Investment Strategies

GUEST ARTICLE: Situational Awareness: Intensifying The Investment Perspective

.jpg)

The discipline around the term "situational awareness" applies to a far wider field than staying physically safe: it can also apply to managing money.

When hearing the term “situational awareness” readers might assume someone is talking about taking steps to be aware of threats to physical wellbeing. But there may be wider applications to cultivating a particular way of handling certain situations, and this may stretch to include wealth management. With this in mind, Diane Harrison, who is principal and owner of Panegyric Marketing, sets out ideas. Her firm is a strategic marketing communications firm founded in 2002 specializing in alternative assets. She is a regular contributor to these pages. (More details on the author below.) This news service is pleased to share such insights with readers and invites responses. Family Wealth Report does not necessarily endorse all views of guest contributors. Email tom.burroughes@wealthbriefing.com

Situational awareness means honing your ability to analyze the surrounding environment as an automatic practice while carrying on regular activities. The US Coast Guard defines situational awareness as the ability to identify, process, and comprehend the critical elements of information about what is happening with regards to a mission. As their training manual states simply, it’s knowing what is going on around you.

From an investment perspective, sharpening one’s overall desired

investment goals and how best to achieve them is an ongoing and

dynamic exercise in diligence and critical thinking. Mckinsey &

Company’s website published a book excerpt in 2015, Perspectives

on the Long Term (Dominic Barton and Mark Wiseman), in which they

referenced Nicholas G Carr, author of The Glass Cage: Automation

and Us, warning us not to secede from the power of active

thinking:

“…what decades of human-factors research tell us are that when

computers and other machines take challenging tasks away from us,

we turn into observers rather than actors. Distanced from our

work, we lose our focus and become even more susceptible to

distraction. And that ends up dulling our existing skills and

hampering our ability to learn new ones. If you’ve ever gotten

lost while following the step-by-step directions of a GPS device,

you’ve had a small lesson in the way that computer automation

erodes awareness of our surroundings and dulls our perceptions

and talents.”

If it can save lives, it can probably assist

investments

Why is situational awareness important? The Coast Guard manual

states that the consequence of not paying attention to it means

that when we lose the bubble (i.e., Situational Awareness) we

increase the potential for human error mishaps. Perhaps a more

relevant question to ask in one’s investment planning is: “What

might go wrong that will negatively impact me?”

Investment planning requires research, surveillance, analysis, and reasoned decision-making…much like military planning. The achievement of a long-term successful investment plan shares more than a few traits with executing a successful military operation. As plans change, course correction occurs, and variables waylay the best-laid goals, this flux demands clear-headed redirection on a regular basis. Sounds an awful lot like the global markets on an average day, doesn’t it? When you compound that activity over decades - the lifecycle of most investment plans—things can get downright hairy to manage.

Offense remains the best defense

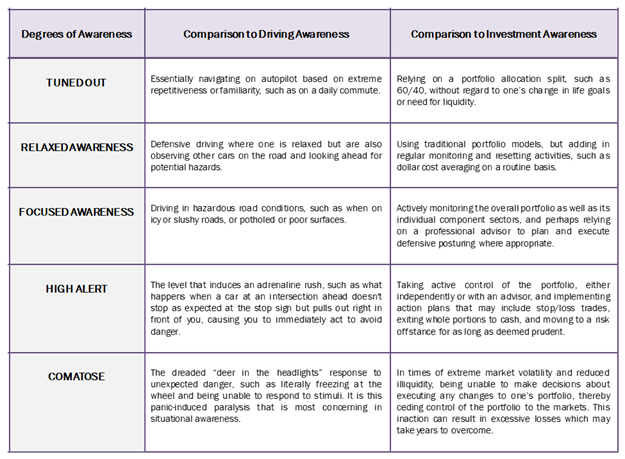

So in reality, situational awareness is a heightened orientation

towards your external surroundings. Scott Stewart provides an

interesting comparison of awareness in his article, A Primer on

Situational Awareness, stating that people typically operate on

five distinct levels of awareness. He illustrates the differences

between the levels by comparing them to the different degrees of

attention we practice while driving.

I thought it might be instructive to take this one step further and compare his driving levels of awareness to investment levels of awareness in varying degrees. Let these serve as a reminder of why knowing what’s going on around you is a meaningful state of awareness for investment perspectives.

Developing an eagle eye for your own goals

Maintaining perspective is a crucial element of any investment

process. This is not to say there is any single master plan that

achieves ultimate success; each approach must fit the needs of an

investor and be tailored to achieve the three elements of

risk/reward/timing in proper combination to suit this objective.

To add complexity to this delicate balance, priorities and

tolerances shift over time, as do the market environments and

investment options available with which to construct these

plans.

The simple goal of achieving a successful investment program is anything but simple. Building a strong relationship with a professional advisor who can help map and manage your plan is priority number one for long-term success. No individual should cede the task of maintaining a close eye on their overall portfolio to an advisor and rely on someone else to ensure that all is well, all the time.