Tax

GUEST ARTICLE: The Taxman Cometh: Opportunities In Muni Bonds

Here is a guest article by James Dearborn, head of municipal bonds at Columbia Management, about the role of muni bonds in the new US tax environment.

Here is a guest article by James Dearborn, head of municipal bonds at the asset manager Columbia Management, about the new US tax environment and how muni bonds can help mitigate one's tax bill - especially high tax bracket investors.

A muncipal or "muni' bond is a debt security issued by a state, municipality or county to finance its capital expenditures.

With the tax season fully upon us, many Americans are about to realize the harsh realities of the new tax environment that came into effect January 2013 with the passage of the oddly-named American Taxpayer Relief Act of 2012 and the introduction of taxes associated with the Affordable Care Act (ACA) of 2010 (Obamacare).

These new and higher levies are likely to cause real pain to taxpayers as they deal with potentially much larger tax bills, even if their income remained stagnant year-over-year.

The two major sources of the increased pain emanate from the increase in the top federal income tax bracket from 35.0 per cent to 39.6 per cent and from the new Net Investment Income Tax (NIIT) of 3.8 per cent, which was enacted as part of the Affordable Care Act.

The NIIT is a particularly unpleasant and unexpected surprise given the nuances in the way it is calculated and the broad category of investment income it is levied against. For higher income taxpayers, these changes may drive their federal tax rate from a 2012 high of 35 per cent to a 2013 and beyond high of 43.4 per cent (a 24 per cent increase). Note that state and local taxes are in addition to federal taxes.

For investors facing the unpleasantness of having to write a check to cover these higher levies, keep in mind that municipal bond interest income is:

• Subject to neither the new higher personal

income tax rate of 39.6 per cent nor the 3.8 per cent NIIT.

• Not included when calculating the modified

adjusted gross income (MAGI) levels that determine whether

investors are subject to the NIIT.

Higher taxes and a growing antipathy toward them are powerful forces behind the renewed interest in municipal bonds. While municipal bonds have performed well since the beginning of the 2014, we continue to believe that they make sense for tax-sensitive, income-oriented investors. After taxes, muni bonds make sense

Today’s municipal bond yields look compelling, especially for high tax bracket investors. If an investor takes the time to determine how much more one has to earn on a taxable fixed income investment to be equal with a tax-free municipal bond — after paying taxes — they will realize how attractive muni bonds are.

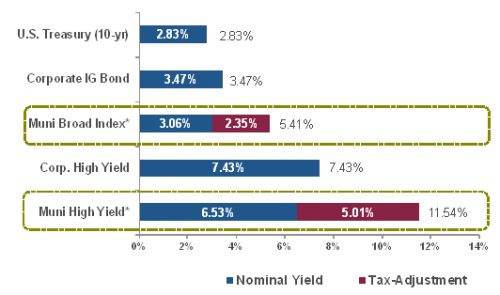

In image 1, we compare municipal yields, adjusted for the benefit of the tax-exemption, to other fixed income instruments. The taxable-equivalent yield of investment-grade municipal bonds easily outpaces Treasuries and investment-grade corporates and rivals corporate high-yield bonds while high-quality municipal bonds are in the same ballpark with non-rated corporates.

Yields on high-yield municipal bonds easily outpace all other fixed income instruments, when taxes are considered. While taxable-equivalent yields on municipal bonds have always been an attractive investment feature for investors, last year’s tax changes make this element even more compelling.

Attractive taxable-equivalent yields (image 1)

Sources: Morgan Stanley Research, Yield Book, Bloomberg, Columbia Management; as of January 21, 2014.

Non-municipal fixed income investors may face much higher levies

High net worth investors may be in for a shock once they determine their 2013 tax bill. This is due to the higher federal income tax rate and the NIIT that was enacted to cover some of the costs of the ACA.

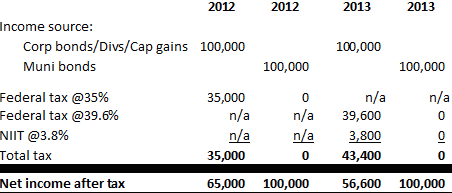

These two changes are likely to result in much higher tax bills for many investors, even if their income and investment earnings did not change much over the prior year. Image 2 details the difference in taxes year-over-year an investor, subject to the top income bracket and the NIIT, might face on $100,000 in non-municipal investment income.

It also shows that the investor in AMT-free municipal bonds pays the same amount of federal income tax in both years — zero. Municipal bonds also aid investors trying to avoid the NIIT because municipal interest is not included in the calculation of MAGI which is used to determine whether a taxpayer is subject to NIIT.

Image 2: Tax treatment: Muni bond income versus other sources of income

Source: Columbia Management Investment Advisors.

Hate taxes, buy municipal bonds

With April 15 nigh, aggrieved investors who will be paying significantly higher taxes to Uncle Sam this year would do well to remember the one surefire investment that remains completely free from federal taxes, including the new NIIT.

All other (non-municipal) income not sheltered in qualified retirement accounts will count toward the adjusted gross income threshold for calculating the NIIT tax ($400,000 for individuals and $450,000 for couples filing jointly) and will be subject to the new 3.8 per cent NIIT levy.

These new and higher taxes amplify the investment case for including municipal bonds in an investment portfolio. Given their long track record of low volatility, safety and reliable income, the case for owning municipal bonds is as strong as ever.