UHNW Institute

Interview With Citi Private Bank: Family Offices' Needs, Business Models Serving Them

Editorial advisory board member and wealth industry luminary Steve Prostano talks with Citi Private Bank's Bill Woodson about the work his firm does in informing family offices and ultra-high net worth clients.

This article is written by Steve Prostano, managing partner of SPI Partners, and a member of this publication’s editorial advisory board. Steve has written a number of items for Family Wealth Report. Here, he interviews Bill Woodson, who is managing director and head of the family office group at Citi Private Bank. The private bank has issued a number of white papers exploring issues confronting ultra-high net worth families such as private aviation and cyber-security.

At the recent Family Wealth Report Family Office Summit held on November 1 in New York, industry thought leaders shared the latest thinking on the needs of ultra-high net worth individuals and what it means to integrate a family’s full balance sheet, and examined specific wealth strategies that they can deploy to ensure financial and emotional well-being. The closing panel brought it all together by exploring specific wealth management business models available to these families in the context of the current state of the industry.

Despite the number of options and business models available to clients today, the panel concluded that there is no single model fully satisfying the unique and dramatically different needs of the UHNW client. Each business model faces challenges that affect their ability to deliver the value needed for clients.

The biggest concern they discovered facing families, was not just the lack of one business model capable of satisfying all of their needs, but the confusion in the marketplace, compounded by a lack of transparency and education available to these clients.

As part of the foundation for Family Wealth Report’s upcoming UHNW and Family Office Educational Initiative, we continue to explore the needs of various client segments and the business models serving them. Today we will focus on family offices and chose to interview an expert in this space to gain the perspective of Bill Woodson, MD and head of the family office group at Citi Private Bank.

Steve Prostano – Do you believe that family offices should be recognized as a separate and distinct client segment?

Bill Woodson – Absolutely. As the number of family offices has grown, they have become an even more important and distinct client segment for wealth management firms. They not only control a substantial amount of wealth and do a significant amount of business with Wall Street, but they also have needs that are truly distinct from typical UHNW investors. As a result, family offices can be quite challenging for wealth management firms to serve. A few key distinctions to note are:

- Family offices act and have requirements best categorized as both "private clients" and "institutional investors". They require a high level of expertise and service and often demand institutional accommodations and pricing.

- Family offices are also unique in that they manifest themselves in many different archetypes. They tend to be a heterogeneous group of investors who control a significant amount of wealth, invested across multiple asset classes where decisions are being made by in-house professionals. These professionals must then address the complex and interrelated service and advisory needs of the family, while simultaneously navigating the unique dynamics of working for private families. This can be extremely challenging, time consuming and complex.

As a result of these distinctions, family offices are emerging as a unique client segment that are perhaps better viewed as companies in a diverse industry; companies with similar needs but which vary greatly in a number of important respects. It is these differences that challenge both traditional family offices and wealth management firms that grew up serving a more homogeneous population of UHNW families and individuals.

Is there a particular business model today that family offices are using in an attempt to satisfy all of their needs?

I believe family offices are using multiple firms to satisfy their broad-based set of needs. Family offices are finding it very hard to identify the right wealth management firm and distinguish between the various business models. This challenge extends into finding the right advisors within these firms because many wealth management teams do not work with family offices on a focused or dedicated basis. For example, while wealth management firms have a significant number of family office clients across the company, these relationships are managed by separate and unconnected teams, each of whom have relationships with only a handful of family offices. Therefore, these advisors have varying levels of contacts in the family office space, insights into their buying behaviors, and understanding about how best to approach, sell and advise them.

How can firms better distinguish themselves?

I believe wealth management firms have the opportunity to distinguish themselves with family offices by outlining their approach, service model, and programs in a clear and transparent way. These firms should be able to articulate that they understand the distinct advisory and service needs of these clients, while ensuring their firm’s entire suite of capabilities is available to them in a seamless manner. They also need to be able to round out their financial offering by providing value-added services including consulting, education, conferences and opportunities to meet and collaborate with other family offices.

How can firms better serve this new client segment?

Many wealth management firms are already working to expand their current offerings or develop new ones – which is great!

However, while most wealth management firms have institutional capabilities that proclaim to meet the needs of even the largest and most sophisticated family offices, the nature of both this client segment and the wealth management firms, makes bringing these capabilities to family offices challenging. Despite the fact that a number of family offices oversee a significant amount of wealth, very few have experience of trading and investing with the volume or frequency that makes them comparable to true institutional investors; such as asset managers, sovereign wealth funds, or hedge funds. As a result, the institutional side of many wealth management firms are unwilling or reluctant to take family offices on as clients, particularly given the time and resources needed to properly serve them.

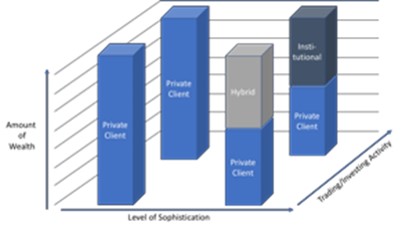

This illustration compares how and where family offices are likely to be served by wealth management firms across three key investor-client attributes: amount of wealth, level of sophistication, and volume of trading/investing activity. As illustrated in the accompanying graph, family offices must, for the most part, meet a minimum threshold in all three of these areas before working with the institutional-side of a wealth management firm makes sense.

In order to be successful, they must evolve their private client offerings to address the differentiated needs of family offices that, on average, are more sophisticated and complex than UHNW clients, but typically do not rise to a level where they can become traditional institutional clients.

Many wealth management firms have addressed this issue by selectively making institutional products and services available to family offices based on a family’s specific needs, capabilities, and volume of business. This is typically done in areas such as debt/equity capital markets (for research, trading and execution) or investment banking (for direct investing) where many firms have developed referral or co-coverage arrangements between the private client and institutional divisions of the company. These programs allow select family offices to be considered as institutions for these specific needs, while they remain a private client for traditional private banking products, services and advice (e.g., cash, custody, lending and traditional investments).

Can you discuss the needs of family offices vs. the UHNW individual in terms of advice and ancillary services?

That is a great question. As an emerging industry with new and distinct needs, family offices and the professionals they employ are increasingly looking for assistance and advice about how best to address similar challenges. Wealth management firms are in a unique position to provide this advice given the number of their family office clients and the insights these clients provide the firm and their advisors. This is similar to the advice these firms already provide UHNW families and individuals in areas such as estate planning, philanthropy and wealth education.

What is different, however, is that many of the issues family offices face extend beyond estate planning, philanthropy and acclimatizing children to growing up with wealth. Family offices are increasingly looking for best-practice advice in areas such as formation, outsourced technologies, cyber-security, compensation and retention, governance and investing. These clients are also looking to connect with each other to collaborate, share experiences, and occasionally co-invest.

Wealth management firms that are able to provide these ancillary, segment-specific advice and services to family offices will distinguish themselves and most likely be rewarded with new or additional business. The most effective and relevant wealth management firms for family offices will be those firms that deliver these resources and capabilities across all their advisors, on a recurring basis, for each of their products and services.

Conclusion

This has been a tremendous opportunity to discuss the specifics around family offices and the business models currently available to support them with Bill Woodson. We’ve learned that family offices are a truly unique and distinct client segment whose needs are more sophisticated and complex than traditional UHNW people. They require much more intentional servicing and comprehensive offerings to satisfy their “private client” and “institutional” characteristics. Education and transparency will also be absolutely critical in the success of both parties. The various firms serving this segment need to not only understand this, but they also need to be transparent in terms of what their individual firm and business models can provide.

This topic leads me into the exciting launch of our new UHNW and Family Office Educational Initiative coming in January 2019. The curriculum will involve a careful examination of the business models available to these clients as they set out to achieve their personal, financial and business goals. An emphasis will be placed on educating these client segments on the key issues and trends affecting these models. A sneak peek into what participants can look forward to will be a glossary of key industry terms and definitions, expert content specifically dedicated to these topics, conferences and webinars, networking events and a due diligence guide to support important decision-making; such as choosing a wealth manager. I look forward to sharing more with you in the weeks to come and wish everyone a safe and healthy holiday season.

To read previous articles written on this topic, please click here.