Tax

GUEST ARTICLE: Bessemer Trust On How Qualified Small Business Stock Fits Into Wealth Plans

The private office examines a particular type of equity holding and its potential to be used as part of wider wealth planning.

There are all manner of ways that tax incentives can be used to mitigate tax while – so its advocates argue – do good for the wider economy. In this article, Stephen Baxley, director of tax and financial planning at Bessemer Trust, and Cameron Caprio, tax consultant at the same organization, look at qualified small business stock, and its use. The team at Family Wealth Report are pleased to share these insights, and invite readers to respond. The views expressed aren’t necessarily endorsed by this publication. So let debate commence. Email tom.burroughes@wealthbriefing.com

Economic data clearly demonstrates that small businesses are a key driver of economic growth - the US Small Business Administration has found that small businesses have provided more than half of all jobs and more than six in ten net new jobs in the US since 1970. To boost activity in this sector, Congress has periodically enacted legislation that provides significant tax incentives for entrepreneurs and investors who can help foster small business growth.

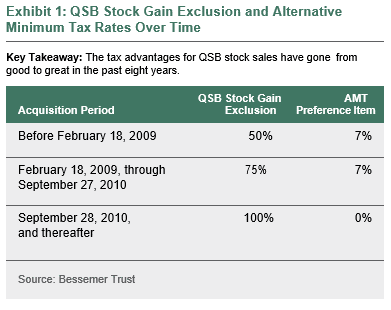

To entice further investment, the Protecting Americans from Tax Hikes Act of 2015 (the “PATH Act”) made permanent the beneficial treatment of qualified small business (QSB) stock. If specified requirements are met, gain on the sale of QSB stock may be excluded from income. Over the past eight years, the tax advantages for QSB stock sales have gone from good to great:

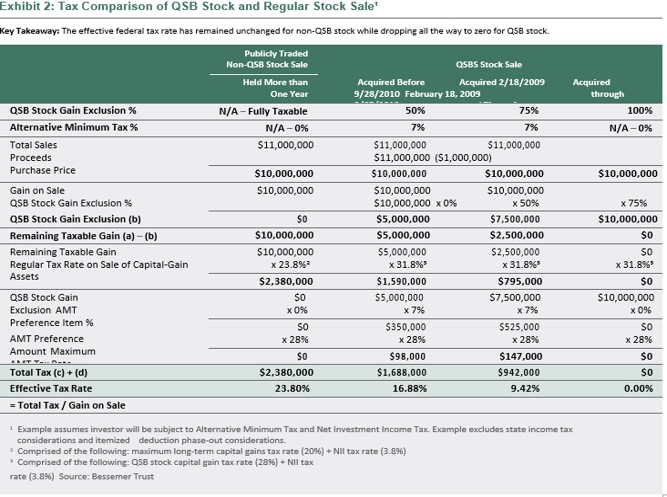

Exhibit 2 walks through a step-by-step example comparing the tax

implications of the sale of publicly held stock (at current tax

rates) and QSB stock in three different time periods.

QSB requirements

Though often an attractive investment opportunity, it’s important

for trusted advisors to remind clients that not all small

businesses are qualified small businesses and not all individuals

and entities can take advantage of the QSB gain exclusion. To

qualify, five main requirements must be met:

1. Issuers of QSB stock must be domestic C corporations (companies that are their own legal entity and taxed separately from their owners); recipients of QSB stock cannot be C corporations. Also, certain specified corporations will not qualify for QSB treatment, including domestic international sales corporations (DISCs), possessions corporations, regulated investment companies (RICs), real estate investment trusts (REITs), and cooperatives.

2. A five year holding period applies. To qualify for QSB gain exclusion, QSB stock must be held for more than five years (though special rules apply in the case of certain corporate mergers and where stock is acquired by gift or inheritance). In such cases the original holding period will still apply. In tax jargon this is called holding period “tacking”.

3. QSB Stock must be acquired as part of an initial issuance. This can take place directly through the corporation or an underwriter, in exchange for money, property, or as compensation for services provided to the corporation.

4. The aggregate gross assets of the corporation must not have exceeded $50 million at any time from August 10, 1993 until immediately after the stock issuance.

5. The corporation must meet an active business requirement during the holding period. To meet this test, at least 80 per cent of the corporation’s assets must be used by the corporation in the active conduct of a trade or business. Importantly, services in the fields of health, law, engineering, consulting or financial services do not qualify, nor do hotel, restaurant, oil and gas, banking, investment, farming, and other specified business activities.

Limitations on gain exclusion

There are some restrictions on the amount of gain that can be

excluded, but the provisions are still extremely generous: $10

million or 10 times the shareholder’s aggregate adjusted tax

basis in the stock sold during that year, whichever is greater.

For example:

.png)

Planning considerations

When seeking potential gain exclusion on QSB stock, the first

step is making sure the business will qualify under the

provisions described above.

Tax efficiency should also be considered and a tax professional consulted. QSB stock can only be issued by C corporations which are subject to an entity level tax, unlike a partnership or LLC, which provide flow-through treatment. A significant gain exclusion will often more than offset the potential double tax on C corporation earnings.

It is also important to monitor the QSB requirements to ensure the investment continues to be qualified. Stock redemptions during the holding period or a failure to meet the active business requirements on a continuous basis are potential pitfalls. It may be advisable to communicate with company management during the holding period to ensure requirements are met.

Liquidity event planning

Qualifying as QSB stock is essential, but careful planning for

disposition is also critical to preserve exclusion of gain. The

main consideration is fulfilling the five year holding period.

QSB stock must be held for more than five years, so a holding

period of at least five years and one day is required. It is

important to retain clear documentation from the acquisition and

sale transactions to support the holding period.

Rollover

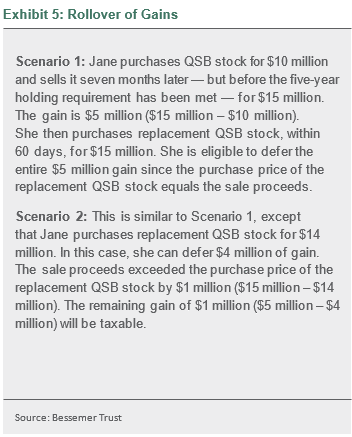

Shareholders who dispose of QSB stock prior to meeting the five

year holding period are not necessarily out of luck: as long as

the stock was held for more than six months prior to sale, a

rollover provision may apply. If the sales proceeds are invested

in replacement QSB stock within 60 days of sale, an election can

be made to rollover the gain into the replacement stock. Gain

will be recognized, however, if less than the full amount of

sales proceeds is reinvested. See exhibit 5.

A win-win scenario

Thus far, the QSB stock provisions appear to work as lawmakers

intended. By promoting a mutually beneficial relationship between

business founders and investors, they assist in the stimulus of

small business growth.

When applicable, this QSB stock incentive should not be overlooked. Taxpayers who are considering an investment - or who may have already invested - in potential QSB stock should consult with their tax professional to determine if these beneficial provisions will apply.