Family Office

Family Offices' Use Of Long-Term Incentives Grow, Adds Complexity

A further look at a new study of US family office executive compensation probes into how long-term incentives work and the potential problems that FOs must address.

US family offices’ use of long-term incentives is growing, such as co-investment opportunities, carried interest and deferred interest plans, although these carry risks if an employee’s time horizons don’t match up with a family’s.

That’s one of the conclusions of the Morgan Stanley and Botoff Consulting report into family office compensation, the broad details of which were covered here in Family Wealth Report yesterday. A more detailed breakdown of the data highlights how complex some modern compensation programs can be. The study shows that 80 per cent of family offices use more than one type of long-term incentive (LTI).

As industry practitioners have told FWR, a challenge for families arises when they hire in non-family experts, giving them stakes in investments and other incentives, only to find that there’s a disagreement down the line if the professional wants to cash out sooner than suits the family, or if there is a dispute about risk and leverage.

“We have seen an increasing trend in family offices providing co-investment opportunities. Many families believe this is an excellent way to align interests, and may even require that key executives and investment staff invest alongside the family. However, there are challenges in designing co-investment structures that must be addressed. For example, will a special purpose vehicle be created or will funds be comingled with the family? Using an SPV can provide for better separation and account management; however, this approach can be costly and cumbersome,” the report said.

“Comingling of funds can also present challenges. Each family needs to assess their objectives and the tax and legal implications of alternatives, and determine an approach that works best for their circumstances,” the report added.

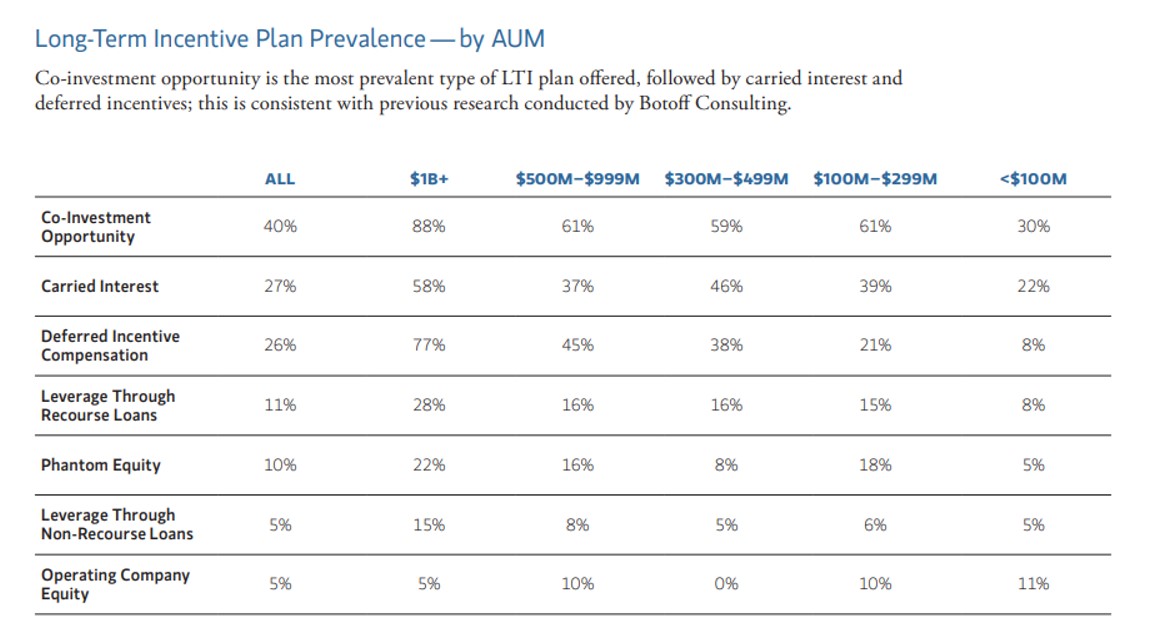

LTIs fall into the following categories and their use by family offices varies depending on how large the area in assets under management is:

-- Co-investment opportunity (used by 40 per cent of all

FOs);

-- Carried interest (27 per cent);

-- Deferred incentive compensation (26 per cent);

-- Leverage through recourse loans (11 per cent);

-- Phantom equity (10 per cent);

-- Leverage through non-recourse loans (5 per cent); and

-- Operating company equity (5 per cent).

As far as carried interest incentives are concerned, the report said its use as an incentive is “quite prevalent” but there can be some issues. Carried interest pools in investment firms are usually set at 20 per cent, after a preferred return or hurdle rate is reached. In family offices, however, it is more common to see the interest pool set between 10 and 15 per cent, it continued.

Because certain investments have long-term holding periods, aka “patient capital”, there can be a challenge in obtaining liquidity to meet payouts for those taking part in carried interest incentives, which means that families increasingly recognize the need to pay these sums early, the report said.

The report also noted that co-investment opportunities, particularly loans, should be limited to employees who are able to shoulder the risk – there can be problems if there is a loss and an employee has to repay the family.

Size makes a difference

To illustrate how the results vary by the size of a family

office’s AuM, while 40 per cent of FOs surveyed said they use

co-investment opportunities as a long-term incentive, 88 per cent

of those holding $1.0 billion or more embraced this approach, but

only 30 per cent of those with less than $100 million did so. On

the other hand, with carried interest, while the average

percentage for all FO sizes was 27 per cent, it is as high as 58

per cent for the $1.0-plus billion bracket, and falls to 22 per

cent for the smaller FOs. The reverse is the case for operating

company equity as an incentive: some 11 per cent of the smallest

FOs used this approach, above the 5 per cent average for all FOs.

Co-investment, as the term suggests, allows participants to make a minority investment alongside the family into assets that such participants would not normally be able to access. With carried interest, it gives a share of profits in excess of a specified return, usually in alternative assets such as private equity or hedge funds. A deferred incentive compensation is based on longer-term performance, vesting over time.

Leverage through recourse loans involves using borrowed capital to boost returns of a co-investment; phantom equity gives participants some of the benefits of owning stock without actually having it. Leverage through non-recourse loans uses borrowed capital to boost co-investments; the loan may be structured as a non-recourse one, in which case it does not have to be repaid but capital is required. Operating company equity comes in the form of stock awards or other company equity.