Alt Investments

Hunting Private Equity Opportunities In Stressed Times

This news service looks at private equity and related private markets investors, such as those focusing on distressed opportunities amid the current extraordinary global economic slowdown.

COVID-19 has hit global economies with a sledgehammer and prompted investors in the private markets field – debt, equity, infrastructure and property – to fret about valuations to existing assets and wonder if they can snap up opportunities.

The term “vintage” – applying to the year when an investment was initiated (like when a grape is harvested) – may be looked at particularly closely in future if managers can buy assets on the cheap. Those funds that were “bottled” when markets were on the floor might hopefully taste wonderful as and when there is a recovery. (Of course, as any serious wine collector knows, it is wise to hold a range of vintages rather than shoot for the “perfect” one.)

Another feature of virus-roiled markets is that some funds that had thought of closing their doors to new money might open up again in the current environment.

That is the view of Heather Jablow, managing director, Private Client Practice, and Philip Walton, managing director, Private Client Practice, for Cambridge Associates.

“Prices are dropping and should create opportunities in a number of areas,” Walton told this news service. For example, technology and healthcare sectors are worth examining given their growth potential. On the flipside, he said, there are also some distressed investing opportunities in parts of the cyclical manufacturing sectors.

Cambridge Associates provides investment services to organisations and private clients including endowments and family offices. Unsurprisingly, the team is busy.

An ever-present area of work is monitoring clients’ liquidity needs, as well as tracking distributions from investments, calls for capital, and tax payments, Jablow told this news service.

As private markets investing is typically far less liquid than for, say, listed equities or cash, such close monitoring of clients’ liquidity needs is particularly important. “It is critical to understand and plan for liquidity needs in both normal markets and in stressed markets, when the circumstances of clients may change,” she said.

The distressed players are on the move. According to the Wall Street Journal (3 May), Apollo Global Management plans to raise money to capitalise on demand for loans during the coronavirus pandemic. The US firm expects to raise $20 billion over the coming year, emphasising credit strategies designed to take advantage of economic dislocation.

Private-equity firm General Atlantic is teaming up with veteran credit investor Tripp Smith to launch a roughly $5 billion fund (WSJ, 14 April). Such operators, also nicknamed perhaps unfairly as “vulture funds”, typically target assets trading at a significant discount, and restructure a business to pocket a profit. While they can be attacked for exploiting tough times, arguably they are vital to a free market system where capital can be put back to profitable use rather than fall idle.

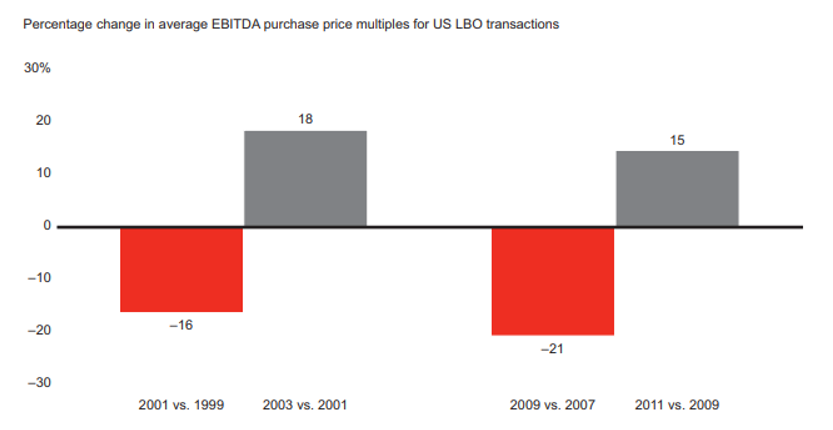

Distressed investors have to move fast. According to a report by Bain & Co, in the past two downturns, the average leveraged buyout purchase price multiple sank by about 20 per cent from its high but then recovered most of that within two years.

Source: Bain & Co

Under pressure

“There will be a lot of distressed assets coming up for sale,”

Olamide "Lami" Ajibesin, who leads transaction advisory for

Anchin,

Block & Anchin LLP, a public accounting firm in North

America, said. She advises private and public clients on M&A

and PE transactions (including secondaries) and strategic

investments in energy (E&P/oil and gas, power), consumer

products, industrials, financial services and technology, among

other industries.

Among areas hit by the pandemic that could lead to opportunities include aviation, luxury and travel, she said.

Ajibesin works with family offices and others, both on the institutional and non-institutional side. The pandemic has raised a few challenges, such as being able to conduct due diligence on investments, although she was already used to working remotely and handling a number of processes via that route.

Private markets investment funds collectively hold a lot “dry powder” – money not yet put to work. At the end of 2018 there was $2.0 trillion of private equity spare money globally (source: Bain & Co, 2019 report). Fast forward to the coronavirus-blighted spring of 2020 and a lot of that money could be put to work. But investors are not going to be in a hurry, given uncertainties for some time to come, said Ajibesin.

“The mood of investors now is more introspective….people are taking their time,” she said.

As the cited Bain & Co report, issued over a year ago shows, the industry was if anything concerned about an overheating, fiercely competitive private markets sector. A decade of ultra-low interest rates and frustration over weak bond and tight equity yields has encouraged a flood of money into the private investments space. In the past few weeks, however, the pace of fundraising into private equity has slackened. A few days ago, research firm Preqin, polling 183 private equity firms in April, found that well over two-thirds of them (69 per cent) said their fundraising had been hit by the global pandemic, and a third (32 per cent) said it had significantly slowed.

Private market industry figures hope that medium- to long-term data will remind people that it makes sense to stay on board for the long haul. According to Cambridge Associates, its US Private Equity Index (Legacy Definition) chalked up 25-year returns (as of 30 September 2019) of 13.35 per cent, ahead of 9.83 per cent for the timespan at the S&P 500 Index of US equities. That “gap” perhaps explains so much of why private investing remains a hot favourite with wealth managers.