Alt Investments

Gold Can Protect Downside Threats, But Don't Get Carried Away - Institute

The organization probes into the claim that gold is a safe-haven asset and at the same time argues that there are reasons to be optimistic about a resolution over trade tariffs.

Gold can insure against stock market tumbles but its protection qualities don’t shine as bright as some people assume, the Wells Fargo Investment Institute says. Its comments come as equities have been volatile recently.

The WFII, which provides research ideas and analysis, said that gold’s centuries-old track record as a store of value and medium of exchange merits respect, and explains why investors - even in the 21st century - treat it as a safe haven. While the Institute doesn’t scorn such ideas, it urges investors to be careful.

“To be clear, we believe that gold holds a place in most investors’ portfolios - most of the time. But like other investments, timing and position sizing are keys. At $1,340 today, we do not think that gold is any great bargain. We’re waiting for much lower prices,” John LaForge, head of real asset strategy at the Institute, said in a note. His comments are accompanied by updates about the Institute’s asset allocations, showing it expects some resolution to global trade deals and is not yet ready to get defensive over equities.

Gold’s status as a safe-haven asset is well known, and there are commentators who, even if they eschew the mocking label “gold bug”, argue that the yellow metal should be given more respect than it has received since the advent of state central banking and fiat currencies in the 19th and 20th centuries. Ironically, even though British economist John Maynard Keynes called the old Gold Standard system a “barbarous relic”, central banks today continue to hold significant amounts of gold, as in the case of China. In Switzerland, the country even held a public referendum about four years ago on the proposition that the Swiss National Bank should hold at least 20 per cent of its reserves in gold (that proposal was heavily defeated). Additionally, the recent rise (at times) of crypto-currencies such as Bitcoin plays to the idea that they are digital equivalents of gold, given that cryptos are designed to be finite in quantity, like gold.

Rich history

The WFII argues that gold’s history can sway investors’ minds,

not always correctly.

“Gold has a rich history as both a store of value (investments, jewelry, bars, etc) and money (coins, etc). Found nearly 5,000 years ago, gold was first coined roughly 3,700 years ago (in the area now known as Turkey). Stocks and bonds, on the other hand, were created in the last 400 years. Impervious to both air and water, gold has the unique benefit of literally surviving time, meaning essentially all of the gold ever mined still exists somewhere (even if sunk off the coast of Florida). The same cannot be said of other financial assets. For example, no country’s paper currency has survived time. Not one,” LaForge says in his note.

The flipside of the coin, so to speak, is that gold’s endurance as a form of money lures people into thinking it is a great safe haven, but it has not always provided the protection people assume, he continues.

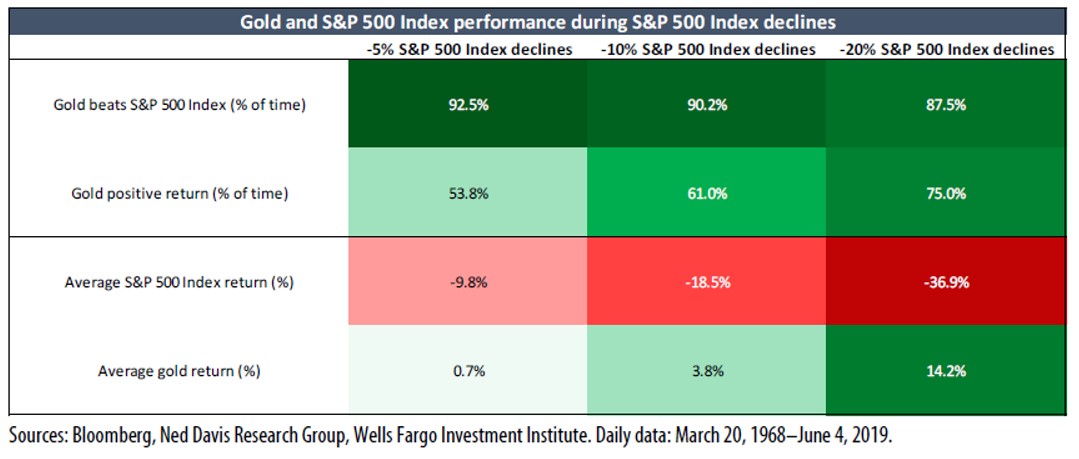

Gold can be useful when stock markets are falling, he says. For example, it has typically outperformed the S&P 500 Index of US stocks when that benchmark has fallen.

Source: Wells Fargo Investment Institute

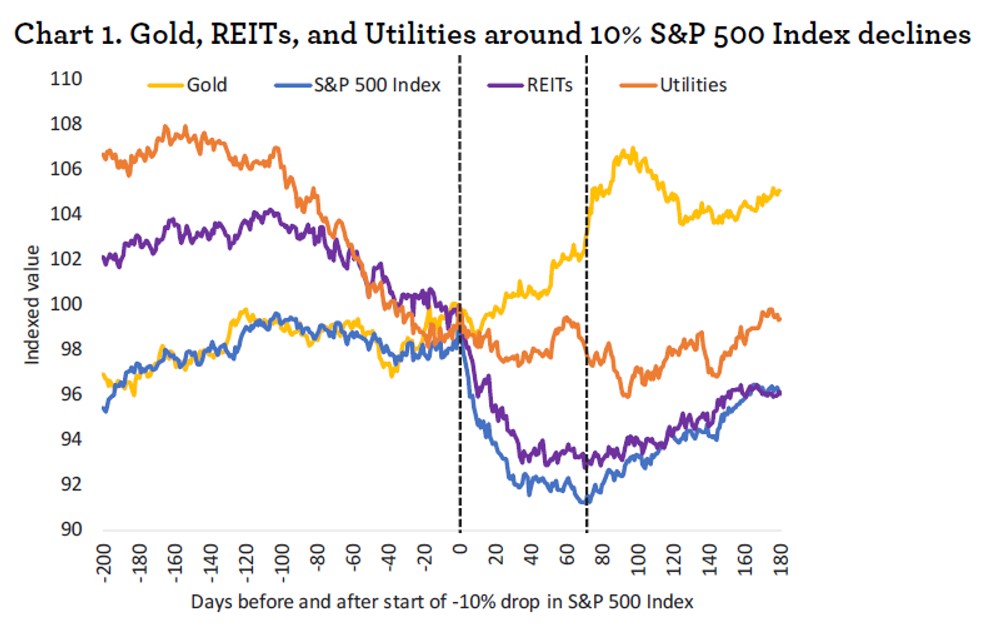

It has also tended to outperform the most defensive stock sectors, when the S&P 500 was correcting.

Source: Wells Fargo Investment Institute

But, LaForge says gold does not offer “golden protection”, however, because while it has historically fared better than the stock market during a downturn, it has not always made positive returns for investors. Figures show that gold prices are positive for only 60-70 per cent of the time and that is when stocks have corrected. Also, gold hasn’t even been the best defensive asset to seek refuge in.

Another cautionary note is that gold may provide some downside risk insurance, LaForge says. He does not advocate that investors should boost holdings now. “For clients willing to endure some short-term choppiness in 2019, equity markets appear to have more upside than gold,” he says.

Too early to be defensive

The Institute goes on to argue that while US-China trade rows and

other geopolitical uncertainties make markets choppy, it is too

early for investors to turn defensive and argues that the US

business cycle has room to run. The Institute is neutral on US

large-cap stocks and mid-caps, underweight US small-caps and

neutral developed market ex-US equities. It is strongly

overweight emerging market stocks.

“We continue to believe that the trade conflicts will be resolved, even if not as swiftly or completely as originally anticipated. Markets likely will respond favorably to a lessening of these trade-related headwinds. Economic growth in the US is forecast to be slower than last year, but still above 2 per cent. As such, we believe this environment will continue to favor cyclical sectors as the most likely beneficiaries going forward,” LaForge says.

Other asset classes

The Institute has the following weightings on other areas such as

bonds and commodities:

Neutral US taxable investment-grade fixed income; overweight US short-term taxable fixed income; neutral US intermediate-term taxable fixed income; neutral US long-term taxable fixed income and underweight high-yield taxable fixed income. It is also underweight developed markets ex-US fixed income. The organization is also neutral on commodities and underweight private real estate and public real estate.

Within the alternative asset class space, the Institute is neutral on private equity and macro hedge funds and event-driven hedge funds, but overweight equity hedge-style hedge funds and relative value funds. It is overweight private debt.