Investment Strategies

How Investors Should Sink Their Teeth Into The "FANGs"

A collection of big, modern-economy stocks that grab lots of headlines and excite investors. This article takes a closer look at their qualities and ponders on how wealth managers should consider them in portfolios.

There are certain stocks - Facebook, Amazon.com, Netflix and Google - and in this industry, with its love of acronyms, are known as FANGs. They have particular qualities for the investor, both positive and negative. In the following article, David Dalgas, chief investment officer, global core equities, AllianceBernstein, talks through some of the issues. The editors of this news service are pleased to share these views; they don't necessarily endorse all such views and readers are most welcome to respond. Email tom.burroughes@wealthbriefing.com

The investing industry is constantly devising new acronyms and buzzwords. Sometimes these can be dangerous. The rise of the FANG stocks highlights how clusters of stocks may create investing hazards that standard risk models struggle to detect.

Equity investors rely on various risk models to protect portfolios from a range of threats. Standard models generally focus on factors that affect performance, such as style, sector, country and currency. These models are designed to make sure that an investor is aware of a portfolio’s exposures and can avoid being too heavily tied to particular areas of the market.

But fundamental risk models track only a defined set of risks. There are countless hazards to investing portfolios that slip under their radar screens. In particular, we think investors should pay more attention to cluster risk. This is the risk that performance patterns of a group of stocks with similar business profiles but different risk classifications become correlated.

Rise of the FANGs

US mega-cap technology stocks are an excellent example. Over the

past two years, Facebook, Amazon.com, Netflix and Google have

become known collectively as the FANG stocks, a group of

companies dominating the transformation of media and consumer

markets through technology. More recently, Apple has been added

to the group, which is now known as the FAANGs.

These companies have a combined market cap of $2.6 trillion, or nearly 11 per cent of the S&P 500 Index market capitalization. From January 1 through August 31, they accounted for more than a quarter of the S&P 500’s gains. And they’ve generated ongoing debate about whether a bubble is developing in technology stocks.

This is where the problems begin. Although technology drives the businesses of all five companies, they aren’t all classified as technology stocks by risk models. According to MSCI’s Global Industry Classification Standard (GICS), Facebook, Google and Apple are information technology companies, while Amazon.com and Netflix are in the consumer-discretionary sector.

Unintended risks matter

Taxonomy is more than just a technicality. Standard risk models

might check that a portfolio doesn’t have too much exposure to

the technology sector or the consumer sector. But they don’t look

at the FANG or FAANG groups as a whole. And if the performance of

these stocks is correlated, a portfolio that holds too much of

the group might face unwanted risks.

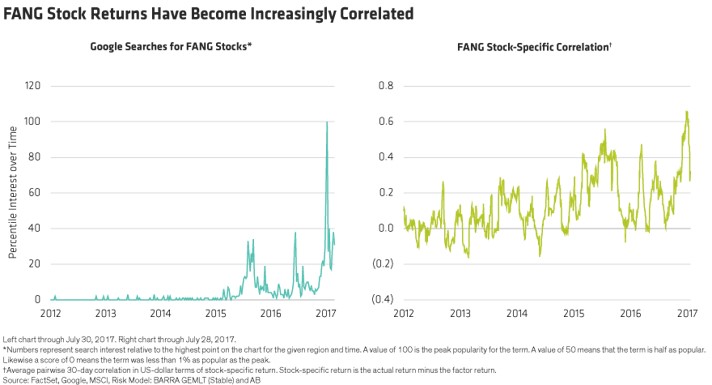

In fact, we believe the group’s stock returns have become

increasingly correlated. Over the past two years, the term “FANG”

became popularized, as indicated by Google trends search data

(Display, left). Meanwhile, stock-specific returns for the group

have increasingly moved in step (Display, right). We calculate

stock-specific returns by taking the stock’s actual return and

subtracting the influence of factor returns.

Looking at specific trading days reveals how this correlation has intensified. For example, on March 8, 2016, equity factor returns were negative for all five FAANG stocks. Yet the stock-specific return for each stock was positive (Display). In our view, this indicates that the returns of this group of stocks are marching to their own beat—and in contrast to expectations.

Why does this matter for investors? Because a risk model that isn’t aware of this correlation may prompt a portfolio manager to purchase all five FAANG stocks - a position that could be vulnerable to a sharp downturn of the group. Or, the risk model may suggest adding to positions in Netflix or Amazon.com without considering the possibility that these positions may suffer if Apple has a bad day.

Cluster risks: From financials to healthcare

Cluster risks can develop in different sectors. In financials,

major credit card companies, including American Express,

MasterCard and Visa, are classified by standard risk models in

multiple industry groups, including financials, credit cards,

information technology and software. So a portfolio with large

positions in all three companies might not trigger standard risk

alarms.

CVS Health, the US drugstore chain, is classified by GICS as a consumer staples company. Express Scripts, the pharmaceutical supplier, is in healthcare. Yet both companies derive most of their revenue from pharmaceuticals benefits management, which creates a potential risk in a portfolio with positions in both stocks.

Ask the right risk questions

These examples illustrate how hidden risks may evade sophisticated risk radars. We’re not suggesting that investors abandon standard risk models. But we do think that robust risk control requires asking the right questions - and applying fundamental logic to a quantitative process.

When done correctly, investors can gain comfort that knowing that a single cluster of stocks isn’t driving too much portfolio risk. And when clusters are identified, portfolio managers should aim to limit positions accordingly. Isolating unintended risks can help ensure that stock-specific risk is the biggest return driver in core equity portfolios.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the UK.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Author's note

David Dalgas is CIO Global Core Equities at

AllianceBernstein. He previously served as head of equities

and CIO at CPH Capital, which he cofounded in 2011. Prior to

that, Dalgas was head of equities at BankInvest, where he was

responsible for a team of 25 investment professionals and 10

equity portfolios serving institutional investors globally. He

previously worked in portfolio management and equity research at

LD Invest (now known as Maj Invest), WestLB, Amagerbanken and the

National Bank of Denmark. Dalgas holds a BSc in economics and

business administration and an MSc in finance and accounting from

the Copenhagen Business School, and is a CFA charterholder.