Wealth Strategies

How A Non-Profit Won Through Strategic Asset Allocation

The author of this article looks at the benefits that non-profit entities, such as charitable trusts, can get from strategic asset allocation and from taking a professional approach to handling risks in portfolios.

As thoughts turn towards investments for the next year and further out, here is a view about asset allocation from Treasury Partners, a New York-based firm. The article considers asset allocation through the lenses of a charitable trust and those who guide them.

The author is Stuart Riemer, managing director, partner and private wealth advisor. The editors are pleased to share these insights - the usual disclaimers apply to external contributors’ articles. To get involved in debating these and other issues, email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

Managing money is a delicate balancing act between preserving principal, earning required returns and managing risks – under any circumstances. Foundations and charitable trusts face unique constraints which makes this even more difficult – in particular, what is effectively a 5 per cent annual return “bogey” just to preserve the real principal. Within what has become an ongoing era of low interest rates, this is no easy feat, as accepted risk-management principles call for offsetting all near-term liabilities with fixed income allocations. Additionally, the unforgiving math of compounding presents a double-edged sword, rewarding success but swiftly punishing failure.

However, “difficult” doesn’t need to mean “impossible,” as opportunistic active management and careful manager selection can be powerful tools in this environment.

This piece presents a case study of a longstanding client who has a charitable trust. This charitable trust is structured as a foundation that has preserved its principal, despite distributing half its initial net value since 2010. This article will demonstrate how the trust was able to achieve its ambitious funding goals without compromising their goals and maintained an asset allocation of at least 40 per cent in fixed income and cash equivalents. We will conclude with what this means regarding the potential legal impacts for a trust or foundation fiduciary.

Slow and steady wins the race

The charitable trust was established to operate exclusively for

charitable, religious, scientific, literacy or educational

purposes. Fiduciary and investment advisors should not dictate to

the trust’s purpose or execute in carrying out that purpose.

However, in forming investment policy, pursuant to the Charitable

Trust’s mission, we targeted a 6-7 per cent annual required rate

of return (which exceeded the IRS’s minimum 5 per cent

distribution rate), with the goal of long-term preservation of

the trust’s purchasing power. In setting the asset allocation for

the trust’s investment portfolio, a strategy was built around a

steady and predictable distribution schedule.

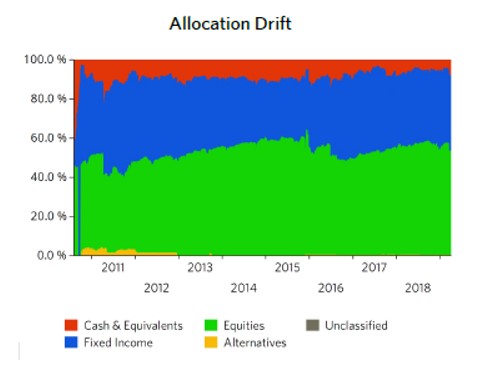

From a top-down perspective, the overall portfolio is reminiscent of a typical life insurance company’s book. Meaning that for known distributions over the next three to four years, we elect to match the liability with an offsetting bond ladder; in fact, fixed income and cash equivalents have historically totaled approximately 40 per cent of the trust’s investible assets. This aspect of the asset allocation strategy locks in a known return and guaranteed availability of funds when needed, as it represents the portion of the trust least suited to weather the potential volatility in riskier asset classes, such as stocks.

Furthermore, to keep the structure of the fixed income allocation consistent with its role within the broader asset allocation, the fixed income portfolio was managed within a fairly conservative investment policy - typically running the bond portfolio with a weighted average rating of A- (with a hard lower limit of Baa2/BBB for individual securities) and a weighted-average final maturity ranging from two to three and a half years.

Unfortunately, the persistent post-crisis low rate environment has also meant that under these conservative parameters, the fixed income portfolio had no chance of generating sufficient income to fund its pro-rated portion of even the 5 per cent minimum distribution requirement.

Risk management

Since the remaining 60 per cent of assets are not currently

earmarked, this would comprise the core “risk capital” of the

trust, and accordingly must drive the large majority of the

aggregate 6-7 per cent target return. Given that three to four

years’ worth of planned distributions are already funded through

the fixed income portfolio, pure avoidance of volatility is not

the highest priority within this portion of the trust, allowing

more flexibility to consider active strategies that will

hopefully generate superior risk-adjusted returns.

Alternative investments with this charitable trust have been avoided for a couple of reasons, including the vagueness of the trust document in terms of the trust’s ability to invest in limited partnerships or other private investments. Alternative investments can sometimes be beneficial because they specialize in seeking to create uncorrelated absolute return streams with superior risk-adjusted downside protection.

However, in addition to the settlor’s intent (or lack thereof) in having the trust participate in alternative investments, which can include very high fees for the attempt, the potential benefits for this modestly sized trust seem low relative to the known cost of the alternative investments. Instead, we recommended allocating this sleeve among several different equity-based managers with a variety of styles and strategies.

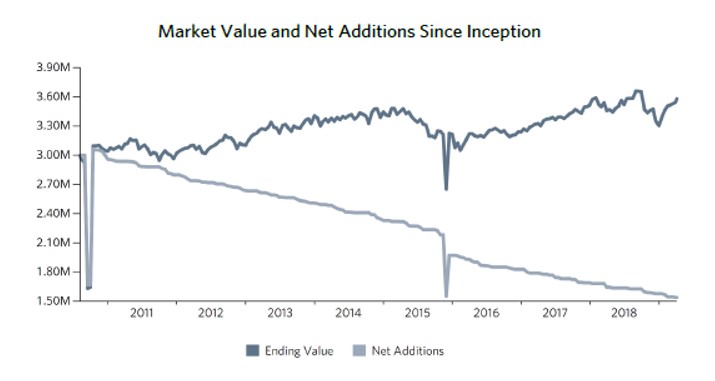

Over time these allocations have done well, as the trust’s equity strategies have combined to earn an annualized 10.9 per cent since inception (source: Black Diamond, October 2010 – March 2019). Initially the trust was funded with $3.1 million in mid-2010. Since then, the overall trust has generated an overall 6.15 per cent annualized net return (source: Black Diamond, October 2010 – March 2019).

Since it is sometimes difficult to appreciate the effects of positive compounding, demonstrating its implications is illuminating:

-- A 6.15 per cent annualized return has allowed the trust to pay out approximately half of its net initial value ($1.5 million) over 8 ½ years while still modestly increasing the overall remaining assets of the trust (now at app. $3.4 million).

Two broad aspects of active management have been key to achieving these results. The first active decision lies with the asset allocation itself, which is much more than simply setting a target percentage of bond and equity exposures - within each asset class, there are active sector-based tilts to be made:

-- Fixed Income – credit weightings, duration targets, floating vs. fixed; and

-- Equities – domestic vs. international, pro-cyclicals vs. countercyclicals, relative percentages to small-mid-large caps

The decision to allocate to a given sector, and how much, is inherently an active one, and a crucial opportunity to implement an outlook. Subsequently, it goes without saying that manager selection is important.

Selecting strong active managers is easier said than done - it is mission critical to have a robust and thorough due diligence process, both in terms of pre-selection and ongoing monitoring/due diligence. The experience that is needed in these types of evaluations is critical and requires deep expertise; it is not as simple as picking top-rated Morningstar funds or recent outperformers versus their benchmarks:

-- “Beating” a benchmark is not necessarily an indicator of good process, nor is it a requirement for these purposes;

-- Rather, it’s about fundamentally understanding a manager’s process (how they propose to find superior risk-adjusted value within their niche) and subsequently evaluating how that process successfully (or unsuccessfully) translates into the actual results, and

-- To borrow a metaphor, not every ace pitcher has his best fastball in every outing; sometimes they get batted around and throw a stinker. But this is an art rather than a science, and if that pitcher has a command of their offerings and can accurately be described as a pitcher rather than a mere thrower, they’re likely a good bet going forward.

Conclusion: What this means for fiduciaries

Every situation is different – in particular with any entity that

has a mandated distribution requirement that requires any degree

of risk to achieve. As a fiduciary, you already have a deep

understanding of the various aspects that actually do make your

client unique, whether it’s related to a charitable purpose, or

the donor’s intended legacy. In addition, either you or the team

in place should have an ongoing understanding of the market

environment, along with the particular strategies deployed in the

charitable trust’s investment portfolio, and a thoughtful process

and approach. As a result, you can be sure that your clients’

trust and confidence to maintain your fiduciary obligations has

been well-placed.