 505. H.R., 1st

Regular Session of the 20th Legislative Assembly (2025).

4 IRC § 865. Dividends and interest are generally sourced

according to the payer’s residence (see IRC §§ 861, 862).

5 See Act 60 § 2022.02.

6 Act 60 §§ 2011.02, 2031.01, 2032.01.

7 Act 60 § 2032.01(d).

8 Puerto Rico Incentives Code (Act 60-2019), Chapter 3 – Export

Services.

9 IRC § 933.

10 Id.

11 Id.

12 Act 60 § 1020.02(a)(4).

13 Treasury Regulations § 1.937-1(b).

14 Treasury Regulations § 1.937-1(c).

15 Id.

16 Id.

17 Treasury Regulations § 1.937-1(d).

18 IRC § 911(d)(3).

19 Treasury Regulations § 1.937-1(f).

20 Treasury Regulations § 1.937-1(e).

21 Act 60 § 6020.10(b).

22 Id.

23 Act 60 § 6020.10(c).

24 Act 60 § 6020.10