Client Affairs

In Plain Sight: Why Having A Home Inventory Matters

To prepare for upheavals of all kinds, it's smart for high net worth individuals to build an inventory of possessions to reduce the pain and difficulty of tracking them once a problem hits.

It pays to get one’s financial and related affairs in order, particularly when those “big events” come up in life that can be emotionally taxing and distracting. Preparation is all important. All the talk about “NextGen” wealth planning and the like can be undermined if people haven’t got a thorough log of their assets. Events such as natural disasters can underline the importance of inventories and meticulous record-keeping.

With this in mind, Carol R Kaufman, founder and chief executive of Alternatives TLC, LLC, walks us through why having a home inventory is necessary. We hope these insights prove useful and, as always, invite readers’ responses and feedback. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

My friend, Ellen, a high net worth individual, lived in an exclusive area near the levee in New Orleans. She got the evacuation call during Hurricane Katrina. She packed a small bag for two days and left the house with her husband and 10-year-old daughter, who’d tucked her baby dolls into bed, covering them with a blanket to “keep them safe”.

They never returned. Their home went completely under water when the levee broke.

Ellen spent an entire year trying to piece together everything in her home, on each wall, inside each closet and in each drawer. All the pictures, baby videos, jewelry, clothing, prescriptions, critical documents - every physical asset was lost in the hurricane.

Ellen didn’t have a digital record, a physical binder or even a list of their belongings, so they couldn’t prove what they’d had and, therefore, what they’d lost. Their insurance paid them nothing for their contents.

More and more, natural and medical disasters are occurring. Global warming and climate change are linked to fires, tornados, floods and earthquakes. Thefts, car accidents, medical disasters...no one’s immune. Additionally, everyone is aging and with that comes settling an estate and asset transfers. The more prepared for any of these, the less time spent scrambling, trying to recover and move on.

What’s a home inventory?

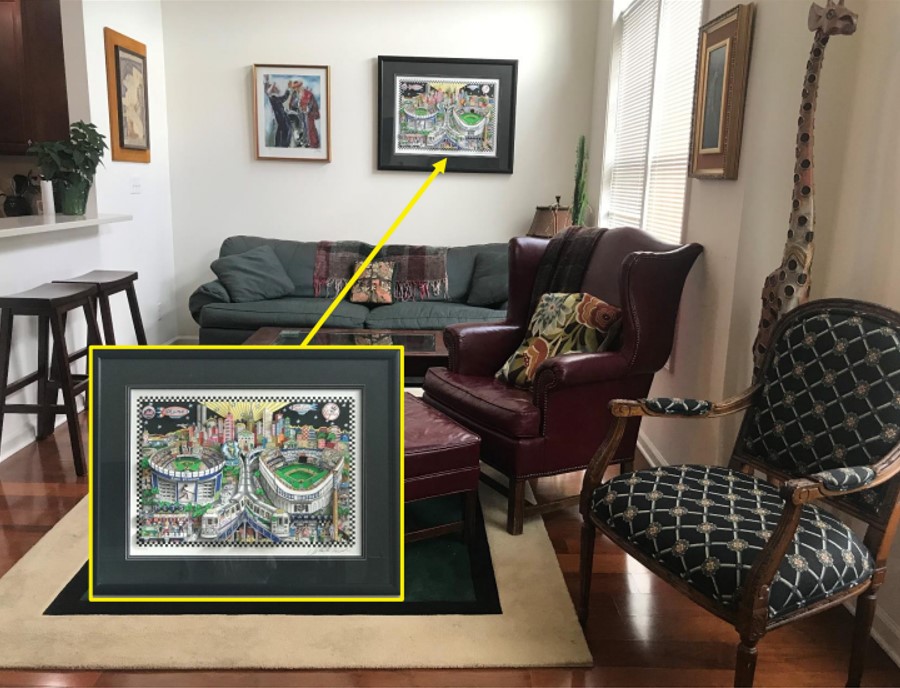

A home inventory is a visual snapshot of every room, every wall,

ceiling and floor that shows the visual condition of what your

house looks like - inside and out. It also contains every

important physical asset that you own, for each place in which

those assets “reside” - including in storage facilities and where

loaned assets may be housed, such as in museums. It’s one of the

essential pieces of a family puzzle.

Why do I need one?

It doesn’t matter if you have a small home or a huge estate with

additional residences. Everyone has “things” they feel are

valuable. Everyone has sentimental items they want certain people

or charities or museums to have, as eventual beneficiaries.

Unless it’s documented, it won’t happen.

High net worth families might not have ever considered the above. They may feel it can’t happen to them. But it did, indeed, happen to Ellen. Families need to be aware of the consequences of not having a home inventory and the many benefits of having this information:

-- Being able to prove ownership and condition of assets

prior to a natural disaster, a theft or a fire;

-- Preventing items from “falling through the cracks” due to

waning memories as people age;

-- Having trusted advisors who may be better at

putting a plan together (e.g., which items to put in a

trust, the proper amount of insurance coverage); and

-- Reducing conflict when disbursing assets to the next

generation.

Marty Shenkman, renowned US attorney and estate planner, agrees. “Most of my clients don’t have a home inventory and don’t even think to get one. It’s the stepchild of planning because most people just never get to it. But some of the worst fights I’ve seen with estates is over the tangibles…and not even the most expensive ones! There are emotional attachments to items that far outweigh their value.” He goes on to say: “There are so many additional things that come into play. Consider the increased use of home health aides with our aging parents… if someone walks off with something, how can you know what they took if you don’t know what your parents have?”

I recently circulated a two-question survey on Facebook, LinkedIn and email. The first question was “Do you have a home inventory for at least one of your residences?” The second question was “If not, why not?” I gave a choice of five answers with the ability for people to additionally insert their own.

The results were sobering but not surprising. Some 84 per cent of respondents answered “No”, they didn’t have a home inventory. Among the top reasons as to why they didn’t have one were the following (multiple selection allowed):

I don’t have the time to do one (46 per cent); I didn’t realize it was important to have one (31 per cent); I haven’t made it a priority (22 per cent); I wouldn’t know how to do one (13 per cent); I don’t know what one is (7 per cent).

For those who didn’t realize the importance of a home inventory, according to Lynn Magnusson, one of the few certified appraisers in the country to belong to both the American Society of Appraisers (ASA) and the Appraisers Association of America (AAA) and co-owner of The Magnusson Group: “Many HNWIs have more assets inside their home, garage and storage than the value of their real estate or financial instruments!“

Lynn reinforces that an inventory of home contents is a great place to start and a worthwhile endeavor and that a qualified appraiser can also advise on market analysis for the purpose of collection management and when and how to buy or sell parts of a collection.

Ways to create a home inventory

Even with available phone apps and online, PC-based and MAC

software products making it easier to accomplish the task, as the

survey confirms, most people don’t have the time, the patience or

the wherewithal to create their own home inventories. Below are

two suggestions for readers to consider:

Allowance Proposal: A rite of

passage

If you have a child at home, eight years or older, consider

having them learn how to create a basic home inventory for your

residence(s). The skills learned include photography (they all

have cell phones), cataloging, valuing, describing, coordinating,

math, teamwork (with siblings) research...the list can go on.

They also learn to respect physical property - including their

own. Allowing them to then help suggest or determine what items

can be donated or gifted to others, teaches them philanthropy,

organizational skills, decluttering skills, in a simplistic and

concrete manner. Having your children help with the family’s home

inventory becomes a seamless and meaningful way to include them

in the process of transitioning information, property and

possessions from one generation to another.

Hire someone to create a home inventory for

you

The biggest response in the survey was people’s not having the

time to create one. There’s a growing presence of home inventory

service providers. These people are usually not certified

appraisers but have been formally trained how to take pictures

and organize supporting documents into a home inventory catalog.

When hiring someone to come to your home and create a home

inventory for you, it’s important that you perform due diligence

on them, just as you would on any other service provider. Be sure

to include the following criteria and questions in your search:

-- How were they trained?

-- How much experience do they have? Do they have

references?

-- Are they a member of a known organization, e.g. NAPO

(National Association of Productivity and Organizing -

Professionals)

-- Do they have insurance?

-- Does the contract you sign with them include a

confidentiality clause in it? Does it state what they

can/can’t do with your information? Do they keep a copy of the

information? If so, for how long and under what

circumstances?

-- What tools/software/apps do they use?

-- What precautions do they take to protect your identity

and minimize security risks of your assets and other

information?

-- What do they deliver to you (Catalog? Digital files?

Physical files? All of these?) and is it sharable with family and

trusted advisors?

-- How do they charge? (it should be by project) and

-- How does the information get updated, on what type of

basis and at what cost?

Summary

There are many compelling reasons to create a home inventory, but

Mitzi Perdue, author of How to Make Your Family Business

Last sums it up best:

"Having a home inventory is for me so valuable that it’s beyond price. The inventory is useful for insurance purposes and also for estate planning, but for me, there’s a huge additional value. In many cases the items have stories that would get lost if we didn’t have an image and a description. As an example, my sister and I inherited six needlepoint cushions that my grandmother created 100 years ago. If no one knew the history of these old cushions, their value would be minuscule.

But with photographs of them, and the story of who made them and when Grandmother Berta lived, suddenly the worthless-looking cushions are transformed into priceless, cherished heirlooms. Without the inventory, they might have ended up in the landfill."