Alt Investments

Fewer Venture Capital Players Predict More Fundraising As Investor Caution Rises – Survey

There's more caution in the venture capital sector globally than there has been, the PitchBook report says. Among the details, Europe is garnering more attention.

A survey of 32 venture capital investors from around the world by PitchBook, the private market research and analysis firm, finds that 38 per cent of them expect VC funding to rise over the next year, falling from 58 per cent taking that view in the second half of 2024.

The figures suggest that economic turmoil associated with US tariffs and geopolitical stresses have taken their toll.

Data from Pitchbook’s H1 VC Tech Survey shows that 43.3 per cent of respondents said their VC firms are located in Europe; 36.7 per cent said US, 10 per cent said China; 3.3 per cent said the Middle East and Africa; 3.3 per cent said Oceana, and 3.3 per cent said Latin America.

“After years of momentum driven by the post-Covid boom, the industry is returning to caution. Capital is less abundant: now with fewer exits on the horizon investors are looking to back companies that can go the distance and are wary of fast growth disjointed from any sustainable value,” Tom Henriksson, general partner at OpenOcean, an early-stage venture firm, said.

Source: Pitchbook H1 VC Tech Survey.

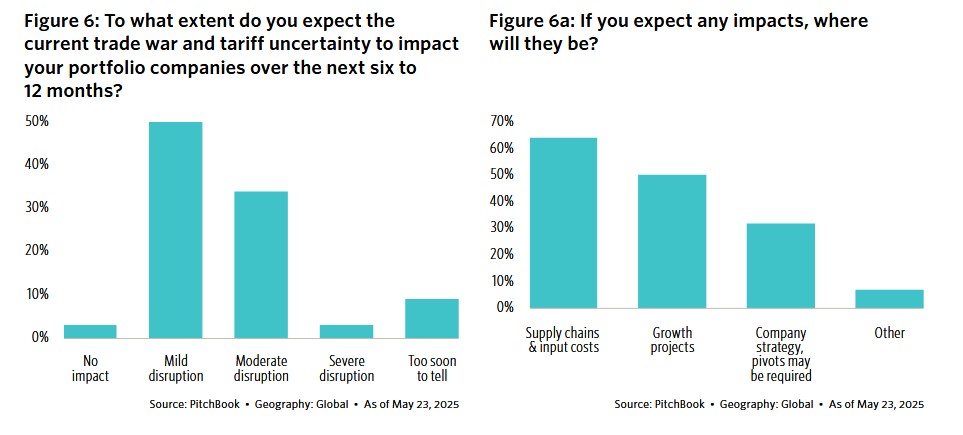

Despite 84 per cent of investors bracing for at least mild disruption from recent trade tariffs, the sector is not folding – it is recalibrating, PitchBook said. Some 53 per cent of investors are still actively hunting for deals even as limited partners grow more risk averse, and a shift toward domestic “tech sovereignty” is underway.

The data comes at a time when investment houses continue to regale wealth managers, private banks, family offices and other players about the benefits of VC, private equity, private credit, forms of real estate and infrastructure. (See an example here from Hamilton Lane.)

The PitchBook report said fintech leads the way in VC activity – with some of the AI hype translating into real-world action; healthcare and enterprise technology are vigorous; transport and logistics are more “stable” in behavior, the report said.

"Looking ahead, 60 per cent of respondents combined still plan to raise another fund within two years, but a growing contingent is pushing timelines to three-to-five years or opting out altogether, hinting at a consolidating market," the report said.

"Regionally, Europe leads as the most attractive destination outside of the US, drawing investment from 48 per cent of respondents. Taken together, the data suggests an industry that remains active and opportunity seeking, but with sharpened caution, a shift in timelines, and a growing emphasis on defensibility and discipline," the report said.

Tariff effect

The report said that 84 per cent of survey respondents expect at

least a mild to moderate impact from the US tariff announcements;

64 per cent expect higher supply chain costs; and 50 per cent

predict slowing growth. The manufacturing and

semiconductor/hardware segments were deemed the most vulnerable

to tariff disruption.

Artificial intelligence

Respondents said the top blocker to AI adoption is a lack of

clear use cases – the cause cited by 45 per cent of

respondents – followed by workforce skill gaps and high

implementation costs. The number of respondents with regulatory

concerns around AI eased from 55 per cent to 39 per cent, and

bullishness on generative AI stabilized, with 44 per cent of

respondents more upbeat and 45 per cent reporting no change in

sentiment.