Trust Estate

As Inflation Worries Grow, Time For Charitable Lead Trusts?

.jpg)

The author of this article examines what tools wealth managers working with HNW clients can and should use to handle worries about inflation.

Regular commentator Matthew Erskine, managing partner, Erskine & Erskine, a tax, law and succession planning specialist firm, talks about how worries of rising inflation shape wealth management. Many people, including younger high net worth individuals, have little experience of high inflation. It belongs in the same category for them as flared jeans, Jimmy Carter and Johnny Carson’s Tonight Show. Whatever happens with inflation - the rise may be temporary, or it may not - wealth advisors need to sit down with clients and set conversations going. Various structures in the private client toolbox have their uses. This article explains charitable lead trusts, or CLTs.

The editors are pleased to share these ideas and invite replies. The usual editorial disclaimers apply. Jump into the conversation! Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

The specter of inflation has returned. Prior to 2020, inflation had averaged below 2 per cent since the Great Recession in 2008. Inflation fell to 1.4 per cent in 2020 and now has jumped to 5.4 per cent year-to-date in 2021. Estate planning is not financial planning, but estate planning tactics are affected both by the value of assets, driven by market conditions, and the time value of money, driven by interest rates. Both are, indirectly or directly, driven by the rate of inflation. Inflation may increase the value of assets while at the same time decreasing the buying power of the money generated by those assets. How does this impact estate planning tactics? Because of the section 7520 rate and client’s expectations.

Section 7520 rates are 120 per cent of the Applicable Federal Midterm Rate (AFR) which is tied to the yield on 3 to 9-year government bond rates. Since the federal bonds are actively traded, the 7520 rate is rather volatile. In May of 2008, the 7520 rate was 3.29 per cent, while in November 2020, the 7520 rate was 0.47 per cent. Today, in September 2021, the 7520 rate is 1.03 per cent, more than twice what it was less than a year earlier.

The 7520 rate determines the discount rates for gifts made over time, which in turn affects what the income, gift and estate tax consequences are of a transfer, where you give a current interest in property to one person, while giving the remainder value to another, often known as a “split interest gift.” There are many variations of the split interest gift, but the three most common are Charitable Remainder Trusts (CRT), Charitable Lead Trusts (CLT) and Grantor Retained Annuity Trusts (GRAT).

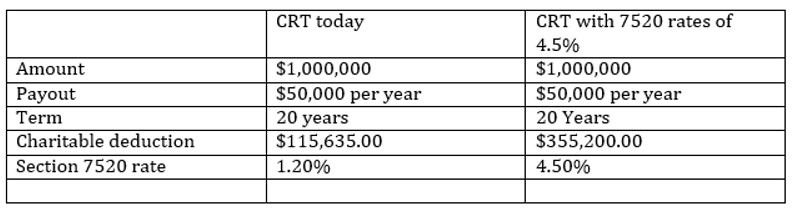

A Charitable Remainder Trust is the best way to defer paying capital gains tax on appreciated assets, if you can transfer those assets into the trust before they are sold, generating an income over time.

When a Charitable Remainder Annuity Trust is established, your gift of cash or property is made to an irrevocable trust. The donor (or another non charitable beneficiary) retains an annuity (fixed payments of principal and interest) from the trust for a specified number of years (up to twenty years) or for the life or lives of the non-charitable beneficiaries. At the end of the term, a qualified charity you specify, receives the balance of the trust property.

Gifts made to a CRAT, qualify for income and gift tax charitable deductions; and, in some cases, an estate tax charitable deduction for the remainder interest gift, only if the trust meets the legislative criteria. The annuity paid must either be a specified amount expressed in terms of a dollar amount (e.g., each non-charitable beneficiary receives a specific amount at least annually), a fraction or a percentage of the initial fair market value of the property contributed to the trust (e.g., beneficiary receives 5 per cent each year for the rest of his/her life).

You will receive an income tax deduction for the present value of the remainder interest that will ultimately pass to the qualified charity. Government regulations determine this amount, which is essentially calculated by subtracting the present value of the annuity from the fair market value of the property and/or cash placed in the trust. The balance is the amount that the grantor can deduct when the grantor contributes the property to the trust.

For the CRT, rising section 7520 rates increases the charitable deduction received in the year the trust is funded. Here is an example:

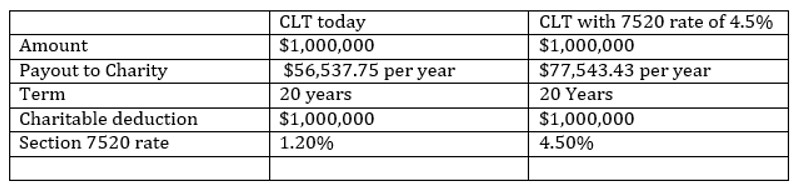

A Charitable Lead Trust is the best way to accelerate charitable deductions to both reduce the negative effects of the new limitations on itemized deductions and to offset adjusted gross income in any tax year. It can also be used as a way of eliminating gift or estate taxes on transfers to children or other beneficiaries.

A CLT is created by transferring cash or other assets to an irrevocable trust. A charity receives fixed annuity (principal and interest) payments from the trust for the number of years you specify. At the end of that term, assets in the trust are transferred to the non-charitable remainder person (or persons), you specified when you set up the trust. This person can be anyone, yourself, a spouse, a child or grandchild, even someone who is not related to you.

You can set up a CLT during your lifetime or at your death. Both corporations and individuals may establish lead trusts, which is useful when you need to take appreciated assets out of a business tax-free.

One advantage of the CLT is the acceleration of the charitable deduction in the year you make the gift, even though the payout is spread out over the term of the CLT. For example, if you have sold a very highly appreciated asset this year, but you can reasonably expect that in future years, your income will drop considerably, you can have a very high deduction in a high bracket year, even if you have to report that income in lower bracket years. In essence, you are spreading out the income (and the tax) over many years.

Another advantage of the CLT is that it allows a "discounted" gift to family members. Under present law, the value of a gift is determined at the time the gift is made. The family member remainder beneficiary must wait for the charity's term to expire; therefore, the value of that remainder man’s interest is discounted for the "time cost" of waiting. In other words, the cost of making a gift is lowered because the value of the gift is decreased by the value of the annuity interest donated to charity. When the assets in the trust are transferred to the remainder beneficiary, any appreciation on the value of the assets is free of either gift or estate taxation in your estate.

The effect of a higher section 7520 rate on a CLT is to increase the annual distribution amount required to fully deduct the initial contribution. Here is an example of the impact of higher section 7520 rates.

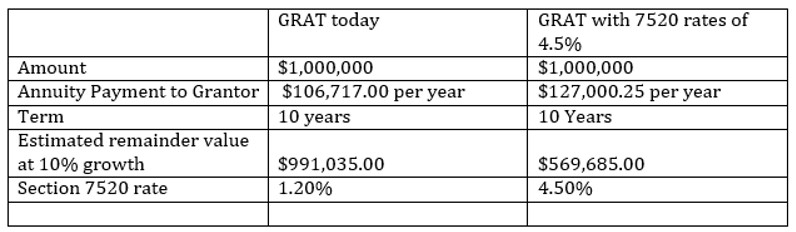

A Grantor Retained Annuity Trust (GRAT) may be an effective means for you, if you need to retain the income from property but wish to transfer the property with minimal gift or estate tax. GRATs are particularly useful where you have one or more significant income-producing assets that you are willing to part with at some specified date in the future to save federal and state death taxes, to obtain privacy on the transfer, and to protect the asset against the claims of creditors.

A GRAT is created by transferring one or more high-yield assets into an irrevocable trust and retaining the right to an annuity interest for a fixed term of years or for the shorter of fixed term or life. When the retention period ends, assets in the trust (including all appreciation) go to the named "remainder" beneficiary. In some cases, other interests, such as the right to have assets revert back to the transferor's estate in the event of the transferor's premature death, may be included.

GRATs provide a fixed annuity payment, usually expressed as a fixed percentage of the original value of the assets transferred. If income earned on the trust assets is insufficient to cover the annuity amount, the payments will be made from principal. Therefore, the client-transferor is assured steady and consistent payments (at least until principal is exhausted).

All income and appreciation in excess of that required to pay the annuity accumulate for the benefit of the remainder beneficiary. Consequently, it may be possible to transfer assets to the beneficiary when the trust terminates with values that far exceed their original values, when transferred into the trust; and, more importantly, that far exceed the gift tax value of the transferred assets.

A higher 7520 rate means that the annuity returned to you will be at a higher rate, so decreasing the amount passing to your beneficiary at the end of the term of the GRAT. Here is an example of the impact of higher section 7520 rates on a GRAT:

Conclusion

As you can see, there is a close interaction between the Section

7520 rate and the effectiveness of split-interest trusts. So, in

this environment you should consider:

1. Using a Charitable Lead Trust to offset

realized gains, earned income and reducing increased estate and

gift taxes.

2. Using a Charitable Remainder Trust, if you

must liquidate a highly appreciated asset (such as the sale of a

business) as 7520 rates rise.

3. Using a Grantor Retained Annuity Trust, if

you feel that the assets you own will appreciate more rapidly in

a higher inflationary market.

As always, keep in mind how the changes in the rate of inflation

affects your existing and future planning.