Investment Strategies

Finding Chinese Corporate “Diamonds” Amidst The “Rough” - Value Partners

There is value to be found among Chinese companies in the midst of the crisis that has gripped that country and the rest of the world, an investment management firm argues.

The following commentary on how investors should view Chinese and other Asian equity markets comes from YU Xiaobo, investment director and head of China business for Value Partners. This news service has been careful not to bombard to readers with excessive amounts of COVID-19 content. Where the editorial team think that a commentary adds new value and incisive insights, we will be happy to share these views.

The Chinese term for crisis ?? is composed of two characters, the first character means danger and the second character means opportunity which lends implications of a turning point. In the same way, even as investors have been spooked by the recent market volatility, they can look to companies with competitive business practices that can create better cash flow and thrive in challenging times.

How do you assess the current epidemic and the volatility

in markets?

Certainly, the virus has made an impact. While China has proved

effective measures to contain the coronavirus, cases outside

China have only just begun and, as of March, were worsening. In

addition to short term disruptions, a long-term impact may be

wider reaching – this means fundamentally altering the global

industrial chain and the evolution of many trends to come.

This virus is only one of the many factors behind volatility in the markets. As professional investors, we encounter a multitude of factors that can change the course of markets so we seek certainty amid the uncertainty in the long run. For example, although the short-term impact of the epidemic has been colossal, there are still scientific ways to prevent and control it, which includes the results of follow-up vaccines and drug development. Taking into account that only three months have passed since the start of this new virus, it may be possible to prevent and find cures further down the road with medical research.

What we do is to find value in the market. The root of value lies in the ability of enterprises to create cash flow so that we focus on companies that can restore certainty and can effect long-term industry disruption, in spite of challenges. We see an opportunity to pick these out amid price fluctuations.

From a value investing standpoint, what opportunities do

you favour in the Greater China region at this time?

Firstly, Hong Kong stocks stand out within the Greater China

region. This is partly because many high quality Chinese

companies have chosen to list their shares in Hong Kong. Much

disparity exists between their price levels and intrinsic value;

the deviation can be attributed to particularities of the Hong

Kong market as well as factors surrounding global market

volatility. This is where strategic investment opportunities lie.

While ownership of Hong Kong stocks are foreign (foreigners hold 50 per cent, mainland capital takes 30 per cent, and Hong Kong capital owns 20 per cent), the fundamentals of its listed companies are heavily dependent on China's economy. In particular, in recent years, more and more high-quality Chinese companies have chosen Hong Kong as a listing destination. At present, over 70 of them are Chinese companies, many of them are engaged in new economy industries, such as internet, healthcare, science and technology, education, and so on.

Institutional investors comprise the largest chunk of investors in Hong Kong, including sovereign funds and other large institutions which take long-term positions. Hence they do not trade frequently so turnover and liquidity remain low. For reference, Hong Kong stocks have an average annual turnover rate of about 60 per cent, compared with 200 per cent in the European and American markets, and 600 per cent on the China A-share market.

In the event of a liquidity crisis in the international financial markets, outflows of foreign capital flows follow with sharp drops in the market. However, such capital flows are now driven more by sentiment and have less to do with the underlying fundamentals of China's economy. Basically, a value opportunity exists currently with the deviation between stock prices and the intrinsic value of companies.

How do current levels of valuation factor into your

assessment?

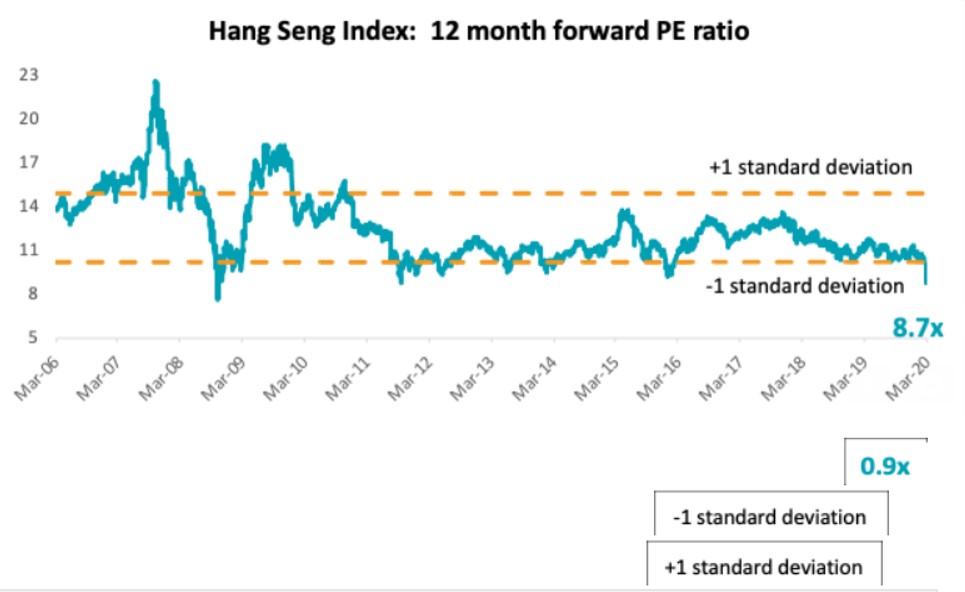

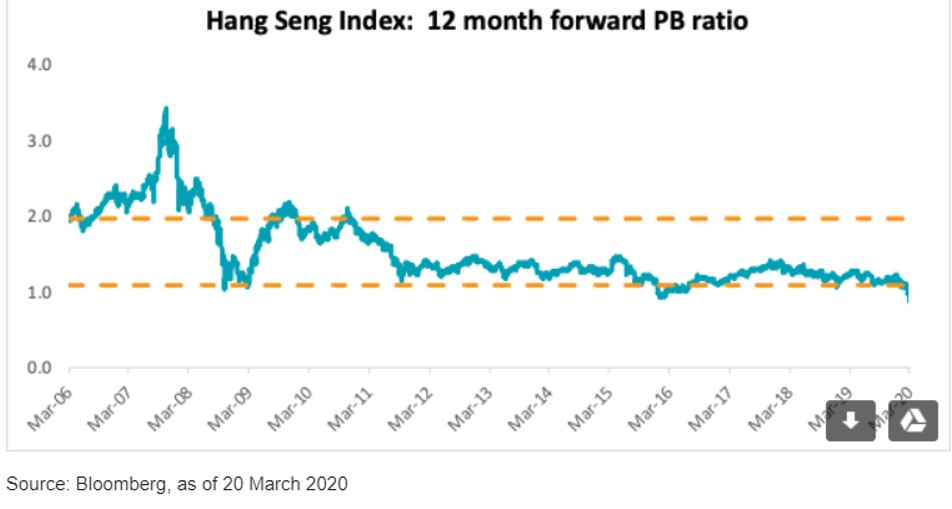

Overall, valuations of Hong Kong stocks are more than one

standard deviation below their historical averages in term of

price-to-earnings (PE) ratio and the price-to-book (PB) ratios.

We need to remember that valuations have always rebounded after a

crisis. We saw that after the 2008 global financial crisis and

the 2011 European debt crisis. Taking global markets as a

comparison, Hong Kong stocks are at the bottom and investors can

take this opportunity to strategically increase their allocation.

4. How long can Hong Kong stocks retain its “offshore

qualities” and stay cheap?

Here is what I think about this issue. First and foremost,

it is insufficient reason to buy a stock just because it is are

cheap, which is to say it is not simply about price levels. If

fundamentals are getting worse, it would certainly be a trap.

However, fundamentals of China's economy offer much potential, a

large consumer market with a population of 1.4 billion, and the

social resilience shown in the face of this epidemic has given us

confidence that a recovery is quick and that bodes well for

corporate profits after the short-term impact wears off.

Second, as a value investor, I consider the return on investment at the current price and the associated risks should valuations fail to pick up.

Overall valuations of Hong Kong stocks are at about nine times on a PE ratio basis, implying a return of more than 10 per cent. There are companies in high growth industries that will be able to achieve growth of more than 15 per cent in the next few years, such as the internet, consumer discretionary, healthcare, and so on. On the other hand, some companies in traditional industries may no longer witness high growth rates, but the stability of the industry makes it unnecessary for large capital expenditure, and corporate cash flows can be returned to investors with high dividends, some as high as 8 per cent.

Regardless of valuations, there is still a high degree of certainty that at least 10 to 15 per cent of the implied value return can be obtained from these high-quality Chinese companies each year.

Thirdly, global financial easing measures are expected to continue and more stimulus measures are likely in the wake of this outbreak. Japan and Europe have negative interest rates, and 10-year US Treasury yields, which anchored forward market rates after the interest rate cut, have also fallen below 1 per cent. China's current 10-year bond yield has also fallen below 3 per cent. While bonds offer long-term cash flows, stocks are seen as riskier assets. In the long run, equity yields are about 5 per cent higher than bonds, which compensates for their risk. Now, if the premium were to be increased between 8 to 12 per cent, I think this risk compensation would be attractive enough for investors.

So how much are Chinese assets worth? Hong Kong stocks at current valuations are equivalent to bonds yielding 10 to 15 per cent pe rcent annually. This is likely to be sustainable as a significant number of these bonds are triple-A rated.

Another aspect to consider is the likelihood of valuations bouncing up once the risk appetite recovers. In identifying value with fundamental research, assets need to be stable even as the environment remains grim in the next three to five years, with products and services easily recognisable and an ability to maintain stable or higher cash flows.

5. How will the increased proportion of Chinese stocks in

Hong Kong impact the valuations of Hong Kong stocks going

forward?

I think this is highly probable. Large amounts of capital have

flowed southward into Hong Kong stocks from mainland China, with

the total amount exceeding that of funds flowing northward. This

has been a 10:1 relationship since the beginning of 2020. For

now, this is mainly driven by long-term insurance funds and some

institutional investors seeking low valuations and high dividend

yields for long-term returns.

Previously, there was a low proportion of mainland investors familiar with the fundamentals of companies. Then, gradually, with the opening of the stock connect mechanism, more Chinese investors began investing in Hong Kong stocks, and valuations and liquidity levels rose. I believe this trend will continue. The correlation between Hong Kong stocks to global markets such as the US has declined greatly in recent years.

6: When Chinese companies are listed on both China

A-share and Hong Kong indexes, how do you then decide between one

over the other?

The two markets differ in the mechanism and level of liquidity,

and it is reasonable to have some valuation differences.

We do not deliberately distinguish preference on the index alone as the interconnect mechanism has increasingly been strengthened. The current valuations of some China A-shares are also attractive relative to their long-term cash flow returns, which we take into account when investing.

The pertinent questions we often ask include:

Can small and medium-sized companies survive in an

economic environment facing distress?

What kind of capital expenditure spent is fair in the pursuit of

gaining market share when the competition ratchets up in new

industries?

How strong are the barriers to entry for the

business?

This is one of the many issues affecting the rate of return on

long-term capital and shareholders' returns, which we are

constantly thinking about as long-term value investors.