Family Office

How Family Offices Should Treat ESG Investing

.jpg)

The author of this article considers the issues around ESG investing for family offices.

Coverage of environment, society and governance-themed investment shows no sign of slowing down. On the contrary, it is one of the noisiest themes in wealth and investment management today, and is prominent in a number of regions.

For HNW individuals, a number of questions remain: How much can ESG add to client reporting? Is there any trade-off between ESG and monetary returns, depending on the approach taken? Could there be risks of “green-washing” if a flood of money purporting to be ESG-compliant enters the space without sufficient supply? Are benchmarks and other measures of results fit for purpose? And is there a risk that ESG investment is skewed unwisely towards equities and traditional assets, while private capital markets are less exposed? It also is worth asking if ESG ideas are part of a wealth industry’s attempt to make itself more appealing to younger people at a time when free enterprise capitalism lacks friends. Whether that is a wise course is a matter of opinion.

There are a lot of questions to tackle. A set of organizations in an interesting position are family offices. They have the time-horizons and freedom to try out new ideas that might be out of reach of, say, public pension funds or retail funds. So their views and actions matter. To discuss how family offices should consider ESG investing is Sherwood Yuen, who is head of partnerships at Just Invest. That firm, an investments and technology business, is based in San Francisco.

The editors of this news service are pleased to share these views but do not necessarily share all views of guest writers and invite readers’ responses. Email tom.burroughes@wealthbriefing.com

A Family Wealth Report recent article “ESG isn't a Passing Fad” highlighted the explosive growth in Environmental, Social, and Governance (ESG) investment choices and media attention surrounding this development. As providers of customized ESG portfolio solutions for leading family offices, we at Just Invest have seen at first-hand the growing demand for ESG and impact integration within family office investment programs. Just Invest has been partnering with progressive family offices who have already implemented ESG solutions for their clients and are now finding new ways to increase the overall efficacy and impact of their investments. We’d like to share a few lessons we have learned along the way.

Based on our experience, most family office clients have either

mission-aligned endowments and foundations and significant

charitable giving programs. Increasingly these families are also

extending their values and belief preferences to their core

investments. These can include environmental, social, and/or

religious beliefs. Think of family offices with religious values

– there would be certain companies they’d like to exclude from

their investments because of specific products or services that

don’t match their beliefs. A matriarch or patriarch of a

household may set up an endowment/foundation with specific

instructions to follow their beliefs. And if that’s not

enough, we’ve noticed a dynamic in families where the younger

generation is being involved in and trained to manage the family

wealth, thus there is a heightened interest from that younger

generation in having a positive impact with their investments.

It’s almost an industry cliché to say that Millennials as a group

have more of a focus on societal and environmental impact in

addition to financial returns. So, you can see that ESG investing

is deeply important to family offices.

Based on our current work, the following are the top three needs

we’ve seen from family offices as they look to innovate new ESG

investment strategies for their clients.

1. Granular reporting and transparency

Family offices are incredibly smart, thoughtful and

sophisticated. As such, simple ESG investment products are not

sufficient to meet the needs of these mission-aligned investors.

Family office clients desire transparency and clarity into how

their investments are aligned with the family mission. Most

traditional investment product offerings (mutual funds, ETFs,

commingled funds, etc.) may offer qualitative ESG scores and/or

rankings, but those are difficult to aggregate across the entire

investment set and fall short in communicating the impact of the

investments held. For example, an environmental score of “4” does

not convey the actual environmental impact or risk of the

investments that can be easily understood by stakeholders.

Furthermore, these scores are based on complex methodologies

which are difficult to explain to layman investors.

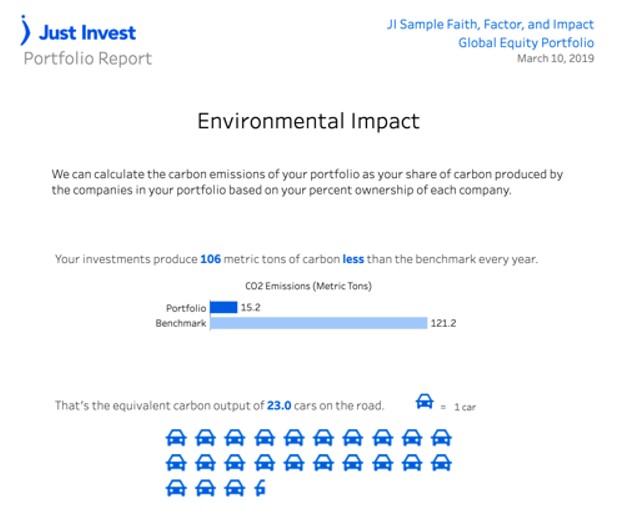

Family office clients that have ESG and/or impact goals want

understandable analytics that measure the impact in their

portfolios. Think things like the carbon footprint of their

portfolio, corporate revenues tied to impact products and

services, racial and gender diversity across company workforces,

and more.

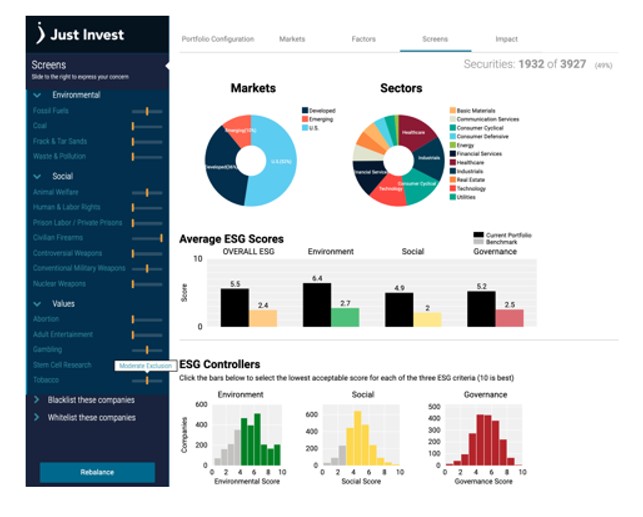

2. Radical customization

Customization and flexibility of selecting individual investments

(direct indexing) are critical to servicing ESG/impact-inclined

family offices' clients. In this day and age of mass

customization, we are all accustomed to having products and

services tailored to personal needs, and family office investors

are no different. Off-the-shelf investment products offerings

can’t offer this type of customization and investors are stuck

with whatever investments a portfolio manager chooses. This leads

to holdings that have individual investments that may clash with

the values of a family office client as he/she can’t control how

an investment product selects the underlying individual companies

in the portfolio. Family office clients need a way to

specifically screen out companies that violate their beliefs and

select specific impact attributes that they want to accentuate in

their investment portfolios.

3. Alignment with existing investments and

holdings

As previously mentioned, progressive family offices have already

implemented ESG investment solutions for their clients. Often

times these solutions are highly complex investment portfolios

that include multi-asset class, multi-product, and/or

multi-manager investments. The portfolios are designed to achieve

specific impact-oriented goals based on their clients’ values.

For instance, impact investing within equity allocations has

traditionally been implemented via private equity and direct

investments. Until recently, Impact-oriented themes have largely

been absent in the public equity space, but advances in corporate

reporting and data collection services are rapidly changing this.

As such, impact investment themes from private equity investments

can also be complemented and/or enhanced from the public equity

investments.

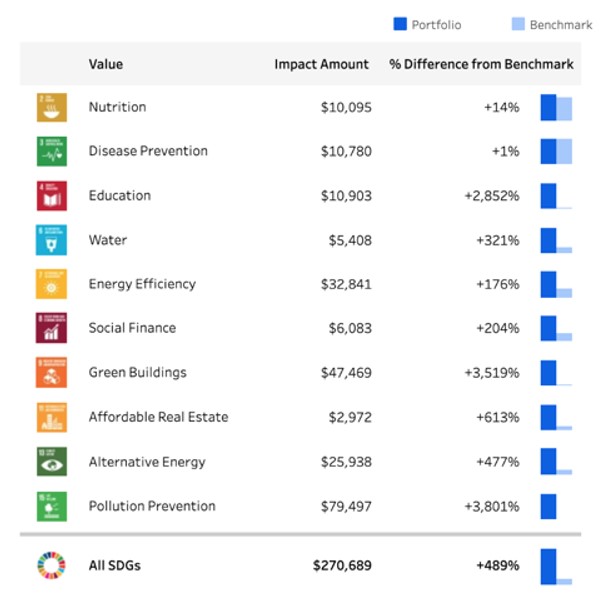

Our work with a number of family offices seeking alignment across the private and public equity allocations has led innovative portfolio management that includes optimizing to public equity companies that can demonstrate corporate revenues directly contributing to impact-oriented themes. These themes are typically related to the Sustainable Development Goals set forth by the United Nations. Families also often target additional impact themes such as labor and human rights issues or pollution and waste reduction which an existing portfolio may be blind to.

As more data and better tools become available, family-offices are not just integrating but are innovating new ESG investment solutions for their clients. Family office clients have always demanded more from their advisors and their investments. Investing in them means more than just financial returns, other needs such as alignment of values, ESG integration, and societal impact are just as important. ESG is not just a trend in the family office space, rather it’s an undertow that has persisted for decades. Only now has the industry realized this and is jumping on for the ride.