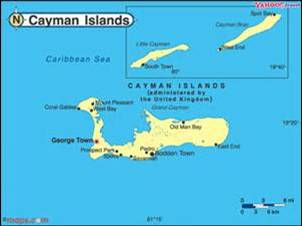

Offshore

Cayman Islands Voices Fury Over Inclusion On UK Regulator's Blacklist

The government of the Cayman Islands, a British Overseas Territory, has voiced its “astonishment and horror” at how the UK financial regulator put it on a list of jurisdictions deemed as high risk for money laundering.

The government of the Cayman Islands, a British Overseas Territory, has voiced its “astonishment and horror” at how the UK financial regulator put it on a list of jurisdictions deemed as high risk for money laundering. It has been put on the same list as places such as North Korea, Saudi Arabia and Yemen.

A list was published by the Financial Conduct Authority a month ago (July 18) as a result of a Freedom of Information Act request.

A check on the FCA website shows it is currently reviewing the list, as it does on a quarterly basis, and that this will be updated “in due course”. A spokesperson for the FCA said the jurisdiction had been included on the list due to concerns it has had.

On 12 August, Martin Wheatley, chief executive of the FCA, wrote in response to G Wayne Panton, Minister of Financial Services, Commerce and Environment, at the Caribbean jurisdiction, to defend the FCA's list.

"We have carefully considered the contents of your letter, in particular your comment that the Cayman Islands does not feature on all the indices we study when assessing country risk. At present, we have concluded that the Cayman Islands should remain on the list. In reaching this decision, we took account of factors including thoseindices and a range of publicly available information which indicates high levels of money laundering risk remain and potential weaknesses in the Cayman Islands’ AML framework," Wheatley wrote.

"We note that the US Senate Sub Committee report vulnerabilities to money laundering, drugs and terrorist finances alleges that Cayman Island legal entities have been used as vehicles for money laundering. This is echoed in the US Homeland Security Report US Vulnerabilities to Money Laundering, Drugs, and Terrorist Financing, which references US dollar accounts in the Cayman Islands which were used for money laundering. We also note that the U.S. State Department report on narcotics control which lists the Cayman Islands as a jurisdiction of primary concern, particularly in light of the size of its financial sector," he wrote.

“Yes, it is a very serious and undeserved issue, and Cayman government has been working to correct the misrepresentation,” a spokesperson for the Caribbean jurisdiction told this publication today in an email.

The sharpness of the Cayman Islands’ government comments highlights how reputational issues are highly sensitive, particularly in the light of recent high-profile cases surrounding money laundering. As reported today, PricewaterhouseCoopers became the latest institution to fall foul of US laws. In that case, it was hit for improper changes to a report for a client (see here); BNP Paribas, France’s largest bank, has been hit with a record $8.97 billion fine for breaches of sanctions against blacklisted nations such as Iran and Sudan. In the past, HSBC, the UK/Hong Kong-listed bank was punished for over AML lapses in 2012, in a case where money flowed through jurisdictions including the Cayman Islands.

Correction demand

Cayman Islands financial services minister Wayne Panton demanded the UK regulator provide an explanation or a correction. In a letter to FCA chair John Griffith-Jones, Panton is said to have expressed “great consternation” at Cayman’s inclusion on the list, which he called "wholly arbitrary". He said the jurisdiction and the UK are rated equally in the OECD’s latest global tax transparency forum rankings, and that Cayman company regulation is in many ways more stringent than that of the UK.

He also noted that the Cayman Islands is not included in any of the Financial Action Task Force’s list of high-risk and non-cooperative jurisdictions. It does appear on the HM Treasury Sanctions List, but so do the BVI, Jersey and the Isle of Man, which are not on the FCA blacklist.

The FCA said on its website that “the list is one of a number of tools used by our Authorizations Division to help inform the effective assessment and processing of applications from firms seeking to conduct regulated financial service activities in the UK. As with the other tools used internally by our Authorizations Division, the list aims to ensure that appropriate consideration is given to all of the different facets of the applicant firm. It does not serve to exclude firms from operating from, or being active in, the jurisdictions featured on the list. Moreover, it does not impose any new requirements on firms as we expect firms to conduct their own thorough risk assessments and apply proportionate systems and controls”.

“Jurisdictions are assessed using a broad range of publicly available information and indices. These include: HM Treasury Sanctions publications, the Financial Action Taskforce high-risk and non-cooperative jurisdictions list in relation to anti-money laundering (AML) and the financing of terrorism, MoneyVal evaluations, Transparency International Corruption Perception Index, the Foreign & Commonwealth Office (FCO) Human Rights Report, the UK Government’s Overseas Business Risk webpages the US Department of State International Narcotics Control Strategy Report and other public information about financial crime issues affecting each jurisdiction,” it said.

The previous list includes such jurisdiction as Afghanistan, Bolivia; Cuba; Egypt; Republic of the Congo; Iran; Iraq; Kosovo; North Korea; Mexico; Pakistan; Saudi Arabia; South Africa; Vatican City; Venezuela; Yemen; Thailand, North Sudan, South Sudan. Offshore jurisdictions such as Jersey, Liechtenstein, Switzerland, Singapore and Hong Kong are not on the previous list.