Wealth Strategies

Is Life Insurance Working As Expected? Tips For Clients, Wealth Advisors

Life insurance is and should be an important component of wealth planning, but are clients and advisors aware of the right options? This article considers challenges and solutions.

As we have seen at Family Wealth Report, life insurance is, or to be, an important part of the wealth structuring toolkit. Life insurance takes many forms, varying in suitability and flexibility, and choosing the right one for a client is not straightforward. In this article, Trevor Hamilton, life insurance advisor at US multi-family office Bessemer Trust, considers the issues. As ever, while editors at FWR are pleased to share such insights, they don’t necessarily endorse all such views and invite responses. Email tom.burroughes@wealthbriefing.com

Life insurance serves as an effective component in an estate plan due to its ability to provide liquid, tax-free benefits to fund estate taxes. However, many life insurance policies have been failing to meet their performance benchmarks over the past few years.

Though the specific reasons for life insurance underperformance may vary based on the policy, in many cases it can be attributed to the decline in interest rates over the past few decades, which has resulted in sustained declines in interest and dividend crediting rates. Even as interest rates gradually rise in the coming years, crediting rates are likely to lag for many years to come.

Here are the points to consider when determining whether life insurance is an attractive option in your client’s estate plan.

The role of interest rates

Insurance policies across the board, including both universal

life and whole life policies, are sensitive to the interest rate

environment. Since interest rates have been — at least until

recently – markedly low for more than 30 years, the yields on

high-quality fixed income investments (which often make up over

80 percent of insurance account assets) have been declining

accordingly. In short, insurers have been earning increasingly

less from their fixed income investments.

This impacts universal life and whole life policies, but in slightly different ways. An example is universal life insurance. The amount of money universal life policy holders are credited in their accounts (also known as interest crediting rates) is directly correlated to the insurance carrier’s profits. Therefore, as interest rates have caused the yields on insurance investments to fall, the interest credited to policy holders has also been under downward pressure. For policy owners, this could mean additional premium payments or lapsed policies. In certain circumstances, policies designed to have increasing death benefits could see less growth than expected. Then there are whole life policies. While they do not receive interest crediting rates, whole life policies are similarly impacted by the insurer’s profitability when it comes to dividend payouts. More specifically, the dividend is based on three factors - insurance carrier profits, the mortality experience of the carrier, and the carrier’s operational expenses. Low interest rates, mortality rates that exceed assumptions, and/or increased operational expenses can all negatively impact dividends. For policy owners, this has many potential implications:

• Death benefit and cash value growth may be less strong than originally projected;

• In cases where projections called for premiums to be paid with dividends, additional out-of-pocket premiums may be required; and

For No Lapse Guarantee (NLG) policies, since the death benefit and duration of coverage are guaranteed if premiums are paid as scheduled, downward pressure on rates is irrelevant. However, if your client owns an NLG policy, you should keep an eye on inflation. Since they tend to have low or no cash values, they won’t benefit from, and may permanently lag, an extended high-interest-rate environment.

Rising interest rates

Despite the gradual rise in interest rates on the horizon,

carrier interest rates may lag, and many policies could still

underperform for the next few years before improving.

Of course, if interest rates were to rise more quickly than expected, crediting rates would rise faster as well, but meaningful increases would still likely be several years out. Rapid rate increases would also place stress on carriers as they struggle to provide a competitive crediting rate while simultaneously dealing with policy owners cashing out to pursue higher-yielding investments elsewhere.

In addition, to generate higher returns, some insurance carriers have turned towards slightly riskier and less liquid longer-term bonds, which will lag new money rates for longer given their longer duration. This should only serve to exacerbate the performance lag factor.

Other factors impacting performance

Beyond interest rates, a sample of the many factors that can

affect life insurance performance includes:

-- Premium Payment Schedule – When it comes to both universal life and whole life insurance, though structured in different ways, if the policy holder doesn’t maintain the original funding schedule or skips payments, even if their policy is experiencing what appears to be solid cash value accumulation, it will not perform as originally projected;

-- Investments and Market Volatility – Variable life insurance (VUL) and indexed universal life insurance (IUL) are both impacted by the general market environment, allowing for potentially greater cash value accumulation depending on investment performance, and may perform better or worse based on market volatility; and

-- Assumed Return Projections - Potential issues can arise when it comes to assumed return projections at the time the policy is issued and during periodic reviews. As with many policies, hypothetical crediting rates are based on the historical performance of the designated investment, and current rates are not necessarily an accurate predictor of the policy’s future performance. Conservative assumptions are always a good idea.

What should your client do?

If your client has a policy that is underperforming expectations,

should they stick with it or chart a new course?

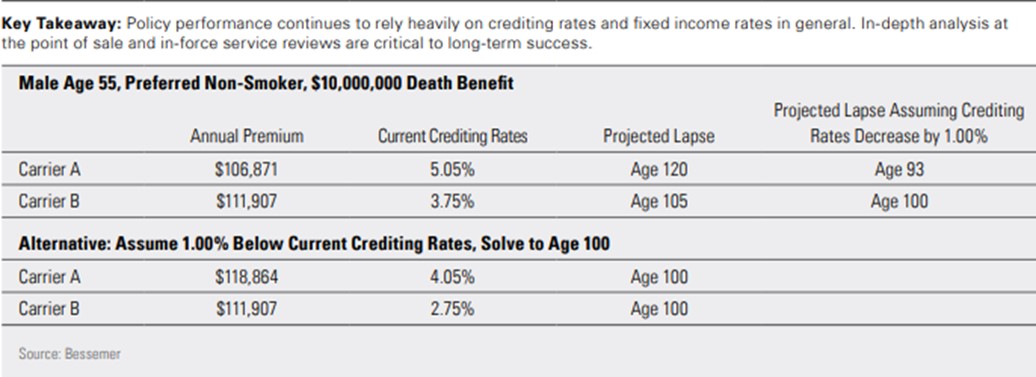

The best plan may not always be obvious. For instance, in the

below exhibit, Carrier A’s policy seems, at first glance, to be a

better option than Carrier B’s policy; both offer an identical

death benefit, but Carrier A requires lower premiums and provides

a longer duration (if crediting rates remain stable).

Re-examining the two policies with a more conservative

stress-tested crediting-rate forecast (one percentage point lower

than the original forecast), however, we can see that Carrier A’s

premiums rise markedly while the crediting rates fall. Carrier

B’s policy becomes the better option.

Source: Bessemer Trust

Objective policy reviews are essential — before a new purchase and then regularly thereafter — to see how a policy is stacking up against projected performance. Particularly given the low rate environment, reviews that include downside stress testing to show how different (lower) crediting rates are likely to impact performance can help to determine reasonable funding levels. At that point, you can begin to weigh the client’s options.

If your client is considering a new policy, make sure they know the risks of each policy type and design their policy conservatively around those risks.

For existing policies, advisors should periodically review their investment allocations, track their policies’ performance to make sure the funding stays on track, and always use conservative appreciation projections to help ensure they remain in line with actual performance. This can put your clients in a better position to decide whether to retain their policy, modify it, exchange the policy for a different type of insurance, or simply allow it to lapse.

Permanent life insurance policies are likely to remain under pressure for some time - but this does not necessarily mean they are inappropriate or even unattractive assets. Determining whether it is right for your client depends upon the results of an objective policy review and a realistic assessment of their individual objectives and personal circumstances.

Disclaimer:

This material is for your general information. The discussion of any estate planning alternatives and other observations herein are not intended as legal or tax advice and do not take into account the particular estate planning objectives, financial situation, or needs of individual clients. This material is based upon information from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no representation or warranty with respect to the accuracy of completeness of such information. Views expressed herein are current only as of the date indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in law, regulation, interest rates, and inflation.