Alt Investments

Cayman Islands Confident Of Getting EU Alternative Funds Regime Passport

The jurisdiction is confident of being brought under the umbrella of a new EU regime governing the sale of alternative investment funds.

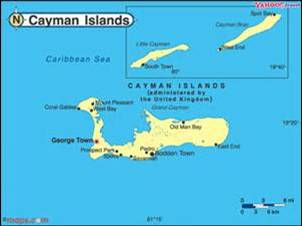

The Cayman Islands is confident that alternative investment funds registered in the Caribbean jurisdiction will be brought under a European Union passport regime, according to a global hedge fund industry group.

The comments from the Alternative Investment Management Association came after the Cayman Islands were not included in initial assessments for such a regime by the European Securities and Markets Authority, as reported here on 30 July. At that time, ESMA recommended the passport for Jersey, Guernsey and Switzerland. Such passports work under the Alternative Investment Fund Managers Directive, or AIFMD. There have been concerns that the directive, which tightens controls on managers of hedge funds, private equity, and other “alternative” assets, will freeze out managers based outside the EU from marketing their funds.

The AIFMD came into force in the wake of the 2008 crisis as policymakers said that alternative investments were insufficiently regulated and posed a potential threat to the financial system, although critics have claimed the measures – such as tightening requirements on disclosure and investor protection – were unnecessary and motivated by a desire to stifle non-EU competition.

AIMA said that the Cayman Islands, home to 11,379 funds of different types (source: Cayman Islands Monetary Authority, 2013), was well-placed to have a successful review in the near future.

The jurisdiction, AIMA said in a statement, has already entered into the requisite co-operation arrangements with the major EU investment securities regulators and the necessary tax information exchange agreements with EU governments as required by the AIFMD. The government in the Caribbean jurisdiction has been developing an AIFMD compliant opt-in regime to ensure that the jurisdiction can continue to meet the needs of Cayman-based alternative investment fund managers who want to market funds into the EU under the passport, AIMA said.

“The global industry as a whole needs Cayman AIFs to be approved under the AIFMD passport to ensure that pension funds and other European institutional investors can continue to benefit from investing in some of the world’s leading alternative investment funds,” Jack Inglis, chief executive of AIMA, said.

Alan Milgate, chairman of AIMA Cayman, said: “ESMA’s decision should not be misinterpreted. Cayman has simply not yet been assessed, and has certainly not been adversely opined on, or excluded by ESMA. We look forward to the Cayman Islands being assessed positively in ESMA’s ongoing review of additional non-EU jurisdictions and that alternative investment funds based in the Cayman Islands will continue to benefit from evolving legislation which is both flexible and adaptable.”

In its July statement, ESMA said it had not yet reached a hard decision on Singapore, Hong Kong and the US.