WM Market Reports

Family Offices Love Real Estate, US Leads Wealth Creation – Knight Frank Study

The property market consultancy and realtor casts its eye over trends shaping certain segments of the world's bricks-and-mortar market.

Real estate investment remains a major focus for family offices, with 44 per cent of global family offices questioned in a new report saying they intend to hike allocations.

The findings come from the 19th edition of an annual wealth report by international real estate consultancy Knight Frank.

“Despite a sharp fall in investment volumes from the 2021 peak, we confirm an ongoing desire for property from private capital,” the report said. “While direct real estate ownership already accounts for 22.5 per cent of the typical family office’s portfolio, more than four in 10 are looking to grow this allocation over the next 18 months.”

“Sectors in demand are led by living, logistics and luxury residential. In addition to this desired expansion of investment portfolios, nearly a quarter of family offices that manage private residential portfolios are considering new acquisitions,” it continued.

Through November and December 2024, Knight Frank said it interviewed 150 single and multi-family offices across the globe. This covered 121 single-family and 18 multi-family offices as well as 11 heads of more diverse structures. The FOs were headquartered in 29 cities across Asia, Europe, the Middle East and the Americas, with "strong representation" from FOs based in London, Singapore, New York, Geneva, Sydney and Hong Kong.

The firm asked why family offices own real estate and how much borrowing they are exposed to in this asset class.

"Across the different metrics employed, FOs on average target an unleveraged 13.8 per cent return. In terms of the objectives that real estate fulfils in the wider investment portfolio growth and capital appreciation (42 per cent) dominates, with wealth preservation (23 per cent) and Income generation (19 per cent) in second and third places," it said.

The indispensable nation

In other main findings, the 88-page report finds that the US

“remains the undisputed leader in global wealth

creation.” Almost 40 per cent of the world’s wealthy reside

in the US. “No other country is as successful at creating

homegrown wealth or attracting migrant UHNWIs,” it said. “For

luxury homes, private jets and superyachts, what happens in the

US shapes global markets.”

The report defines “high net worth” as a person having $1 million more in wealth; “ultra-HNW” is $30 million-plus. Its “Wealth Sizing Model” defines HNW individuals as those with a net worth of at least $10 million; the UHNW version of this model pegs the figure as at least $100 million.

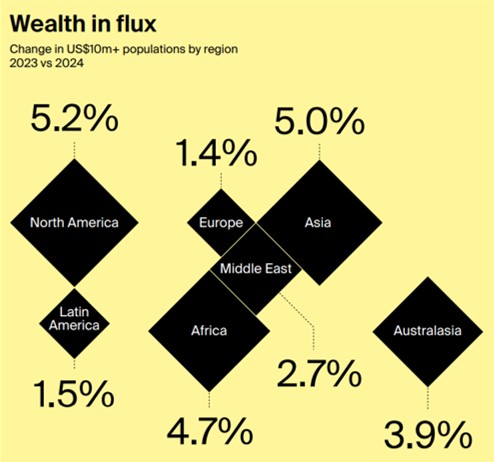

Changes in the wealth held in different regions are set out in the report.

"In 2024, the fortunes of the wealthy improved, with a 4.4 per cent hike in the number of individuals worth over $10 million. All regions saw an uptick, but North America led with growth of 5.2 per cent. Future wealth creation, especially in the ultra-wealthy ($100 million+) segment, is likely to be subject to a more activist regulatory and tax response," it said.

Source: Knight Frank

The report says the the mobility of wealth is “only set to increase,” saying that this theme is driving “supercharged growth” in some housing markets, with Miami, Palm Beach and Aspen in the US serving as prime examples. “The ease with which wealth can move is driving efforts to attract it and attempts to control it. While private jets and yachts should promote mobility, we delve into some surprising limitations,” it said.

The luxury property market is also being shaped by moves in market pricing and currencies, Knight Frank said. Its review of changes in buying power showed that while London offers savings of 43 per cent for dollar-based buyers compared with pricing in 2014, other markets have seen equally dramatic falls in relative buying power, with some weakening by more than 50 per cent over the period.

On the well-trodden theme of intergenerational wealth transfer, Knight Frank said this process is well underway, even though Baby Boomers still control most global wealth.

The report contains a warning about more difficult economic times possibly ahead – the report came out days after the US slapped tariffs on neighbors Canada and Mexico, as well as China.

“The world economy has had a good run. Global GDP surpassed its pre-pandemic peak in mid-2021 and has continued to expand at around 3 per cent every year since. Will 2025 be the year that run ends? It’s possible, perhaps even likely. The US has a new, volatile president, a man inviting trade wars on multiple fronts. Inflation isn’t quite tamed. Government deficits appear out of control. Stock market valuations are inflated. War is ongoing in various theaters, and could spread to others,” it said.