Tax

Deferred Annual Incentive Plans in the FTSE 250

This is the third in a series of articles focusing on trends in the remuneration of directors of companies in the FTSE 250 (excluding invest...

This is the third in a series of articles focusing on trends in the remuneration of directors of companies in the FTSE 250 (excluding investment trusts). Information is taken from annual reports accounts published before 30 June 2005 and, in the case of long-term incentive plans, also includes information from shareholder communications on new plans put forward for approval at AGMs up until early July 2005.

In the last article we focused in more detail on annual incentives. In this article we have focused on deferred annual incentive plans.

In subsequent articles we will focus in on long-term incentive arrangements and on non-executive directors’ remuneration.

Deferred Annual Incentive Plans

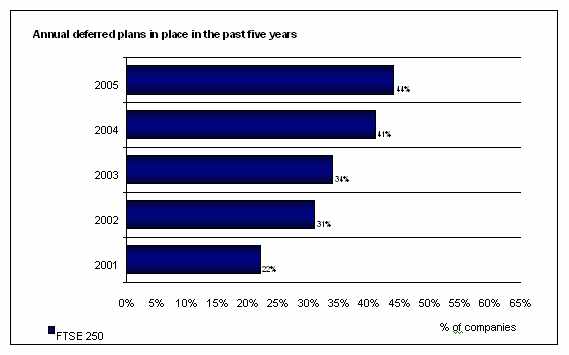

A significant number of deferred annual incentive plans have been introduced in the past two years. Seventeen new plans were introduced by FTSE 250 companies between July 2004 and July 2005 compared with 18 in the previous period.

Currently, deferred annual incentive plans are in place in 44 per cent of FTSE 250 companies, compared to 41 per cent last year. Despite the number of new plans introduced over the past year, the overall number of plans has not increased as much as would be expected and this is due in part to the change in the constituent companies and also seven FTSE 250 companies where the plan has ceased to be used in the past year. In most cases the cessation of the deferred plan was part of an overall review of incentive arrangements and was replaced by alternative long term arrangements.

New plans

Of the 17 plans introduced during the year, two pay part of the bonus in deferred shares but do not enhance the award with matching shares, three plans make matching share awards with no performance conditions and 12 ( 71 per cent) of these plans match the deferred shares only if further performance conditions are met over the deferred period. Within the 12 plans in the latter category the bonus deferral is compulsory in four of the plans, voluntary in four and in four plans there is a compulsory element with the option to voluntarily defer the remainder of the bonus.

- Where matching shares are awarded, the level of matching varies but the median is one matching share for one deferred share.

- In only one plan the full match vests on an all or nothing basis, if the performance conditions are achieved. This plan is based on EPS performance.

- In the other 11 plans the level of match depends on the level of performance achieved. Last year these plans were most commonly based on TSR performance. This year four are based on EPS performance and four on TSR. The remaining four are based on other measures such as economic profit, return on capital employed and cash flow.

The chart below shows how the overall number of deferred plans in place has changed over the past five years.

There is considerable variety in the design of these plans.

- Plans may require part of the bonus to be paid in deferred shares or may give the participant the opportunity to invest part, or all, of the bonus in shares. Some plans include a combination of both of these elements.

- It is becoming increasingly common for the plan to require any portion of bonus paid above a specified percentage of salary to be taken in deferred shares. This is often the case where the maximum bonus that may be earned has been increased.

- Matching shares may be available at the end of the deferred period for both compulsory and voluntary elements and the matching ratio may vary from one share for every four shares held, to three or more shares for every one share held.

- The award of matching shares may or may not depend on further performance conditions over the deferred period, and in some cases the number of matching shares may vary according to the level of performance achieved.

Best practice guidelines state that any matching shares should be subject to further performance conditions over the deferred period. There are still a significant number of plans where the executive will receive the deferred award and any additional shares subject only to continued employment at the end of the restricted period but the balance has changed during the year. The matching element of the award is subject to further performance conditions in 85 per cent of these plans compared to only 47 per cent last year. As noted above, three of the new plans introduced during the year award have matching shares which are not dependent on performance.

The chart below shows how the percentage of FTSE 250 companies with deferred bonus plans has changed over the past three years. The plans are categorised into:

- Plans which require part of the bonus to be deferred, or offer the opportunity to invest the bonus in shares, where matching shares are given at the end of a specified period of time providing that certain performance conditions are met.

- Plans which require part of the bonus to be deferred, or offer the opportunity to invest the bonus in shares, where matching shares are given if the shares are held for a specified period of time but without any performance conditions.

- Plans which require part of the bonus to be deferred for a period of time with no matching shares given.

Deferred annual bonus plans practice in 2002/2003, 2003/2004 and 2004/2005

These three types of plans are examined in more detail below.

Deferred bonus plans with no matching awards

In 17 per cent of FTSE 250 companies, compared to 15 per cent last year, part of the bonus is deferred for a period of time, usually three years with no provision of matching shares.

In all of these plans the deferral is compulsory.

Deferral period

Typically the deferral period is three years. In one plan, the deferral period is one year. In five plans it is two years and in two plans it is five years.

Proportion deferred

In approximately two thirds of companies 50 per cent of the bonus must be deferred. In six companies the proportion is lower and in four companies higher than this. In two companies 100 per cent of the bonus is deferred. In six companies any bonus earned above a specified percentage of salary must be deferred.

Deferred bonus plans with non-performance based matching awards

The guidelines produced by the Association of British Insurers (which were updated in December) state that institutional shareholders will generally expect that satisfaction of further performance criteria will be required in order for the matching element to vest. Hence it is perhaps not surprising that deferred annual incentive plans where additional matching awards are non-performance related are now in place in only 4 per cent of FTSE 250 companies compared to 6 per cent last year.

Matching awards

For those companies where there is a deferred bonus plan with non-performance related matching shares the following table shows the maximum bonus opportunity, the maximum proportion of the bonus that will, or can, be deferred and the maximum match that may be made. The match is shown as a percentage of the deferred award i.e. 100 per cent implies one matching share for every deferred share.

|

style='mso-bidi-font-weight:normal'>FTSE 250 |

Maximum bonus opportunity |

Maximum deferra% of bonus |

Maximum match% of bonus |

|

style='font-size:10.0pt;font-family:Verdana;color:black'>Upper quartile |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

|

style='font-size:10.0pt;font-family:Verdana;color:black'>Median |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

|

style='font-size:10.0pt;font-family:Verdana;color:black'>Lower quartile |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

Deferred bonus plans with performance based matching awards

Deferred annual bonus plans in which matching shares are awarded subject to performance conditions over the performance period are operated by 23 per cent of FTSE 250 companies, compared to 19 per cent last year. In many of these plans the level of matching shares released depends on the level of performance attained and these plans are therefore effectively operated on a similar basis to performance share plans. In some companies this may be the main long term plan and in these companies the matching awards may be significant.

Deferred bonus plans with performance based matching awards

|

style='font-size:10.0pt;font-family:Verdana;color:black'> |

style='mso-bidi-font-weight:normal'>FTSE 250 companies |

|

Type Compulsory Voluntary Both |

style='font-size:10.0pt;font-family:Verdana;color:black'> style='font-size:10.0pt;font-family:Verdana;color:black'>38% style='font-size:10.0pt;font-family:Verdana;color:black'>38% style='font-size:10.0pt;font-family:Verdana;color:black'>24% |

|

Deferred period 2 years 3 years 4 years 5 years |

style='font-size:10.0pt;font-family:Verdana'> style='font-size:10.0pt;font-family:Verdana'>2% style='font-size:10.0pt;font-family:Verdana'>93% style='font-size:10.0pt;font-family:Verdana'>3% style='font-size:10.0pt;font-family:Verdana'>2% |

|

Deferred amount

(% Compulsory Voluntary Both |

style='font-size:10.0pt;font-family:Verdana'> style='font-size:10.0pt;font-family:Verdana'> style='font-size:10.0pt;font-family:Verdana'>50% style='font-size:10.0pt;font-family:Verdana'>50% - 100% (median 100%) style='font-size:10.0pt;font-family:Verdana'>- |

|

Matching shares

(% Compulsory Voluntary Both |

style='font-size:10.0pt;font-family:Verdana'> style='font-size:10.0pt;font-family:Verdana'> style='font-size:10.0pt;font-family:Verdana'>50% - 400% (median 100%) style='font-size:10.0pt;font-family:Verdana'>50% - 350% (median 100%) style='font-size:10.0pt;font-family:Verdana'>- |

|

Performance EPS TSR EPS and TSR EPS and other TSR and other Other No details |

style='font-size:10.0pt;font-family:Verdana'> style='font-size:10.0pt;font-family:Verdana'>54% style='font-size:10.0pt;font-family:Verdana'>28% style='font-size:10.0pt;font-family:Verdana'>0% style='font-size:10.0pt;font-family:Verdana'>2% style='font-size:10.0pt;font-family:Verdana'>4% style='font-size:10.0pt;font-family:Verdana'>8% style='font-size:10.0pt;font-family:Verdana'>4% style='font-size:10.0pt;font-family:Verdana'> |

|

Match scaled Yes No No details |

style='font-size:10.0pt;font-family:Verdana'> style='font-size:10.0pt;font-family:Verdana'> style='font-size:10.0pt;font-family:Verdana'>72% style='font-size:10.0pt;font-family:Verdana'>24% style='font-size:10.0pt;font-family:Verdana'>4% |

Where the plans consist of a compulsory deferred element with the option to voluntarily defer a further amount typically the plans allows the total bonus to be deferred although in a few plans this is not the case. In most cases the match is on both elements of deferral but in some plans matching shares are only awarded on the voluntary element.

Matching awards

For those companies where there is a deferred bonus plan with performance related matching shares the following table shows the maximum bonus opportunity, the maximum proportion of the bonus that will, or can, be deferred and the maximum match that may be made assuming the performance conditions are met in full. The match is shown as a percentage of the deferred award, that is, 100 per cent implies one matching share for every deferred share.

A comparison of this table with the one given above for plans with non-performance based matching shows that although in a non-performance based matching plan the amount of bonus that may be deferred is typically higher, the level of matching is significantly less than in those plans where the matching shares are dependent on performance.

|

style='mso-bidi-font-weight:normal'>FTSE 250 |

Maximum bonus opportunity |

Maximum deferral% of bonus |

Maximum match% of bonus |

|

style='font-size:10.0pt;font-family:Verdana;color:black'>Upper quartile |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

|

style='font-size:10.0pt;font-family:Verdana;color:black'>Median |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

|

style='font-size:10.0pt;font-family:Verdana;color:black'>Lower quartile |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

style='font-size:10.0pt;mso-bidi-font-size:8.0pt;font-family:Verdana; |

Potential awards under annual and deferred bonus plans

The following table shows, for all companies, the maximum potential annual bonus award including the maximum matching shares that may be given assuming all performance conditions are met and the shares are held for the required length of time. These numbers do not take into account any share price growth over the deferred period. The matching award has been added to the maximum annual bonus to give an indication of the impact of deferred plans.

There is no evidence to suggest that where an annual deferred plan with matching shares is in operation the potential annual bonus is lower than in companies where there is no deferred plan.

Potential awards under annual and deferred bonus plans - % of salary

|

style='font-size:10.0pt;font-family:Verdana'>FTSE 250 style='font-size:10.0pt;font-family:Verdana'> |

style='font-size:10.0pt;font-family:Verdana'>Maximum annual bonus |

style='font-size:10.0pt;font-family:Verdana'>Maximum

annual bonus plus |

|

Upper quartile |

100% |

150% |

|

Median |

100% |

100% |

|

Lower quartile |

60% |

75% |

Both the maximum and median potential bonus that may be earned has increased in the past year.

Conclusion

We believe that annual deferred bonus plans will increasingly become a common feature of the remuneration package for directors and other senior executives in FTSE 250 companies with an increasing proportion of them having some form of matching subject to meeting additional performance criteria.

In addition, we expect that there will be increased focus by the institutional investors in particular on the size of the potential reward under these plans and the appropriateness of the performance criteria adopted. Simply “following market practice” may not be sufficient in the future.